Everest Securities’ EVS Stock Soars as Chairman Acquires Significant Stake

As Vietnam’s stock market faced challenges near its three-year peak,

Everest Securities’ EVS stock surprised with a stunning surge. The share price skyrocketed to the daily limit-up level, witnessing a 9% increase to reach 6,200 VND per share, the highest level in the past two months. Trading volume also improved, with nearly 560,000 shares changing hands during the session on May 30.

Everest Securities’ Trading Interface

The sharp rise in EVS stock followed the announcement that Mr. Nguyen Hai Chau, Chairman of the Board of Directors of EVS, had purchased over 2.1 million shares out of the registered 2.2 million shares during the period from May 6 to May 27. The reason for not completing the full transaction was a change in investment plans.

With this transaction, Chairman Nguyen Hai Chau increased his holdings from 6.5 million shares (3.95%) to over 8.65 million shares (5.25%), becoming a major shareholder at Everest Securities.

Regarding Everest Securities’ financial performance in the first quarter of 2025, the company generated nearly VND 87 billion in operating revenue, a 70% increase compared to the same period last year. This growth was primarily driven by an increase in fair value gains on financial assets classified as measured at fair value through profit or loss (FVTPL).

However, during this period, the company had to make provision expenses instead of reversals, as in the previous year. As a result, Everest Securities reported a net profit of over VND 10 billion, a 31% decrease compared to the corresponding period.

For the full year 2025, EVS set a target of VND 174.77 billion in operating revenue and VND 9.36 billion in net profit. With these latest results, EVS has officially exceeded its annual plan.

According to EVS’s management, the conservative profit target for 2025 was due to the company’s focus on restructuring, addressing financial receivables, and dealing with inefficient investments from the previous period, which carried a high risk of losses. This strategic approach aimed to strengthen the company’s financial position for future business expansion.

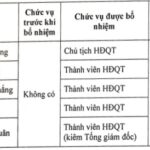

“Everest Securities Welcomes Major Shareholder, Chairman Nguyễn Hải Châu.”

“Following the purchase of 2,147,420 EVS shares out of the registered 2,200,000, Chairwoman Nguyen Hai Chau now holds 5.25% of Everest Securities’ capital, thus becoming a major shareholder in the company.”

“TMT Motors Invests Nearly 100 Billion VND in Electric Vehicle Charging Station Venture”

“TMT Motors is proud to announce a significant investment of 98 billion VND in the establishment of TMT Electric Vehicle Charging Station Investment and Trading Joint Stock Company. With this investment, TMT Motors now owns 98% of the company’s charter capital, solidifying its position as a leading player in the electric vehicle industry. This bold move underscores TMT Motors’ commitment to driving innovation and sustainability in the automotive sector, as it gears up to revolutionize the way people power their vehicles.”