In its latest announcement, Hoá Phát Group Joint Stock Company (code: HPG) stated that June 27 will be the record date to finalize the list of shareholders for a 20% stock dividend, meaning that for every 5 shares held, investors will receive 1 new share. The ex-date is June 26.

With nearly 6.4 billion shares currently outstanding, Hoa Phat plans to issue approximately 1.28 billion new shares, equivalent to a par value of VND 12,793 billion. This issuance will be funded by undistributed post-tax profits from the 2024 audited financial statements.

Following this issuance, Hoa Phat’s charter capital is expected to increase to VND 76,755 billion, the highest among non-financial enterprises listed on the stock exchange. In fact, this number is only lower than a few top banks.

This issuance plan is in accordance with the resolutions of the 2025 Annual General Meeting of Shareholders. Accordingly, the Board of Directors approved a proposal to pay a 2024 dividend of 20% in shares (for every 5 shares held, investors will receive 1 new share).

This plan replaces the previous proposal of a 5% cash dividend and a 15% stock dividend, which was put forward by Hoa Phat in late March 2025.

The reason for Hoa Phat’s decision to pay the entire dividend in shares is to ensure the safety of its cash flow as a defensive measure against global fluctuations, especially the US tax policy.

According to the 2024 management report, Mr. Tran Dinh Long owns 1.65 billion HPG shares, equivalent to a 25.8% stake, making him the largest shareholder. Mr. Long’s wife, Mrs. Vu Thi Hien, holds 440 million HPG shares, or 6.88% of the capital. His son, Tran Vu Minh, holds nearly 147 million HPG shares (2.3% capital). Tran Vu Minh’s company, Dai Phong Trading and Investment Company, holds 3 million HPG shares (0.05% stake). In addition, Mr. Long’s four siblings also own a total of nearly 2.9 million shares (0.05% stake).

Thus, the total ownership percentage of Mr. Tran Dinh Long and related shareholders in Hoa Phat is over 35%. With this percentage, Mr. Long and related shareholders are expected to receive approximately 448 million HPG shares in the upcoming issuance.

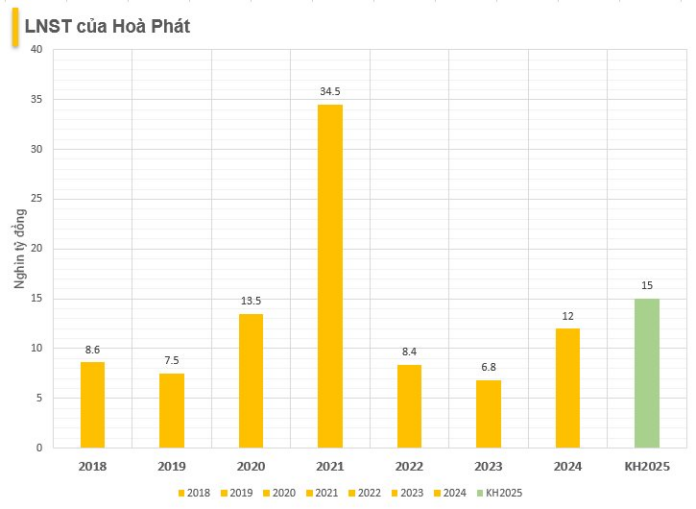

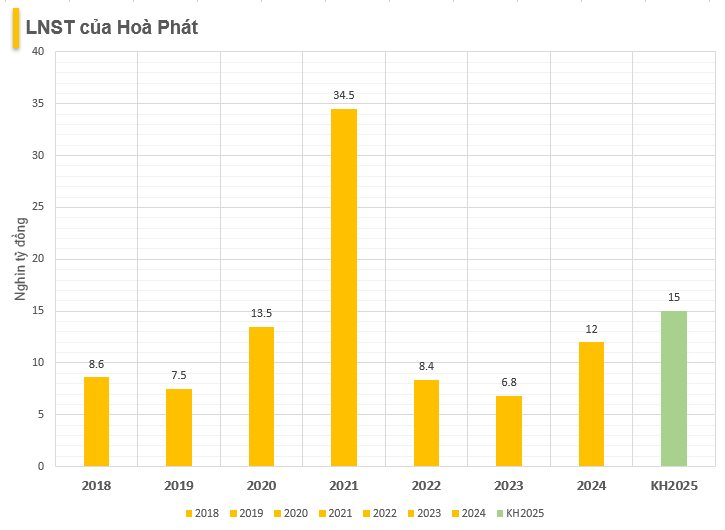

In terms of business results, in the first quarter of 2025, Hoa Phat recorded revenue of over VND 37,900 billion and after-tax profit of VND 3,300 billion, up 22% and 16%, respectively, compared to the same period in 2024. In the first quarter of 2025, Hoa Phat completed about 22% of its annual revenue plan and 22% of its annual profit plan.

In the first quarter, the Hoa Phat Group produced 2.66 million tons of crude steel, up 25% over the same period. Sales volume of hot-rolled steel coils, high-quality steel, construction steel, and steel billets reached 2.38 million tons, up 29% compared to the first quarter of 2024.

“Hòa Phát and German Partners Forge Ahead with Railway Steel Venture: First Products Expected in Two Years”

On May 29, Hoa Phat Group (HOSE: HPG) and Germany’s SMS Group inked a deal for the provision of technology and a production line for rail and shaped steel with an annual capacity of 700,000 tons. The production line is slated for completion within 20 months, with the first high-speed rail products expected to roll out in Q1 2027.

The F2 Generation Splashes Billions to Boost Ownership in Family Business

Recently, the F2 generation of Vietnamese tycoons has been splashing out hundreds of billions of dong to purchase shares and increase their ownership in family businesses.

The Stock Price Surges 37% from its Low: Vice Chairman Registers to Purchase Additional 7 Million Shares

“In a bold move, the Vice Chairman of the Board of Members at STK Fiber Corporation (HOSE: STK) has registered to purchase 7 million shares of the company’s stock, with ambitions to raise his ownership stake to 21.72%. This development comes at a time when the company’s shares have witnessed a robust recovery, and the first-quarter financial results showcase an impressive surge in growth.”