Is the Stock Market About to Surge?

At the program “Vietnam and the Indices: Financial Prosperity”,

Tran Hoang Son, Market Strategy Director of VPBank Securities Joint Stock Company (VPBankS),

likened the rising candle in May to a “healing” candle after April’s crash.

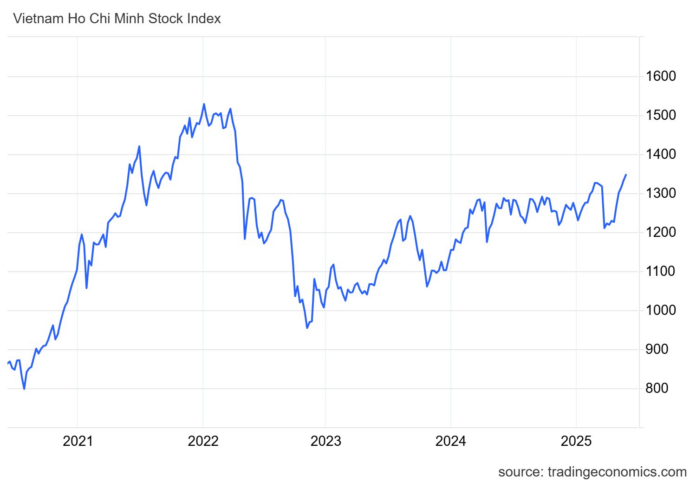

Looking at both weekly and monthly candles, the market is in an accumulation phase. The monthly candle in May reflected a return of confidence after April’s setback. After stock prices fell deeply, medium and long-term money returned to buy stocks, holding the index until now.

However, in the medium term, the market is in a sideways accumulation zone for many months. Referring to the accumulation phases in 2004–2005 and 2014–2015, Mr. Son said that after these phases, the market experienced strong gains. The VPBankS expert expects the market to be in an accumulation phase as the Fibonacci trend is upward.

In May, the VN-Index hit a high of nearly 1,338 points and reached some resistance levels. Therefore, it is entirely normal to have corrective sessions at the beginning of June. “If there is a correction in the middle or end of June, mid-term investors can buy in to prepare for the wave in September–October this year,” Mr. Son pointed out.

Additionally, from a macro perspective, the government has just issued Resolution 68, which could transform Vietnam’s economy for at least the next 50 years. It can be said that the present period is a “hinge” moment, with numerous resolutions and policies being introduced and resolved. Private enterprises will benefit first.

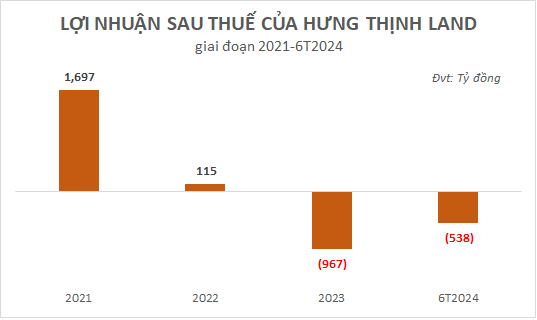

For example, since the beginning of the year, real estate businesses facing legal and planning difficulties have been resolved, and real estate stocks have surged strongly, such as NVL, CEO, and DIG. This phenomenon is due to low valuations and government solutions.

Thanks to these factors, we can expect the latter part of the year to be more positive. The market will still have its ups and downs but will be on an upward trajectory rather than a downward spiral.

“Opportunity in Crisis”: Time to Buy Undervalued Stocks

Regarding the macroeconomic situation, Vietnam is approaching the stage of reciprocal tariffs returning after a 90-day postponement. After 90 days, combined with the legal uncertainty surrounding the laws that Mr. Trump is using to impose tariffs, US trade policies create even more uncertainty.

According to the VPBankS expert, import-export enterprises will not be able to anticipate tariff rates as Mr. Trump constantly changes his rhetoric on tariffs and deadlines. Enterprises will lack initiative in pricing, orders, and customers. This is a factor that creates uncertainty for the financial market as a whole.

Statistics from Bloomberg show that during the 2018–2019 period, when Mr. Trump’s trade policies changed continuously, the global stock market fluctuated wildly. Similarly, the VN-Index set a record of around 1,200 points, then corrected downward to around 860–900 points. In 2025, the index measuring uncertainty even rose higher, reaching an all-time high of about 15 points.

Currently, this index has cooled down but has not returned to normal as the US does not have enough time to negotiate with all countries. At the same time, legal uncertainty will create more fluctuations in tariffs. If the court rules that Mr. Trump’s policies are not in force, businesses currently subject to tariffs will benefit greatly. On the other hand, if the Supreme Court recognizes these laws, the impact on global GDP growth will be significant.

Because of uncertain trade policies, the stock market, currency market, and bond market are all affected. In March 2020, when the COVID wave occurred, all three markets fluctuated wildly. The next phase of intense volatility was when the Fed raised interest rates in 2022. Most recently, the stock market was impacted by stories such as the yen carry trade in September 2024 and Trump’s Trade War 2.0 in April 2025. Mr. Trump’s decision to postpone tariffs has helped calm market volatility, almost returning to average levels.

Therefore, some experts also believe that the bottom of the stock market in April was the lowest point of the year. In the coming period, even if the tariff policy changes, the market will not fall as low as it did in April. At the same time, emotionally, after experiencing many ups and downs, investors now have a certain perspective and evaluation.

In summary, Mr. Son believes that the market will remain unpredictable in the short term. But in the long run, the recovery and growth potential of the markets, especially the frontier and emerging markets, are very positive. It can be said that this is an “opportunity in crisis”: “When the market fluctuates, there will be an opportunity to buy and hold for the next growth cycle.”

On another note, as the USD has weakened, investors have reduced the proportion of USD-denominated assets, especially in the US. There are signs that this money is returning to emerging and frontier markets. The VPBankS expert stated: “If the enterprise valuation is cheap and less affected by tariff factors, investors can rest assured to buy during the adjustment phase and hold for the wave at the end of this year.”

The Ultimate Trading Stock Has Arrived

The VN-Index closed today’s session (June 3rd) at a year-to-date high of 1,347 points. The stock market witnessed a robust rally across securities as investors circulated rumors about the market upgrade progress. A notable highlight was the massive transaction by foreign funds, with over 37 million shares traded through a block deal in APG.

Market Pulse June 4th: A Tale of Two Markets

The VN-Index witnessed a tug-of-war around the reference mark in the morning session, closing the mid-session with a slight loss of 0.64 points (-0.05%), settling at 1,346.61. Meanwhile, the HNX-Index continued its impressive winning streak, adding 1.74 points (+0.76%) to reach 230.68. The market breadth tilted slightly towards the advancers, with 353 gainers versus 290 decliners.

The Big Sell-Off: Brokerage Offloads Nearly $600 Million in Stock on June 3rd

The HoSE witnessed a notable development as proprietary securities firms recorded net selling of 429 billion dong. This significant move by these firms has caught the attention of market observers, sparking curiosity about the potential implications on Vietnam’s stock market landscape.