PTX has just announced its 2024 cash dividend payout plan, with a remarkable 24% dividend ratio (VND 2,400 per share). The ex-dividend date is set for June 9th, and the expected payment date is June 24th. With over 6.4 million shares in circulation, the total estimated payout for this period exceeds VND 15.4 billion.

This dividend payout sets a record for PTX, accounting for nearly 79% of its 2024 post-tax profits and far surpassing the initially planned 10% dividend ratio. In the previous years, from 2018 to 2023, the company distributed cash dividends ranging from only 8% to 15%. For 2025, the projected dividend ratio is expected to decrease to 15%.

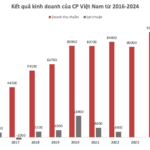

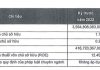

This substantial increase in dividend payout comes on the heels of PTX‘s impressive financial performance in 2024, during which the company achieved a record-high net profit of nearly VND 20 billion. This remarkable figure reflects a 67% surge compared to the previous year, despite a 9% decline in revenue to just over VND 1,900 billion. PTX has consistently demonstrated its ability to maximize profits, marking the fourth consecutive year of peak profitability through effective cost management and efficient utilization of resources.

| PTX’s Annual Net Profit |

In the first quarter of 2025, PTX witnessed a 23% year-on-year decline in revenue, falling below VND 412 billion. However, its net profit increased by 17%, surpassing VND 4 billion. This positive outcome can be attributed to significant reductions in selling, management, and financial expenses, which decreased by 11%, 21%, and 36%, respectively. As of the first quarter, the company has accomplished 26% of its annual revenue and profit targets.

On the stock market, PTX‘s shares are currently trading at around VND 20,600 per share, reflecting a modest 4% gain over the past month. Nonetheless, over the past year, the stock has witnessed an extraordinary surge of more than 3,100% from its previous level of just VND 600 per share. However, liquidity remains low, with an average of fewer than 1,700 shares traded per session.

Notably, PTX shares, which had been stagnant below VND 500 per share for several years, began their remarkable ascent in late May 2024. By late August, they had skyrocketed to an all-time high of nearly VND 23,000 per share—a staggering 46-fold increase within three months. Subsequently, the shares experienced a sharp decline to below VND 15,000 per share in mid-September 2024 and have continued to fluctuate significantly, currently trading in the VND 21,000 range, which represents a more than 10% drop from their peak.

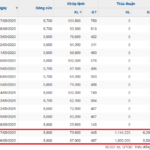

PTX Share Price Movement – Source: VietstockFinance

|

The dramatic surge in PTX’s share price occurred just before its transfer from the UPCoM to the HNX in early October 2024. During the mid-August period, when the share price was surging, numerous trading sessions witnessed tens of thousands of matched orders, with the share price frequently hitting the maximum daily limit. In their explanatory notes, PTX‘s management attributed these price fluctuations solely to market supply and demand dynamics, asserting that the company had not engaged in any activities that might influence the share price. They assured that the company’s operations remained stable and business-as-usual.

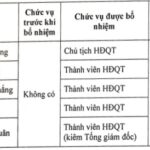

PTX, headquartered in Vinh City, Nghe An Province, was corporatized in 2000, evolving from the former Transport and Mechanics Enterprise, which was a subsidiary of Nghe Tinh Petroleum Company. With a current workforce of 449 employees and a charter capital of over VND 64.3 billion, PTX specializes in petroleum, cargo transportation, and the trading of petroleum and petrochemical products. The Petroleum Services Joint Stock Company (Petrolimex) holds nearly 51% of PTX’s capital. Several internal leaders also hold significant stakes, including Chairman Hoang Cong Thanh, who owns 3.2%, and Deputy Director Dao Ngoc Tien, who holds 1.1%.

– 11:28 02/06/2025

The Chairman of EVS Unable to Purchase 2.2 Million Registered Shares Due to Changes in Plans

Mr. Nguyen Hai Chau, Chairman of the Board of Directors of Everest Securities Joint Stock Company (HNX: EVS), has reported the purchase of nearly 2.15 million EVS shares from May 6 to May 27.