Providing insights into the macroeconomic outlook and stock market trends for the upcoming period, Mr. Phan Dũng Khánh, Director of Investment Consulting at Maybank Investment Bank, emphasized that the Vietnamese economy has progressed through nearly half of 2025 with notable growth across various economic indicators, including a well-controlled inflation rate. The country’s GDP growth in the first quarter of 2025 stood at an impressive 6.93%, the highest in five years compared to the same period from 2020 to 2025.

Meanwhile, the financial market, including the stock market, has been effectively managed. Since the US President’s announcement of tariffs, which caused a dip in global financial markets and Vietnam’s stock market, the Vietnamese market has shown a remarkable recovery. It has climbed from around 1,070 to 1,080 points to over 1,300 points as of now, reflecting a few percent increase since the beginning of the year.

This market growth indicates that positive information outweighs the negative. Notably, foreign investor transactions have significantly improved recently, with multiple net buying sessions after consecutive net selling for two years.

Examining market liquidity and cash flow reveals a consistent improvement. The cash flow has been steady and continuously growing, with bottom-fishing demand always ready to support the market during corrections, demonstrating the market’s stability and sustainability. These factors boost investor confidence.

Investors have long anticipated the launch of KRX and the potential market upgrade. These factors have already been priced into the market to some extent, tempering their enthusiasm. Hence, while these factors provide support, a more potent catalyst would be fundamental news, such as expectations of stronger economic growth in the future and the possible official announcement of the market upgrade in September.

“Investors are focusing more on medium- and long-term prospects rather than short-term influences. I am optimistic that the market peak of 1,500 points achieved about three years ago could be reached again this year in a positive scenario. If there are delays, it should happen soon next year,” emphasized Mr. Khánh.

Currently, the PE and projected PE for 2025, as estimated by various organizations, are generally above 10 and below 15 times. Compared to Southeast Asian and Asian markets, Vietnam’s stock market valuation is attractive and lower.

The driving force for the market in the coming period is Resolution 68 and recent policies that identify the private sector as a critical pillar of the Vietnamese economy. The focus now should be on effective implementation. Additionally, policies concentrating resources on economic development, aiming for an 8% growth rate and double-digit figures from next year, coupled with the expected market upgrade later this year, present a perfect combination of “heavenly timing, geographical advantage, and human harmony.” These factors fuel our optimism about the market returning to its historical peak of 1,500 points.

Investing in blue-chip stocks, industry leaders, and companies with solid fundamentals will bring benefits and profits to investors in the coming period. However, it’s important to note that the opportunity to realize profits is medium- to long-term. Investors can diversify their portfolios by allocating a portion to stocks with strong fundamentals, industry leaders, and companies with positive business results and attractive valuations for the medium to long-term.

The remaining portion can be used for short-term trading, but this ratio should be moderate and not exceed 50%. Overdoing short-term trading can decrease overall profit and return on investment.

Regarding sectors, it’s worth noting that as the market grows, sectors with a large weight in the index and those leading the market will benefit the most. These include finance and banking, investment and construction, energy, technology, and transportation. Keep an eye on sectors that have been quiet for a long time, such as real estate, as they may surge more robustly than the overall market during growth periods.

The Golden Conundrum: Why Does Importing Gold Spark Fears of Currency Drain, While Cigar and Liquor Imports Go Unscrutinized?

“Gold, according to Dr. Le Xuan Nghia, is an extremely important reserve. Vietnam only needs to import around $3-4 billion worth of gold annually, yet many worry about ‘foreign currency outflow’. In contrast, the import of foreign liquor, cigars, and cigarettes amounts to $8 billion yearly, an issue that rarely sparks concern. This irony is quite absurd.”

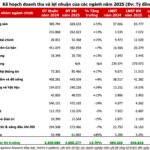

“Sifting Through Sand for Gold”: Unveiling the Industries Poised for a New Growth Cycle in 2025’s Business Plans

The market’s profit outlook for 2025 is positive, according to Agriseco, but there is a distinct divergence between industry sectors.