On May 30, Hoang Anh Gia Lai Joint Stock Company (HAGL, HOSE: HAG) announced the trading of shares by insiders and related persons of insiders.

Accordingly, Ms. Doan Hoang Anh, daughter of Mr. Doan Nguyen Duc (“Bầu Đức”), Chairman of HAGL, registered to sell 1 million HAG shares from June 4 to July 3, due to personal financial arrangements.

If the transaction is completed, Ms. Hoang Anh’s ownership in HAG will decrease from 1.32% (14 million shares) to 1.23%, equivalent to 13 million shares.

Previously, Ms. Doan Hoang Anh had registered to purchase 4 million HAG shares from May 14 to May 13, however, she was unable to purchase any shares due to personal financial constraints. Notably, from December 30, 2024, to January 21, 2025, Ms. Doan Hoang Anh successfully purchased 1 million HAG shares, bringing her ownership to the current level.

Currently, Mr. Doan Nguyen Duc is the largest shareholder of HAG, holding 30.26% of the charter capital, equivalent to nearly 320 million shares. Combined, Bầu Đức’s family holds nearly 334 million HAG shares, representing approximately 31.58% of the charter capital of Hoang Anh Gia Lai Joint Stock Company.

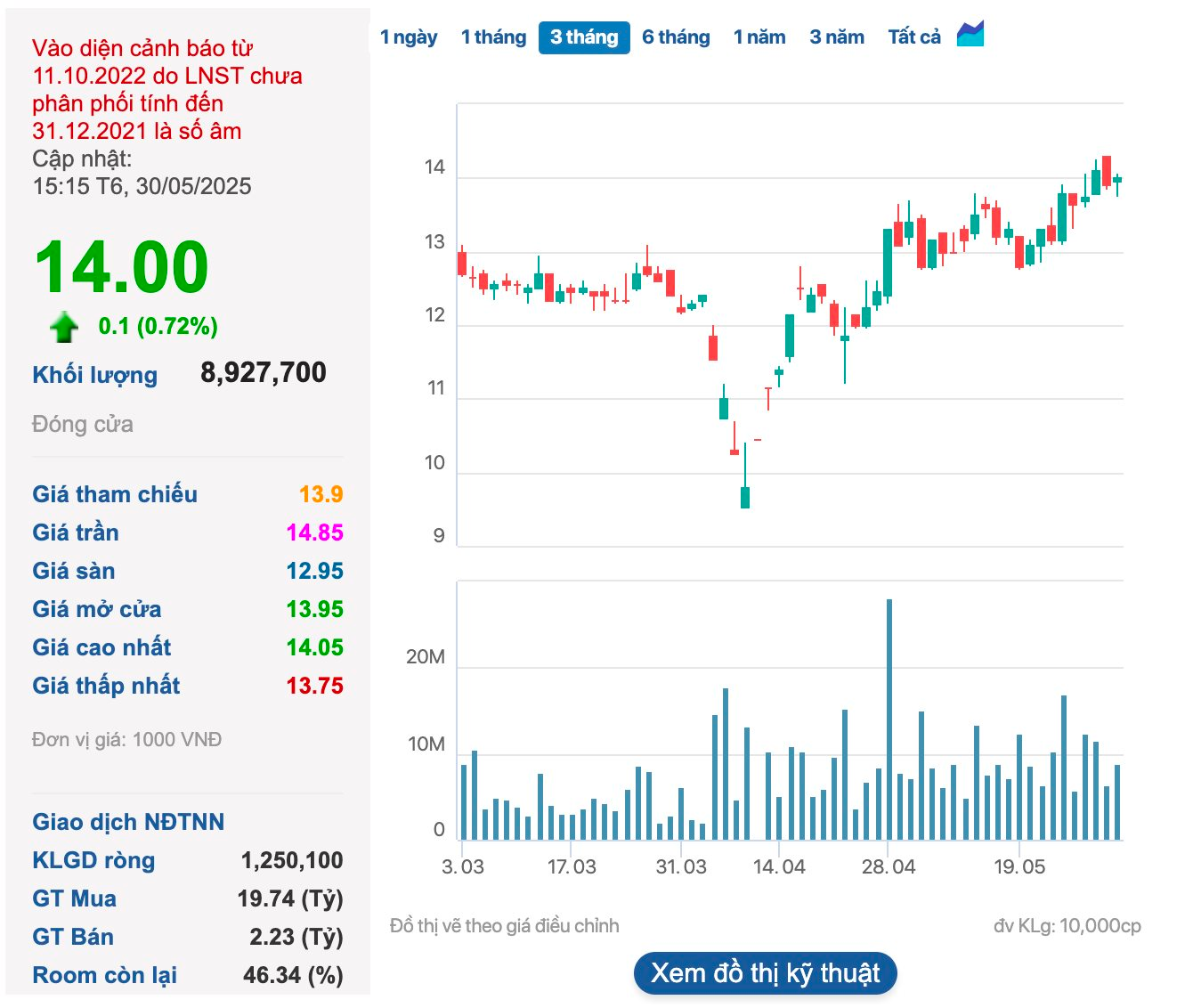

In the stock market, HAG shares have shown positive performance despite being under warning status. At the end of the trading session on May 30, HAG shares closed at VND 14,000/share, an increase of more than 43% in less than two months.

At this price, if Ms. Hoang Anh successfully sells 1 million HAG shares, she could potentially earn approximately VND 14 billion.

In another development, HAGL announced the list of nominees and candidates for the Board of Directors for the term 2025-2030, which includes several new faces.

In addition to Mr. Doan Nguyen Duc’s self-nomination, Mr. Vo Truong Son and Ms. Vo Thi My Hanh were also nominated.

