The afternoon session witnessed a significant surge in excitement as the matched liquidity on the two exchanges soared to the highest level in eight sessions, a 23% jump from the morning session. While the VN-Index didn’t climb much higher, the overall price level saw an uplift, particularly with foreign capital inflows, recording a remarkable net buy of over 900 billion VND on the HoSE.

The highlight of the afternoon was undoubtedly the liquidity. The strong inflow of money alongside rising prices is an extremely positive signal. The two exchanges added approximately 13,989 billion VND in liquidity, with HoSE alone accounting for 12,779 billion, a 26% increase from the morning session.

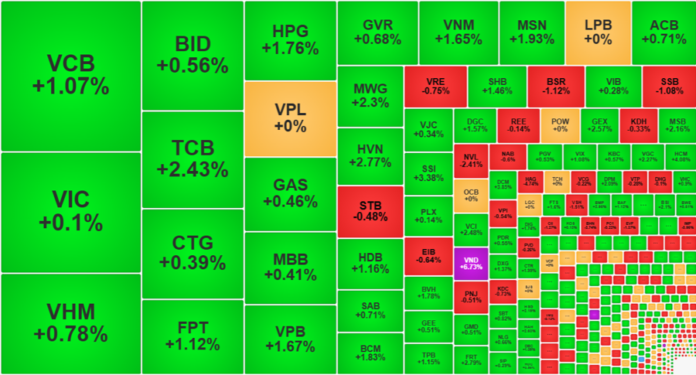

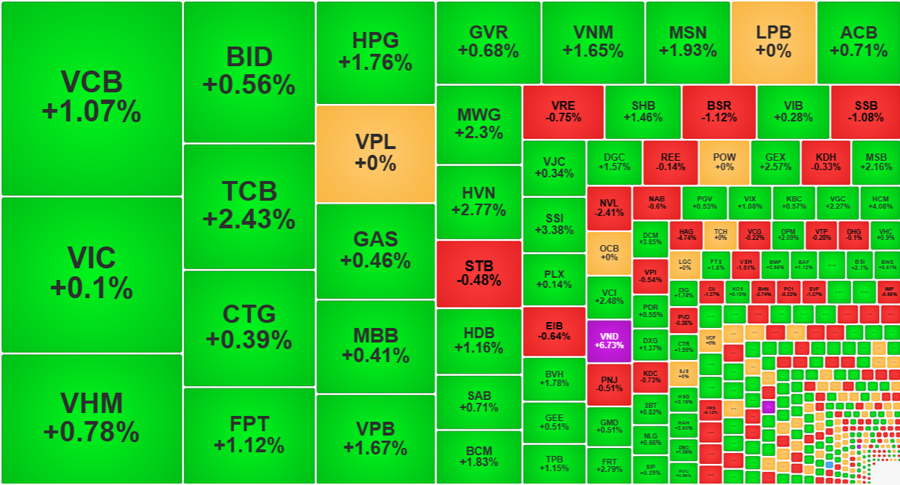

The VN-Index displayed excellent energy, reaching a new intraday high at 2 pm, surging nearly 14.6 points before retreating slightly as some leading stocks faced profit-taking pressure, resulting in a 10.95-point gain at the close. This modest gain from the morning session (which ended with a 9.03-point increase) was accompanied by a broad market that didn’t differ significantly, with 191 gainers and 117 losers.

Nonetheless, the price level witnessed a noticeable uplift. The HoSE closed with 108 stocks rising over 1%, including 50 stocks climbing more than 2%. In the morning session, these numbers stood at 89 and 40, respectively. The list of stocks hitting the ceiling price expanded with VND, witnessing massive liquidity of nearly 1,256 billion VND. This marked a record trading volume for VND since March 2024, and the stock also closed at its highest price in 11 months.

