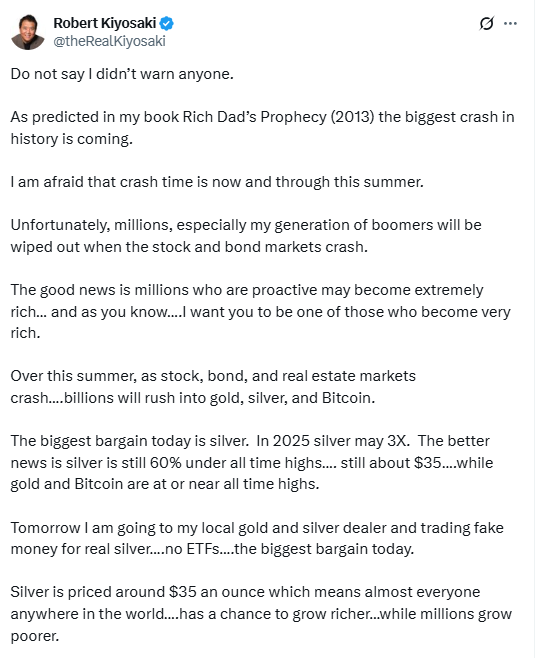

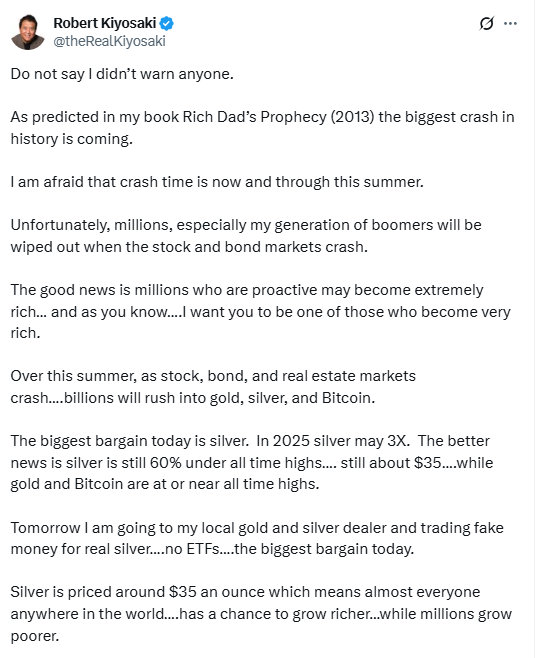

In his latest social media post, Robert Kiyosaki, the renowned author of ‘Rich Dad, Poor Dad’, reiterates his perspective on the financial market fluctuations and expresses a strong belief in silver.

Kiyosaki reveals that he is shifting his focus to investing in physical silver over Bitcoin, deeming it the “biggest bargain at the moment”. With silver trading around $35 per ounce, he believes it is still 60% below its all-time high and could potentially triple by 2025. Previously, he had predicted a doubling in price, but now his expectations have tripled, showcasing his growing faith in this precious metal.

Compared to gold and Bitcoin, which are at or near all-time highs, Kiyosaki views silver as a more attractive investment with room for growth, befitting a defensive strategy amid looming crises.

According to Kitco News, gold and silver prices surged amidst ongoing economic and geopolitical unrest, driving the demand for safe-haven assets. Like Robert Kiyosaki, some experts believe silver is poised to enter a new breakout phase.

Michele Schneider, Market Strategist at MarketGauge, maintains a neutral stance on gold and silver as their prices undergo a consolidation phase. However, she indicates a potential shift to buying silver if its price sustains an upward trajectory and stabilizes above the $34 per ounce mark.

This statement comes as silver witnessed its strongest rally since October 2023, with spot silver reaching $34.39 per ounce, surging over 4% in a single day. Nonetheless, Schneider remains cautious, awaiting further buying momentum to confirm the new trend.

Gold prices also exhibited a positive trend, with spot gold rising over 2.6% to $3,374.90 per ounce in the latest session. However, Schneider predicts that silver may garner greater market attention, especially as the gold-silver ratio undergoes a notable adjustment.

The gold-silver ratio, indicating the number of silver ounces needed to buy an ounce of gold, has recently dipped below its 50-day moving average, suggesting a potential shift in favor of silver in the precious metals market. Last month, this ratio peaked at 107 – a five-year high – following gold’s record high of $3,500 per ounce. Schneider draws parallels with 2020, when a similar decline in the ratio after reaching a peak resulted in silver outperforming gold as an investment over the subsequent year.

Interest rates also play a role in the positive outlook for the precious metals market. According to Schneider, the Federal Reserve may be compelled to cut rates sooner than expected if economic growth continues to slow, despite persistent inflation. Markets are already pricing in the possibility of a Fed rate cut by September, as indicated by the FedWatch tool from CME.

Lower interest rates would particularly benefit silver, which has extensive industrial applications, ranging from solar energy production to electronics and healthcare. With rising industrial consumption, silver is considered a more effective hedge against inflation in the upcoming phase.

Schneider also emphasizes the downward pressure on the US dollar. In her view, an increasing number of foreign investors are concerned about the stability of the US financial system, contributing to the prolonged weakness of the greenback.

In fact, the US Dollar Index has dipped below its 80-month moving average twice – most recently in 2020, amid the fiscal aftermath of the pandemic and rising public debt. Prior to that, in 2011, a significant drop in the dollar occurred after a US credit rating downgrade by S&P.

While safe-haven assets are typically expected to benefit from a weaker dollar, Schneider believes that any rallies in the greenback will likely be short-lived and insufficient to reverse the prevailing trend.

Against this backdrop, both gold and silver are well-positioned for further price appreciation. However, Schneider leans towards silver due to its multiple tailwinds from both the financial and industrial markets.

In Vietnam, silver prices also surged 3.7% on June 3rd, following the global upward trend. According to Phu Quy Group, a leading precious metals company, silver bars of 1 kilogram were priced at 34.9 million VND (buy) and 36.05 million VND (sell).

Gold is Steady, But Now’s the Time for Investors to Keep a Close Eye on This ‘Sibling’ Metal

According to a seasoned expert, if the current price of $34 per ounce holds firm, silver could surge rapidly towards the $40 mark.

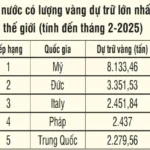

Gold: From Traditional Reserve to Modern Financial Weaponry

For centuries, gold has been a core component of the global monetary system, offering a lower-risk asset class compared to many other alternatives. In today’s volatile geopolitical climate, with soaring inflation and strained global trade, nations are re-evaluating their approach to this precious metal.

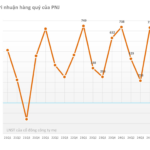

“PNJ Responds to State Bank’s Gold Business Inspection Findings: Addressing Shortcomings Since 2024”

PNJ acknowledges the findings of the Banking Inspection and Supervision Agency and assures that it will fully comply with the agency’s decisions. The company has taken proactive measures to address the shortcomings and rectify any consequences that may have arisen.