According to preliminary statistics from the General Department of Customs, Vietnam’s exports of animal feed and raw materials in April 2025 reached over $121 million, a 10.3% increase from the previous month. In the first four months of the year, this commodity earned more than $388 million, up 24.6% from the same period last year.

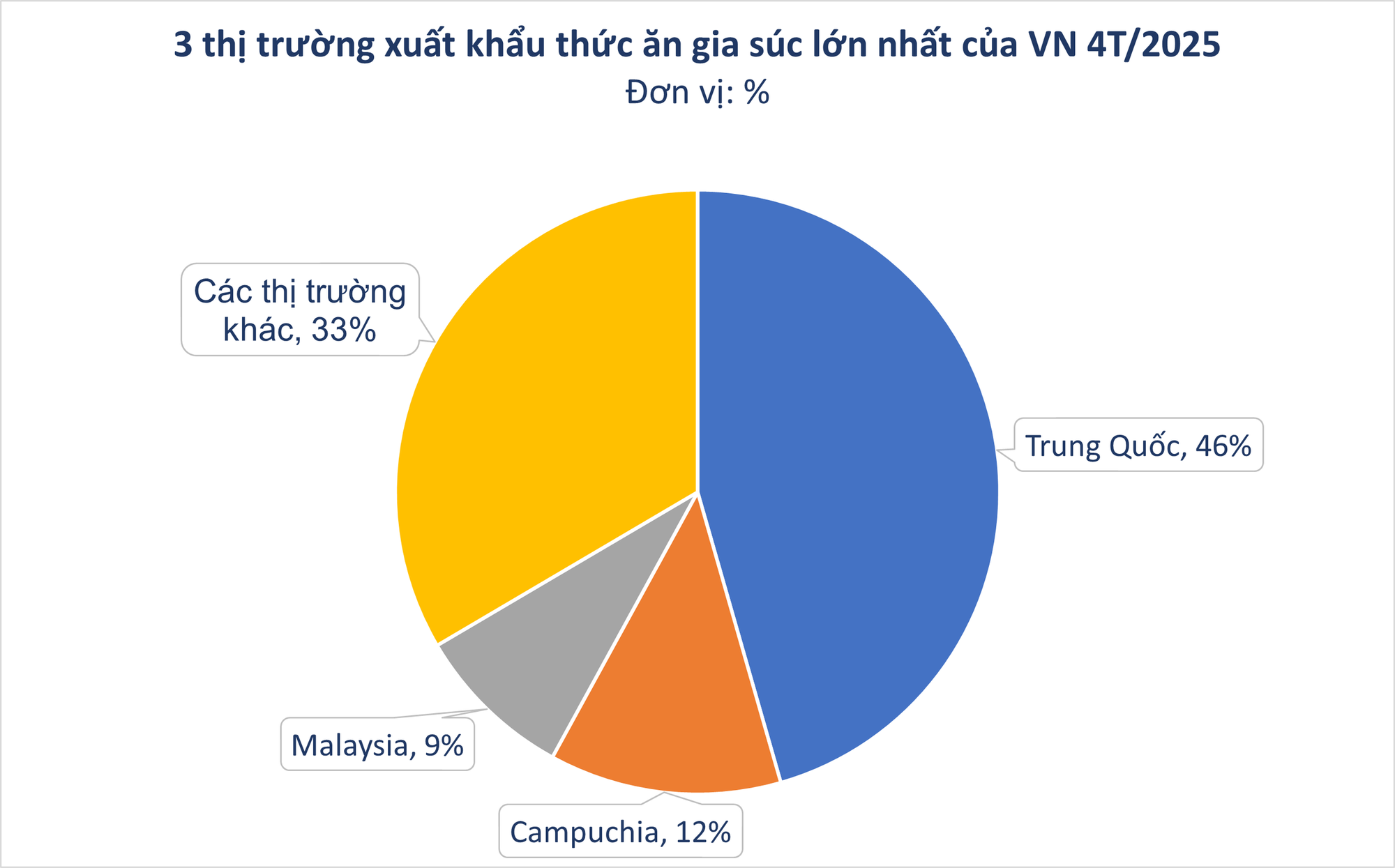

In terms of market, China is Vietnam’s largest export market for animal feed, with over $176 million, a significant 46.5% increase compared to the same period in 2024.

As the world’s largest pork producer and a leading manufacturer of animal feed, China has been facing unstable domestic supply in recent years, leading to continuous imports of animal feed and raw materials from other countries, including Vietnam.

Cambodia was the second-largest export market for Vietnam, with over $48 million, a 25.5% increase from 2024. Malaysia followed closely with a turnover of more than $33 million in the first four months of 2025, a slight decrease of 1.7% from the previous year.

According to the National Agricultural Extension Center, the livestock industry has always played a crucial role in the country’s economic development and food security. Currently, livestock farming is the primary livelihood for over ten million rural households.

The Ministry of Agriculture and Rural Development estimates that Vietnam needs 32-33 million tons of various types of animal feed annually. In addition to importing this product (spending nearly $3 billion), the industry also aims to export. The number of animal feed factories has grown significantly in both quantity and capacity. In 2019, Vietnam had 261 factories with an output of 18.9 million tons, which increased to 294 factories and a production capacity of 20 million tons by 2023. FDI enterprises account for about 60% of the production output, while domestic enterprises contribute about 40%.

According to VIRAC, a market research unit, Vietnam’s animal feed market is attracting many businesses, both domestic and foreign. Notable names include Cargill Group (USA), Haid (China), CP Group (Thailand), De Heus (Netherlands), BRF (Brazil), Mavin (France), Japfa (Singapore), and CJ (South Korea), to name a few.

According to the Development Plan for the Animal Feed Processing Industry by 2030, Vietnam’s industrial animal feed production is expected to grow and reach 24-25 million tons by 2025 and 30-32 million tons by 2030, meeting a minimum of 70% of the domestic demand for animal feed concentrates.

In the first few months of the year, animal feed prices continued their downward trend from last year, despite economic uncertainties in the global market. Many key commodities for feed production, such as corn and soybeans, have been affected by tariff policies.

At the 2025 Annual General Meeting of Shareholders, Mr. Nguyen Nhu So, Chairman of the Board of Directors of Dabaco Group, shared that the decrease in animal feed raw material prices would lead to a reduction in the selling price of the Group’s finished products and those of many other companies.

Additionally, the current downward trend in animal feed prices, coupled with the rising trend in pork prices, is expected to improve the profit margins of businesses and pig farmers.

The Golden Opportunity: Unveiling the Billion-Dollar “Gold Mine” that Captivates Americans

This product has immense potential for growth in the upcoming years. With its unique features and innovative design, it is poised to capture the attention of a wide audience and make a significant impact in the market. The possibilities are endless, and the future looks bright for this promising offering.

The Trade Tensions Weave Uncertainty for Vietnam’s Textile Industry

In light of the US-China trade truce, while Vietnam is still in negotiations, Vinatex forecasts a stable order volume for Q3 due to low US inventory levels. However, the company predicts a potential 10% decline in orders for Q4 as purchasing power may weaken. Chairman Le Tien Truong emphasizes the industry’s need to seize the negotiation “lull” to proactively adapt and stay resilient.

HSG: Estimated Accumulated Profit After Tax for the First Seven Months of the 2024-2025 Financial Year Reaches VND 460 Billion

The Hoa Sen Group Joint Stock Company (HOSE: HSG) has released an update on its operational and financial performance.