US stocks rebound as Trump delays tariffs on EU, Fed delivers positive economic assessment, and semiconductor companies report strong earnings.

ETF investment flows continue their net inflow trend, although at a slower pace than the previous two weeks, according to Yuanta. Domestic equity funds attracted an additional $3.5 billion, a 52% decrease from the previous week, while US bond funds saw net inflows of $3.6 billion, a 59% decline.

Overseas investment funds for equities and bonds followed a similar pattern, with net inflows of $2.3 billion and $931 million, respectively, representing reductions of 44% and 70% from the previous week.

Commodity ETFs, on the other hand, reversed their trend and witnessed net inflows of $973 million, ending five consecutive weeks of outflows.

In Asia, foreign investors withdrew $447 million from Taiwan’s stock market but injected $636 million into India’s market, making it the top recipient of inflows last week.

Southeast Asian ETFs maintained their net inflow trend, attracting $7.2 million, a 53.8% drop from the previous week. Singapore’s market stood out with net inflows of $28.4 million.

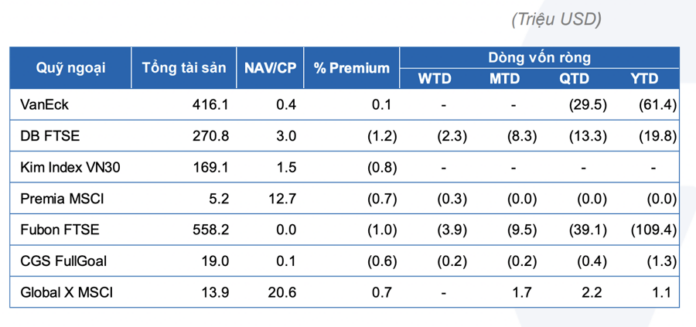

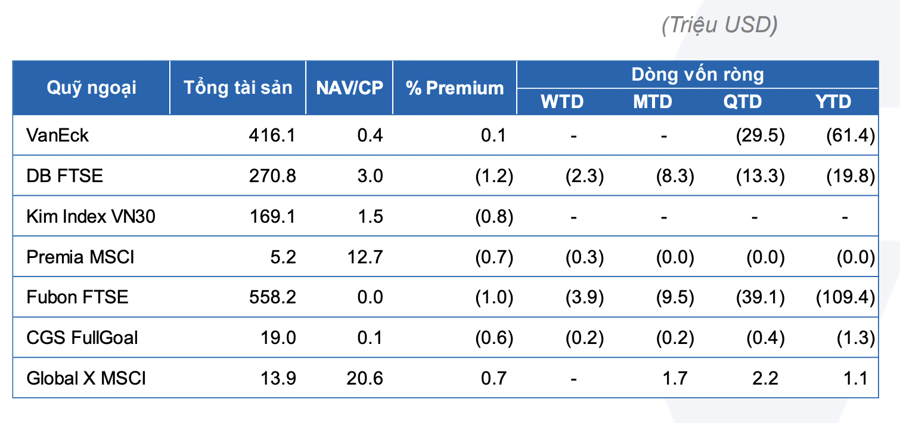

Conversely, Vietnam witnessed outflows of $13.7 million, with Fubon FTSE, DB FTSE, and E1FVN30 being the main contributors to this outflow.

According to FiinTrade, Vietnam-focused ETFs experienced outflows of over VND 394 billion, with 10 out of 19 funds witnessing outflows, mainly from foreign funds like the Fubon FTSE Vietnam ETF. Foreign ETFs saw outflows of more than VND 184 billion, with the Fubon FTSE Vietnam ETF accounting for VND 101.8 billion. The Xtrackers FTSE Vietnam ETF also experienced outflows of nearly VND 61 billion.

Similarly, domestic ETFs faced outflows of over VND 210 billion, mainly from the VFM VN30 ETF (VND 90.4 billion) and the VFM VNDiamond ETF (nearly VND 68 billion). The SSIAM VNFIN LEAD ETF witnessed outflows of over VND 44 billion.

Thai investors sold more than 1 million certificates of deposit (DRs) in the VFM VNDiamond ETF (FUEVFVND01), equivalent to VND 33.7 billion. They also offloaded 100,000 DRs in the VFM VN30 ETF (FUEVFVND01), valued at VND 2.5 billion.

In May 2025, ETFs experienced outflows of over VND 366 billion, bringing the year-to-date outflows to nearly VND 7 trillion (lower than the 2024 outflows of VND 21.8 trillion). As of May 30, 2025, the total net asset value of ETFs (including allocations to the Vietnamese market) stood at VND 55 trillion, a 3.2% decrease from the end of 2024. The top stocks sold by ETFs from May 26 to May 30, 2025, were VIC, VHM, HPG, TCB, and VCB.

On June 2, 2025, the Fubon FTSE Vietnam ETF experienced outflows of nearly VND 27 billion, bringing the year-to-date outflows to over VND 2,800 billion. The fund continued to sell stocks, with estimated outflows of over VND 27 billion. The top sold stocks were HPG (-89,000 shares, -VND 2.3 billion), SSI (-55,000 shares, -VND 1.3 billion), SHB (-49,000 shares, -VND 700 million), VIC (-47,000 shares, -VND 4.6 billion), and VHM (-44,000 shares, -VND 3.4 billion).

Additionally, the VFM VNDiamond ETF and the VEM VN30 ETF faced outflows of approximately VND 32 billion and VND 13 billion, respectively.

In the Vietnamese stock market, foreign investors increased their net selling by VND 1,800 billion, equivalent to nearly $62 million across the three exchanges. HPG was the top sold stock, with net selling of VND 507 billion, while real estate stocks like NVL (VND 366 billion) and VHM (VND 245 billion) led the net buying.

Market Pulse June 4th: VN-Index Closes Slightly Lower, Foreigners Resume Net Selling

The market closed with the VN-Index down 1.74 points (-0.13%) to 1,345.51, while the HNX-Index bucked the trend and rose 1.25 points (+0.55%) to 230.19. The market breadth tilted towards decliners, with 379 stocks falling versus 340 advancing. The large-cap stocks also painted a gloomy picture, as reflected in the VN30 basket, where 21 stocks retreated, 6 advanced, and 3 remained unchanged.

“Small and Mid-Cap Stocks Soar: Real Estate Takes the Lead”

The lackluster performance of blue-chip stocks once again dampens the momentum of VN-Index’s peak. While the breadth of the index remains favorable, the gainers are predominantly mid and small-cap stocks, with a surprising surge in the real estate sector.