## TNA Plans to Divest Three Real Estate Properties to Offset Debts

On May 30th, TNA’s Board of Directors passed a resolution to approve the transfer of land use rights, ownership of houses, and other assets attached to land in District 10, Ho Chi Minh City. The assets are located at 355-365 Ngo Gia Tu, Ward 3; 1-3 Ngo Gia Tu, Ward 2; and 451-453 Nguyen Tri Phuong, Ward 8, as per the land use right certificates.

The Chairman of the Board of Directors and the Executive Board of TNA are authorized to search for buyers, negotiate, decide on the transfer price, sign the transfer contract, and implement related legal procedures, as well as report to the Board of Directors.

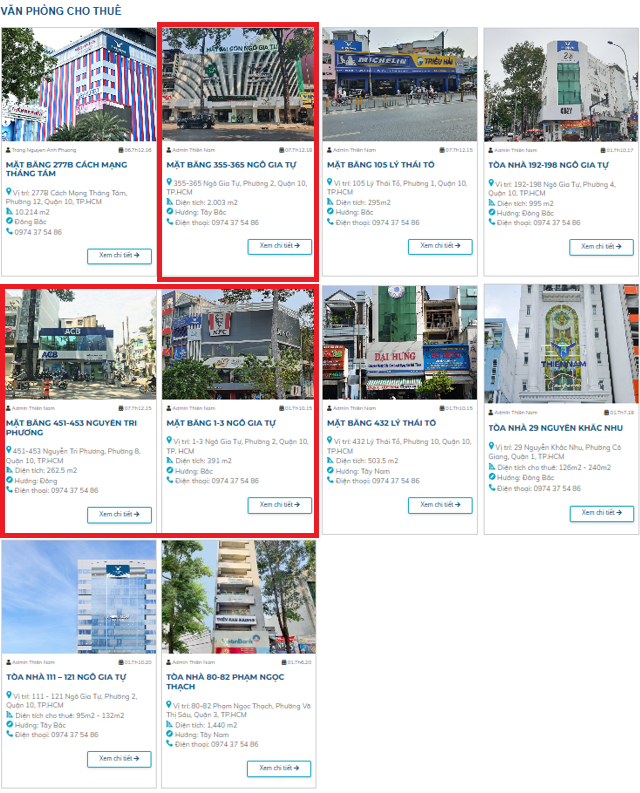

According to TNA’s website, these three locations are among the ten sites that TNA is leasing as office space. The 355-365 Ngo Gia Tu property, with an area of 2,003 sq. m., is currently leased to Saigon Eye Hospital; the 1-3 Ngo Gia Tu property, with an area of 391 sq. m., is leased to KFC; and the 451-453 Nguyen Tri Phuong property, with an area of 262.5 sq. m., is leased to ACB.

