Vietnam’s stock market witnessed a vibrant trading session on June 3rd, with the VN-Index surging to its highest level since March 2025. Driven by positive market sentiment, the index opened with a bullish gap and climbed to its intraday high. At the closing bell, the VN-Index gained 10.95 points (+0.82%), settling at 1,347.25. Notably, foreign investors emerged as the highlight of the session, aggressively snapping up nearly VND970 billion net buy value across the market.

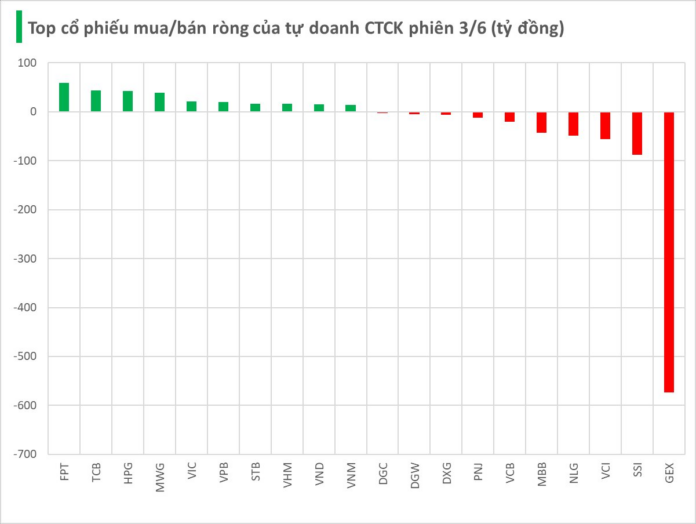

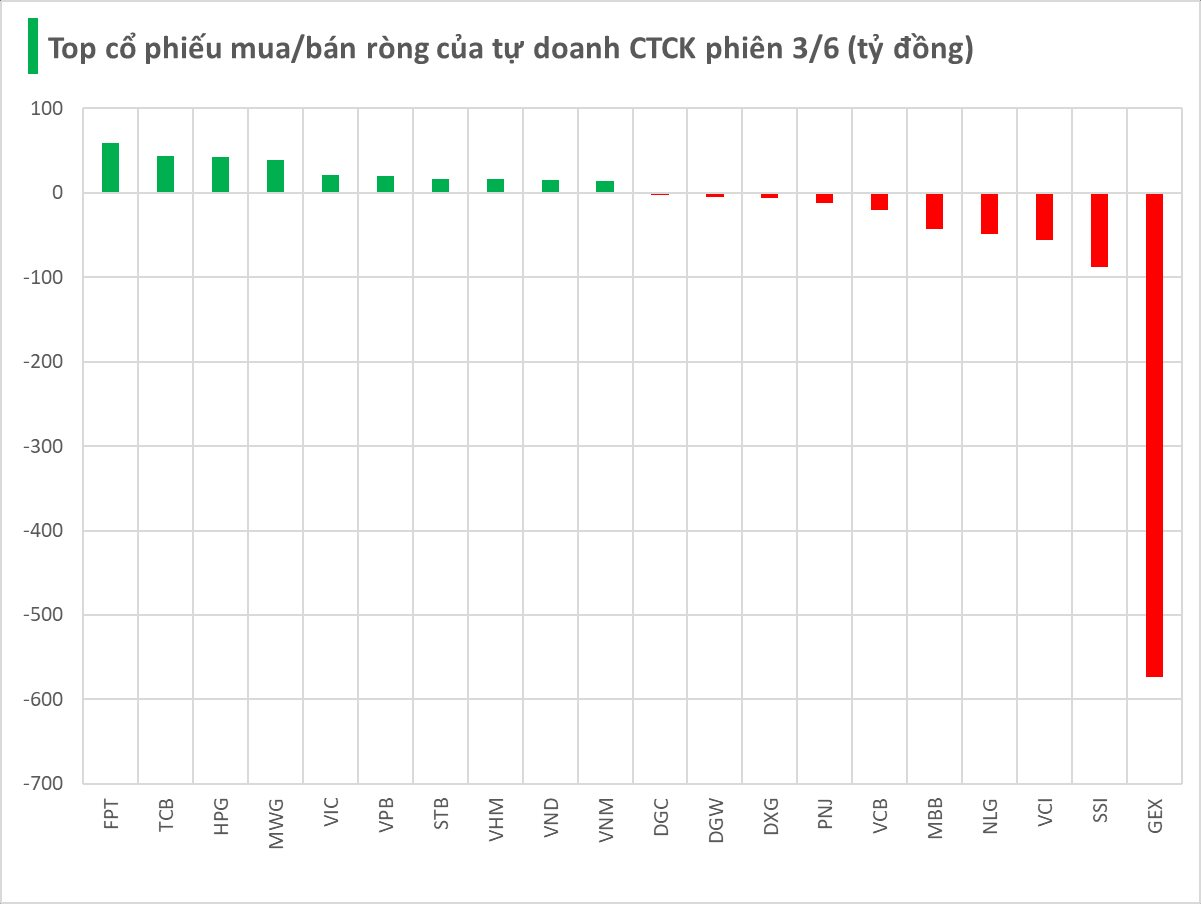

In contrast, securities companies’ proprietary trading activities recorded a net sell value of VND429 billion on the HoSE.

A deep dive into the data reveals that securities companies offloaded GEX the most, with a net sell value of VND574 billion. This was followed by SSI and VCI, which were net sold for VND88 billion and VND56 billion, respectively. Other stocks that witnessed net selling pressure included NLG, MBB, VCB, and PNJ.

On the flip side, securities companies focused their buying activities on FPT and TCB, resulting in net buy values of VND58 billion and VND43 billion, respectively. HPG also attracted buying interest, with a net buy value of VND43 billion. MWG, VIC, VPB, STB, VHM, VND, and VNM were among the stocks that enjoyed net buying during the session.

Market Pulse for June 4th: Caution Prevails, PVS and PVD Duo Maintains Positive Momentum

The cautious sentiment among investors resulted in a mixed performance for the market’s key indices, which hovered around the reference marks. As of 10:30 am, the VN-Index witnessed a slight dip of 1.17 points, hovering around the 1,346 mark. Conversely, the HNX-Index displayed resilience, climbing by 1.09 points to trade at approximately 230 points.

A Flood of Cash, Stocks Surge: What’s the Story?

The stock market surge comes after a prolonged period of stagnation, defying the continuous rally of the VN-Index.