The securities group witnessed an impressive performance, with 31 stocks climbing over 1%, 23 of which surged more than 2%. SSI maintained its leading position in the market with liquidity of 1,430.2 billion VND and a price increase of 3.38%. While VND slipped to second place after being overtaken by SHB, it still managed to achieve liquidity of over a thousand billion VND. VIX climbed to fourth place with 928.6 billion VND, followed by VCI and HCM, which ranked among the top 10 stocks with the largest trading volume in the market, recording 675 billion VND and 647 billion VND, respectively. Smaller securities stocks, including HAC, MBS, AAS, HBS, PSI, SBS, ORS, and HCM, witnessed gains of over 4%.

The leading stocks from the morning session struggled to extend their gains in the afternoon, which was the primary reason the VN-Index couldn’t break out further. VIC even faced selling pressure, causing its price to retreat to the reference price, despite a 1.12% gain in the morning. TCB, the stock that led the index in the morning, lost momentum, inching up by only one tick. BID remained unchanged, while FPT slipped slightly. CTG, VCB, and VHM, however, contributed to the index’s gains in the afternoon but with minimal increases.

The VN30-Index closed with a 1.04% gain, not differing much from its level at the end of the morning session. The basket’s breadth was relatively weaker, with 26 gainers and 3 losers. Among the top 10 stocks by market capitalization, four recorded strong gains: VCB rose by 1.07%, TCB by 2.43%, FPT by 1.12%, and HPG by 1.76%. However, most of these gains were already achieved in the morning session.

The rest of the market maintained its positive momentum, but some stocks exhibited selling signals. The decliners included CII, HAG, EVF, and HDC, which faced substantial selling pressure, alongside NVL. Notably, HAG experienced a fierce wave of selling. At the end of the morning session, HAG was up by 1.09%, but just 20 minutes after the market reopened, its price started to plummet. The stock closed with a significant loss of 4.74%, accompanied by robust liquidity of nearly 260.2 billion VND. HDC also witnessed a selling spree after 2 pm, with its price plunging from 26,000 VND to as low as 25,300 VND, equivalent to a 2.7% drop. It closed with a 1.16% loss against the reference price, recording a liquidity of 126.5 billion VND.

On the upside, the securities group shone brightly in terms of both price and liquidity. Additionally, the VN30 basket contributed SHB, HPG, and TCB to the list of stocks with the highest liquidity and gains of over 1%. Notable mid-cap stocks included DXG, rising by 1.37% with 436.2 billion VND in liquidity; DIG, climbing by 1.74% with 431 billion VND; GEX, surging by 2.57% with 426.8 billion VND; and DCM, increasing by 3.85% with 287.4 billion VND…

Foreign investors continued their enthusiastic participation in the afternoon session, with net buying on the HoSE increasing by approximately 484 billion VND after net buying 424.9 billion VND in the morning. This was the best net buying session since May 15. The top bought stocks were APG (467.5 billion VND), VND (208.2 billion VND), and SHB (159.5 billion VND). Notable net sold stocks included FPT (-104.2 billion VND), VRE (-82.9 billion VND), STB (-65 billion VND), KDH (-60.9 billion VND), and CII (-54.9 billion VND).

Stock Market Blog: Unexpected Euphoria Returns, Don’t Miss the Boat by Selling Too Soon!

The market surged unexpectedly today, fueled by a rally in stock securities. Although unable to lead the score, this momentum positively influenced investors’ psychology. Those who took profits are now hesitant, feeling the psychological pressure of missing out on potential gains.

The Stock Market in June: What to Expect After a Brilliant May

The VN-Index ended May with the strongest gain since the beginning of the year, but it now faces profit-taking pressure at the old peak. Analysts remain cautious, suggesting that the market will continue its accumulation trend to absorb profit-taking selling pressure while awaiting new supportive information.

The Billionaire’s Boom: How Pham Nhat Vuong’s Wealth Surged by $2.9 Billion in May, Matching BIDV’s Market Cap and Surpassing the Next 12 Individuals’ Combined Net Worth

As of Tuesday, June 3, 2025, Mr. Vuong’s net worth surpasses the market capitalization of several prominent Vietnamese businesses listed on the stock exchange. His wealth exceeds that of industry giants such as Hoa Phat, FPT Corporation, PV Gas, Masan Consumer, and Vinamilk. Furthermore, his assets surpass those of notable banks, including Techcombank, MB, VPBank, and ACB.