|

3 properties to be divested by TNA to offset debts

Source: TNA Website

|

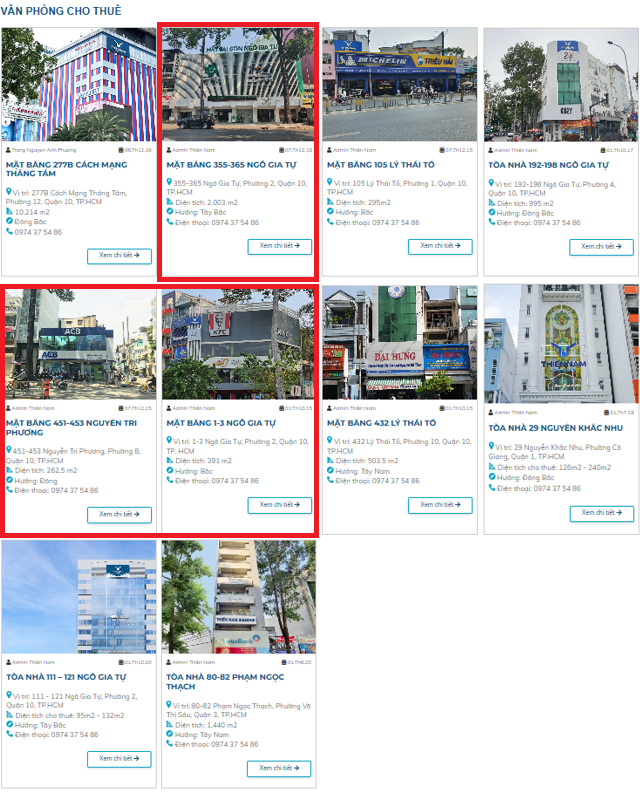

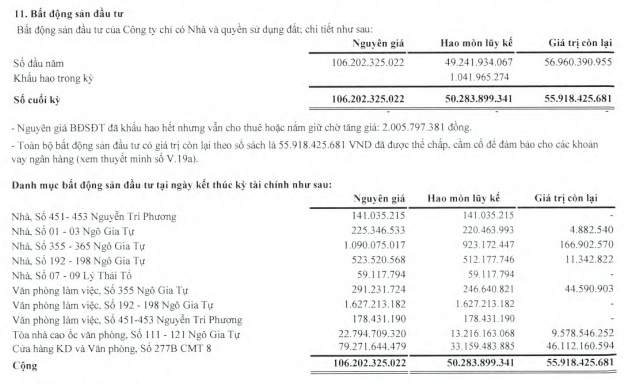

As of the end of the first quarter of 2025, the remaining value of TNA’s invested real estate assets was not significant, and some assets had fully depreciated.

Source: TNA’s Q1/2025 Financial Statements

|

The three assets to be divested by TNA are valued at approximately VND 60 billion, intended to offset debts.

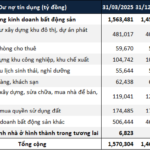

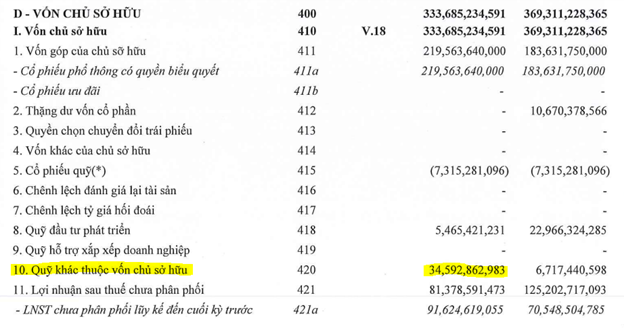

As of the end of the first quarter of 2025, TNA had over VND 1,582 billion in payables, mainly short-term, accounting for 77% of total capital sources. The largest liability was short-term payables to sellers, amounting to nearly VND 651 billion. The company also had nearly VND 185 billion in other short-term payables and nearly VND 120 billion in short-term prepayments from buyers. In addition, the company had borrowings of nearly VND 507 billion, mainly from BIDV and VPBank.

TNA, formerly known as District 10 Commercial Services Import-Export Joint Stock Company, had its shares listed on HOSE in 2005. The company’s main business activities include trading in steel, real estate (office leasing and project real estate), electrical appliances, education, food technology, and welding materials. Its main areas of operation are Ho Chi Minh City, Dong Nai, and Long An.

TNA’s business performance has been lackluster in recent years. After reaching a peak in 2019, the company has been on a downward trajectory, incurring a loss of over VND 61 billion in 2024, marking the first year of loss since its listing on HOSE.

On November 19, 2024, TNA’s shares were delisted from HOSE, and on November 29, 2024, they began trading on the UPCoM market at a price of VND 3,700 per share. Since then, the share price has remained unchanged due to a trading suspension.

In the first quarter of 2025, TNA recorded a consolidated revenue of over VND 41 billion, a 67% decrease compared to the same period last year. The revenue structure mainly comprised goods sales and investment real estate business. Ultimately, the company incurred a loss of over VND 24 billion, higher than the loss of VND 8 billion in the same period last year, marking the sixth consecutive quarter of losses.

| TNA has been incurring losses for the last six consecutive quarters |

Huy Khai

– 16:22 04/06/2025

“TCH Invests $800 Billion to Acquire 64 Million HHS Shares”

The Hoang Huy Finance Services Investment Joint Stock Company (HOSE: TCH) plans to settle the entire payment for the purchase of 64 million privately placed shares from its subsidiary, Hoang Huy Services Investment Joint Stock Company (HOSE: HHS), in June 2025. However, the intended use of these funds raises some interesting points.

The Ever-Rising Tide of Commercial Real Estate Debt: A Post-Quarterly Review

With the market expected to bounce back strongly by the end of 2025, real estate businesses are gearing up for project development and expansion. There are indications that these businesses are increasingly taking on debt to finance their ambitious plans.

Unlocking New Opportunities: Real Estate Businesses Anticipate Expanded Land Reserves and International Capital with Resolution 68

“At the recent seminar ‘Unblocking Institutional Bottlenecks – Unleashing Private Resources’ hosted by VTV, Ms. Nguyen Thanh Huong, Investment Director of Nam Long Group, emphasized that since the issuance of Resolution 68-NQ/TW, there has been a turning point, boosting businesses’ confidence, especially when dealing with international partners.”

The New Way of Living: Redefining Real Estate with Business Suites

As the lines between living and working spaces blur, the demand for multi-functional areas becomes evident. The Business Suite real estate model emerges as a novel option, offering flexibility to accommodate the trifecta of needs: living, working, and investment opportunities.