New nominees include Ms. Ho Thi Kim Chi, Ms. Ha Kiet Tran – Investment Director of Huong Viet Investment Consulting Joint Stock Company – Huong Viet Holdings (nominated by Mr. Duc) and Ms. Vu Thanh Hue, Member of the Board of Directors – Deputy CEO of Thaiholdings (nominated by Thaigroup – LPBank Securities shareholder group).

There are also two new nominees for the Supervisory Board: Ms. Doan Nguyen Minh Hoa (nominated by Mr. Duc) and Mr. Nguyen Tien Hung – Head of Member Management Department, Thaiholdings Joint Stock Company (nominated by the shareholder group).

The Big Dip: Why Large-Cap Stocks are Taking a Tumble, While Small Real Estate Remains Resilient

The market opened the month of June with a steep decline in the VN30-Index, erasing 0.99% as large-cap stocks faced downward pressure. The VN-Index also took a hit, falling 0.62% due to losses in VIC and VHM. However, money continued to flow into mid-cap stocks, indicating a cautious but persistent appetite for opportunities in the market.

The Ultimate Penmanship: Crafting a Captivating Title

“The Penultimate Stroke: Unveiling the Intricacies of a 17-Million Share Trade”

The Vietnam Investment Group Joint Stock Company intends to sell 17 million VAB shares of VietABank through a matched or negotiated deal. This move is designed to comply with the Law on Credit Institutions 2024, which stipulates that institutional shareholders cannot own more than 10% of a bank’s charter capital.

The Maverick Mogul: A Self-Made Billionaire’s Journey

The Thaigroup-affiliated shareholder bloc, holding 11.47% of HAG’s charter capital, has nominated Ms. Vu Thanh Hue for the Board of Management and Mr. Nguyen Tien Hung for the Inspection Board of Hoang Anh Gia Lai Joint Stock Company for the term 2025–2030. Meanwhile, Mr. Duc has nominated himself to retain his position as Chairman of the Board of Management.

The Foreign Sell-Off Continues: Another Day of Heavy Selling by Foreign Investors, Contrasted by Aggressive Buying in Real Estate Stocks

Foreign investor group continued their net selling streak, offloading nearly VND 301 billion across the market today.