VN-Index Surges to a 3-Year High: Foreign Investors Fuel the Rally

The VN-Index witnessed another robust trading session on June 3rd, with gains expanding towards the end of the day. At the close, the VN-Index climbed nearly 11 points to reach 1,347.25, the highest level in over three years. Liquidity improved significantly, with the matching value on HoSE reaching VND 22,890 billion.

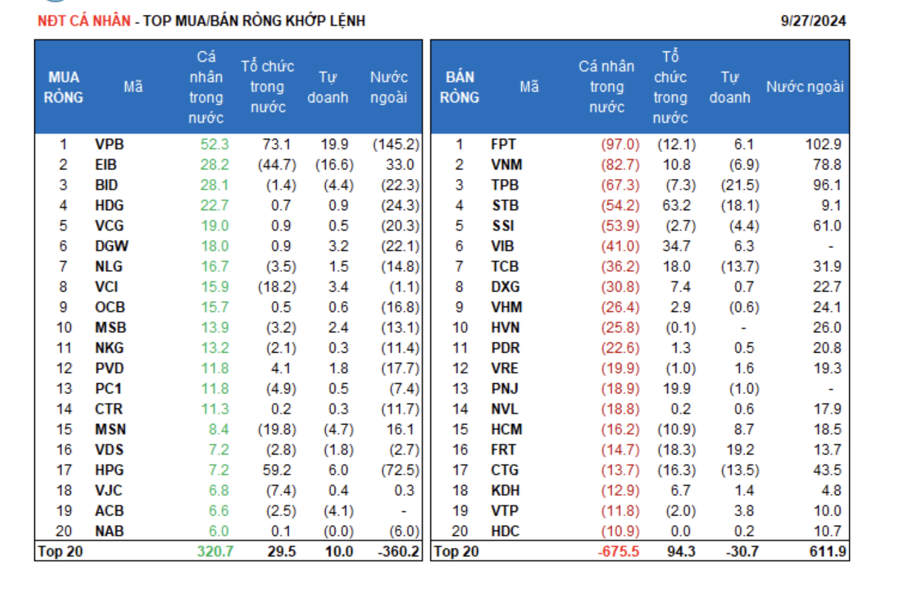

In this context, foreign investors’ transactions stood out as they net bought aggressively, nearly VND 970 billion in this session. Specifically:

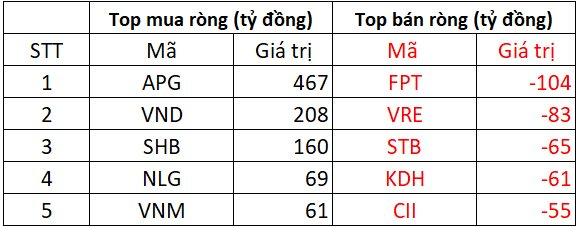

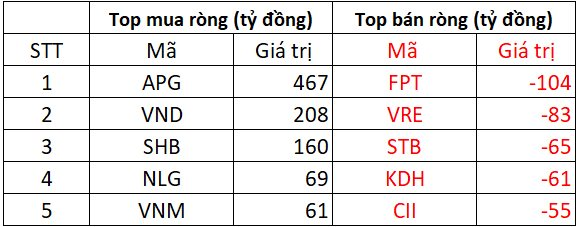

On HoSE, foreign investors net bought approximately VND 909 billion

On the buying side, the pair of securities stocks, APG and VND, saw the strongest net buying in the market, with values of VND 467 billion and VND 208 billion, respectively. Following this, SHB shares were also net bought at around VND 160 billion. Additionally, NLG and VNM shares were net bought by a few dozen billion VND each.

In contrast, FPT shares were net sold by foreign investors for VND 104 billion, and VRE also witnessed net selling of up to VND 83 billion. Subsequently, codes such as STB, KDH, and CII also made it to the top net sell list for this session, with values ranging from VND 55 to 65 billion.

On HNX, foreign investors net bought approximately VND 73 billion

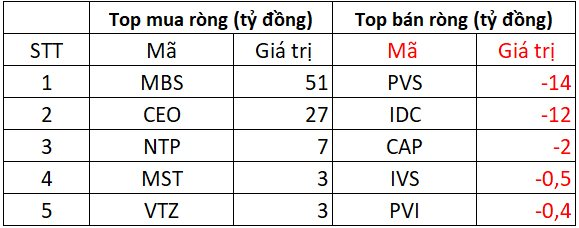

MBS shares were heavily net bought at VND 51 billion on the buying side, while CEO shares were net bought at VND 27 billion. Following this, NTP, MST, and VTZ were also net bought in this session, with values of a few billion VND each.

On the opposite side, PVS and IDC shares witnessed the strongest net selling, ranging from VND 12 to 14 billion. CAP, IVS, and PVI were also net sold, ranging from a few hundred million to a few billion VND each.

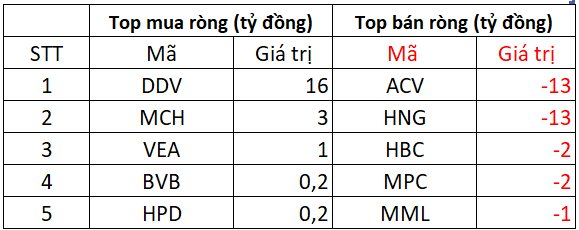

On UPCOM, foreign investors net sold nearly VND 12 billion

Regarding purchases, DDV shares were net bought at around VND 16 billion; subsequently, MCH and VEA were lightly net bought at VND 1-3 billion each; BVB and HPD were also net bought at a few hundred million VND.

Conversely, ACV and HNG shares were net sold at VND 13 billion; HBC, MPC, and MML were also net sold, but the values were insignificant, amounting to only VND 1-2 billion each.