Hoang Anh Gia Lai Joint Stock Company (HAG-HOSE) announces related-party transactions involving insider trading by Doan Hoang Anh.

Accordingly, Ms. Doan Hoang Anh, daughter of Mr. Doan Nguyen Duc – Chairman of the Board of HAG, has registered to sell 1 million HAG shares from June 4 to July 3, due to personal financial reasons.

If the transaction is successful, Ms. Hoang Anh’s ownership in HAG will decrease from 14 million shares, or 1.32%, to 13 million shares, representing 1.23% of the company’s shares.

Previously, Ms. Hoang Anh had registered to purchase 4 million shares from April 14 to May 13. However, due to financial constraints, she was unable to purchase any shares as registered and continues to hold the same percentage of ownership as before.

On the stock market, HAG shares have been performing positively, rising from below 10,000 VND/share in early April to 14,000 VND/share at the end of May – a recovery of over 43% in less than two months. With this share price, if Ms. Hoang Anh successfully sells 1 million HAG shares, she could potentially earn approximately 14 billion VND.

Currently, Mr. Doan Nguyen Duc is the largest shareholder in HAGL, holding 30.26% of the charter capital, equivalent to nearly 320 million shares. Combined with the rest of Mr. Duc’s family, their total ownership amounts to nearly 334 million shares, representing 31.58% of the company’s capital.

It is worth noting that HAG will be holding its 2025 Annual General Meeting of Shareholders on June 6 in Ho Chi Minh City. One of the key agenda items is the election of the Board of Directors and Supervisory Board for the term 2025-2030.

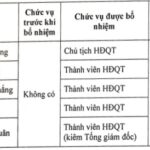

According to the nomination list announced by HAG, Mr. Doan Nguyen Duc is seeking re-election, along with Mr. Vo Truong Son – Board member since 2015, Ms. Vo Thi My Hanh – Board member and Vice President since 2021, and Ms. Ho Thi Kim Chi – Vice President. Ms. Kiet Tran – Independent Member, has also been nominated.

Notably, a group of major shareholders, including Thaigroup, LPBank Securities (LPBS), and Mr. Nguyen Phan Anh, holding a combined 11.47% of HAG shares, have nominated new candidates. Among them, Ms. Vu Thanh Hue, currently a member of the Board of Directors and Vice President of Thaigroup, Chairman of Thaihomes, and Vice Chairman of LPBS, has been nominated to the HAG Board of Directors. Mr. Nguyen Tien Hung, Head of Management at Thaiholdings, has been nominated to the Supervisory Board.

Recently, HAG announced its divestment from a linked company. The company sold its entire stake in ADC at a transfer price of 6 billion VND, earning a profit of 1 billion VND compared to the original cost. As of May 20, ADC is no longer a linked company of HAG.

In the first quarter of 2025, the company reported a profit of 360 billion VND, an increase of 134 billion VND from the previous year. This improvement is attributed to a 66 billion VND increase in gross profit from banana business activities, a 53 billion VND decrease in financial expenses due to reduced interest expenses as HAG repaid a significant portion of its bond debt, and no reversal of provisions for financial investments in the same period. Additionally, there was an 8 billion VND reduction in selling expenses and management expenses compared to the previous year.

The Big Dip: Why Large-Cap Stocks are Taking a Tumble, While Small Real Estate Remains Resilient

The market opened the month of June with a steep decline in the VN30-Index, erasing 0.99% as large-cap stocks faced downward pressure. The VN-Index also took a hit, falling 0.62% due to losses in VIC and VHM. However, money continued to flow into mid-cap stocks, indicating a cautious but persistent appetite for opportunities in the market.

The Ultimate Penmanship: Crafting a Captivating Title

“The Penultimate Stroke: Unveiling the Intricacies of a 17-Million Share Trade”

The Vietnam Investment Group Joint Stock Company intends to sell 17 million VAB shares of VietABank through a matched or negotiated deal. This move is designed to comply with the Law on Credit Institutions 2024, which stipulates that institutional shareholders cannot own more than 10% of a bank’s charter capital.

“Equity Incentive Windfall: Real Estate Firm Prepares for 200% Stock Bonus Payout.”

“The company’s chartered capital will increase significantly, from 36 billion VND to an impressive 108 billion VND, following this issuance.”