Petrolimex Nghe Tinh JSC to Pay Out 2024 Dividends in Cash

On June 10th, Petrolimex Nghe Tinh JSC (code: PTX) will finalize the list of shareholders eligible for a 2024 cash dividend payout at a rate of 24% (equivalent to VND 2,400 per share).

The company plans to start making payments to shareholders from June 24th, 2025. With over 6.4 million shares, PTX is expected to pay out more than VND 15 billion.

PTX has consistently paid dividends in cash over the years, with rates ranging from 8-15%. The 2024 dividend rate is the highest in the company’s history, far exceeding the planned rate of 10%. For 2025, PTX aims for a dividend rate of 15%.

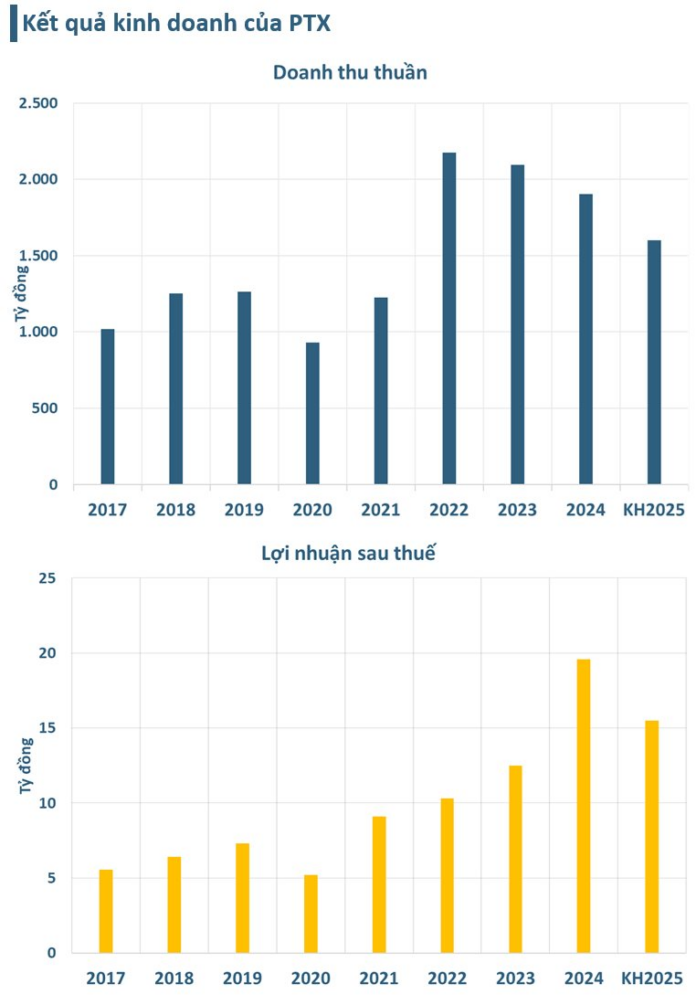

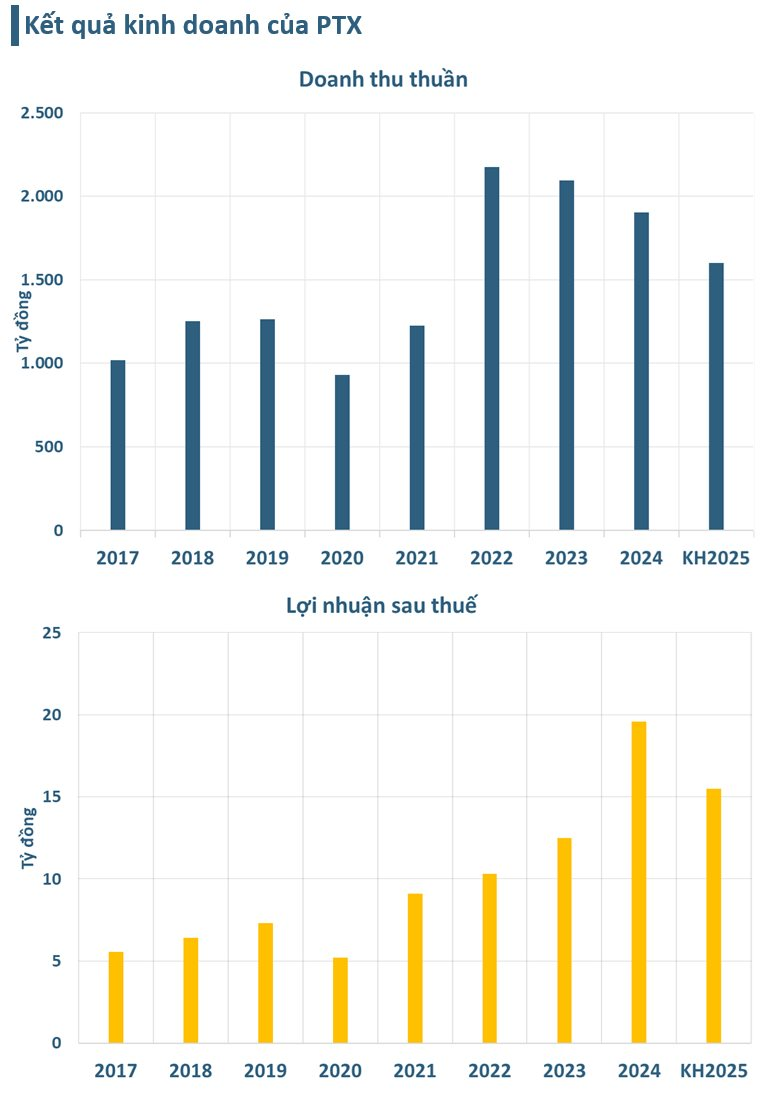

The high dividend payout follows a successful year for the company. Specifically, PTX recorded a 9% decrease in revenue, amounting to over VND 1,900 billion. However, thanks to effective cost control, net profit surged by 67% to a record high of nearly VND 20 billion. This was the fourth consecutive year of peak profits for the company.

In the first quarter of 2025, PTX’s revenue decreased by 23% year-on-year to VND 411 billion, but net profit increased by 17% to over VND 4 billion, thus completing 26% of the annual profit target (VND 15.5 billion).

