The VN-Index recovered from a lackluster morning session, turning green in the afternoon. The recovery was led mainly by oil and gas, banking, securities, and real estate stocks. At the close of June 2nd, the VN-Index rose slightly by 3.7 points to 1,336.3 points. Liquidity continued to decline, with the matching value on HoSE reaching a meager VND18.622 trillion.

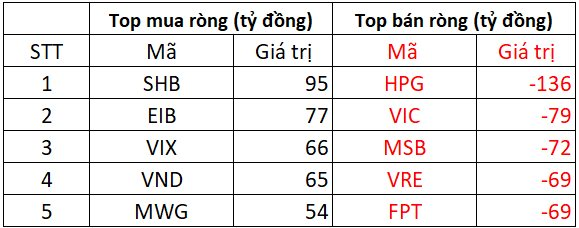

In this context, foreign investors continued their net selling trend, but the pressure eased compared to previous sessions. The total net selling value on the three exchanges today was approximately VND159 billion. Specifically:

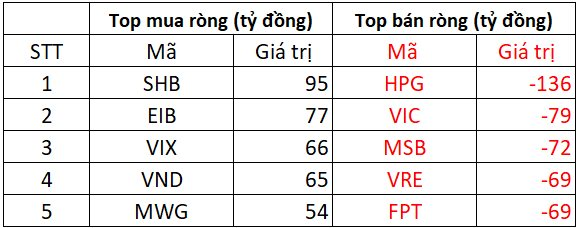

Foreign investors net sold approximately VND203 billion on HoSE

In the selling session, HPG was the most net-sold stock in the market by foreign investors, with a value of VND136 billion. This was followed by VIC and MSB, which were also heavily sold, with net selling values of VND79 billion and VND72 billion, respectively. VRE and FPT were both net sold, with values of VND69 billion each.

Conversely, SHB was the most net bought stock in the market, with a value of VND95 billion. EIB also saw significant net buying of around VND77 billion. Additionally, VIX, VND, and MWG were net bought, with values ranging from VND54 to VND66 billion each.

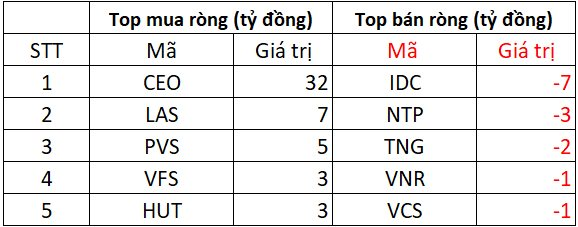

On the HNX, foreign investors net bought nearly VND42 billion

In the buying session, CEO was the most net bought stock by foreign investors, with a value of VND32 billion. LAS, PVS, VFS, and HUT were also among the top net bought stocks today.

On the opposite side, IDC experienced the highest net selling value of VND7 billion, followed by NTP and TNG with net selling values of VND2-3 billion each. Additionally, codes such as VNR and VCS were net sold at around VND1 billion each.

On UPCOM, foreign investors net bought approximately VND2 billion

In the buying session, VEA and DDV were net bought with values of VND4-5 billion each, followed by MCH with a net buying value of VND2 billion. ABI and VHG were also net bought, with values of a few hundred million VND each.

Conversely, OIL and ACV experienced net selling values of VND3-4 billion, while MPC, MML, and FOC were net sold at a few hundred million to VND1 billion each.

Shipping Stocks, Seafood, and Textiles: A Trio of Lucrative Investment Opportunities

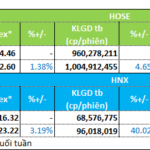

The HNX exchange witnessed a significant improvement in liquidity during the final trading week of May. Marine transportation, textiles, and seafood were the top-performing sectors, attracting the most capital inflows over the week.

Market Pulse June 2nd: Energy Sector Surges, VN-Index Recaptures Green Territory

The trading session concluded with the VN-Index climbing 3.7 points (+0.28%), reaching 1,336.3. Meanwhile, the HNX-Index witnessed a rise of 2.95 points (+1.32%), ending at 226.17. The market breadth tilted towards gainers, as 438 stocks advanced against 323 decliners. Similarly, the VN30 basket saw a slight dominance of greens, with 16 gainers, 13 losers, and 1 stock remaining unchanged.

Market Pulse June 2nd: Blue Chips Dive, VN-Index Down Over 8 Points

The heavy pressure from the pillar group is causing the VN-Index to gradually lose momentum in the late morning session. By the mid-session break, the VN-Index had dropped 0.62%, settling at 1,324.4 points. In contrast, the HNX-Index climbed 0.66% to reach 224.69 points. The market breadth was negative, with 353 declining stocks against 306 gainers.