DX Group Joint Stock Company (Stock Code: DXG, HoSE) has just announced a resolution approving the investment policy and plan to increase ownership in DX Commercial JSC (DXC).

Accordingly, DXG aims to increase its ownership to a minimum of 99% of DXC’s charter capital through share transfer or additional capital contribution. The maximum investment value is up to VND 210 billion.

As of the end of the first quarter of 2025, DXC was a direct subsidiary of DX Services JSC (DXS, HoSE), which held 70% of its capital.

Meanwhile, DXS is a subsidiary of DXG, with DXG holding 59% of its capital. As a result, DXG indirectly owns DXC.

On May 23, DXS approved the transfer of its entire stake in DXC. The transaction is expected to take place in the second quarter of 2025. After the transfer, DXS will no longer hold any shares in DXC. It is likely that DXG will acquire DXC shares from DXS.

Illustrative image

In another development, on May 23, the State Securities Commission (SSC) received a report on DXG’s bonus share issuance to increase its charter capital from owner’s equity.

Accordingly, DXG will issue over 148 million bonus shares to shareholders at a ratio of 100:17, meaning that for every 100 shares owned, shareholders will receive 17 new shares.

The newly issued shares are not restricted from transfer, except that existing shareholders holding ESOP 2023 (bonus) shares during the restricted transfer period will still receive new shares, but these shares will be restricted from transfer for the same period as the original ESOP shares.

The issuance value is VND 1,480.4 billion, including VND 1,200 billion from after-tax profit not distributed based on the audited 2024 consolidated financial statements, and over VND 280.4 billion from capital surplus based on the company’s audited 2024 separate financial statements.

If the issuance is successful, DXG’s charter capital will increase from nearly VND 8,726 billion to over VND 10,206 billion.

In the first quarter of 2025, DXG recorded consolidated net revenue of approximately VND 925 billion, down 13% year-on-year. This decrease was mainly due to a nearly 19% decline in core revenue from real estate transfers, amounting to over VND 666 billion. However, thanks to a 30% reduction in cost of goods sold, gross profit increased by 8% to over VND 510 billion.

After deducting taxes and expenses, DXG reported a net profit of over VND 78 billion, up 1% compared to the same period last year.

The Ultimate Stock Market Superstar: Unveiling the 4,100% Surge and a Record-Breaking 24% Dividend

Petrolimex Nghe Tinh Joint Stock Company (HNX: PTX) has been dubbed the ‘dark horse’ of the oil and gas industry, with its stock price soaring from a few hundred dong to a peak of 23,000 dong per share ahead of its exchange transfer. The company continues to surprise with its announcement of a record-high cash dividend of 24%, equivalent to nearly 80% of its 2024 post-tax profits.

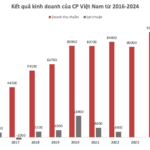

“C.P. Vietnam’s Road to Success: Unveiling the Strategies Behind their Impressive Growth”

With a staggering revenue of nearly 93,000 billion VND and a supply of 6.8 million pigs per year, C.P. Vietnam is the undisputed leader in animal feed market share. The company plays a pivotal role in the global strategy of the renowned Charoen Pokphand (C.P.) Group.