Petrolimex Nghe Tinh JSC is a subsidiary of Petrolimex Vietnam. In 2018, the company officially started trading on UPCoM. After several rounds of capital increases, PTX now has a charter capital of nearly VND 64 billion, with Petrolimex Services Joint Stock Company as the parent company, holding 3.2 million shares, equivalent to 51%.

Notably, PTX’s market price has fluctuated significantly over the past year after a long period of stagnation. Specifically, the share price surged by nearly 3,500% compared to the price of only VND 640/share (June 2024) to a peak of VND 22,900/share (August 2024).

This dramatic increase occurred just before PTX’s shares were transferred from UPCoM to the HNX in early October 2024. The market price quickly adjusted and has since stabilized, ending the session on June 2nd, 2025, at VND 21,900/share, a decrease of about 10% from its peak.

The Ultimate Stock Market Superstar: Unveiling the 4,100% Surge and a Record-Breaking 24% Dividend

Petrolimex Nghe Tinh Joint Stock Company (HNX: PTX) has been dubbed the ‘dark horse’ of the oil and gas industry, with its stock price soaring from a few hundred dong to a peak of 23,000 dong per share ahead of its exchange transfer. The company continues to surprise with its announcement of a record-high cash dividend of 24%, equivalent to nearly 80% of its 2024 post-tax profits.

“Hoarding Cash Reserves, State-Owned Enterprise Proposes a Dividend Payout of Over $12 Million”

As of the end of Q1 2025, this enterprise boasted an impressive cash reserve of VND 16.5 trillion, surpassing its market capitalization.