Land Price Manipulation Tactics?

Recently, following the announcement of the Western Ha Tinh Planning Area, land brokers have flocked to many villages in Toan Luu commune to inspect land, causing a stir in the rural area. Additionally, land subdivision and parcel splitting are rampant in many villages, increasing pressure on local land management.

Brokers congregate in large numbers on village roads in Toan Luu commune.

According to reports, many long-term cropland areas, previously almost abandoned, have suddenly become hotspots for land acquisition and subdivision.

However, most subdivided land areas lack essential infrastructure such as electricity and water supply. Notably, even remote, sparsely populated areas with narrow concrete roads, located at the end of villages, in dead-ends, or near Khe Giao River, are being subdivided and sold.

Acquiring long-term cropland, then subdividing and splitting parcels for sale.

Mr. Nguyen Van C. (70 years old, Trung Tam village) shared that his family’s plot, originally 5,500m² with 400m² of residential land and the rest as long-term cropland, was sold due to family difficulties. Now, an investor has paved a 7m wide road and divided it into 23 plots for sale. Each plot, approximately 130-140m², is priced at around 500-600 million VND.

Land without infrastructure is still being marketed by brokers, priced from 460 million to over 1 billion VND.

In Trung Tam village, besides areas with developed infrastructure, many subdivided plots without roads are still being aggressively marketed.

Posing as a potential buyer, the reporter was approached by brokers with promises: “Currently, there are no roads or electricity, but they will be implemented soon, and infrastructure will be fully developed. Prices are low now, buying today is an opportunity. Like yesterday, a plot was only 950 million, today it’s nearly 1.1 billion, land prices are rising daily.”

Despite incomplete infrastructure, sales contracts are still being signed.

Despite incomplete infrastructure, just empty land, a broker mentioned that the land, spanning thousands of square meters, is divided into about 60 plots, each ranging from 140m² to over 200m², priced between 460 million and over 1 billion VND.

Local Concerns

Along Provincial Road 550, from the roundabout leading to the expressway to Khe Giao intersection (in the former Ngoc Son commune), many areas have been subdivided by investors, with temporary roads connecting to the land.

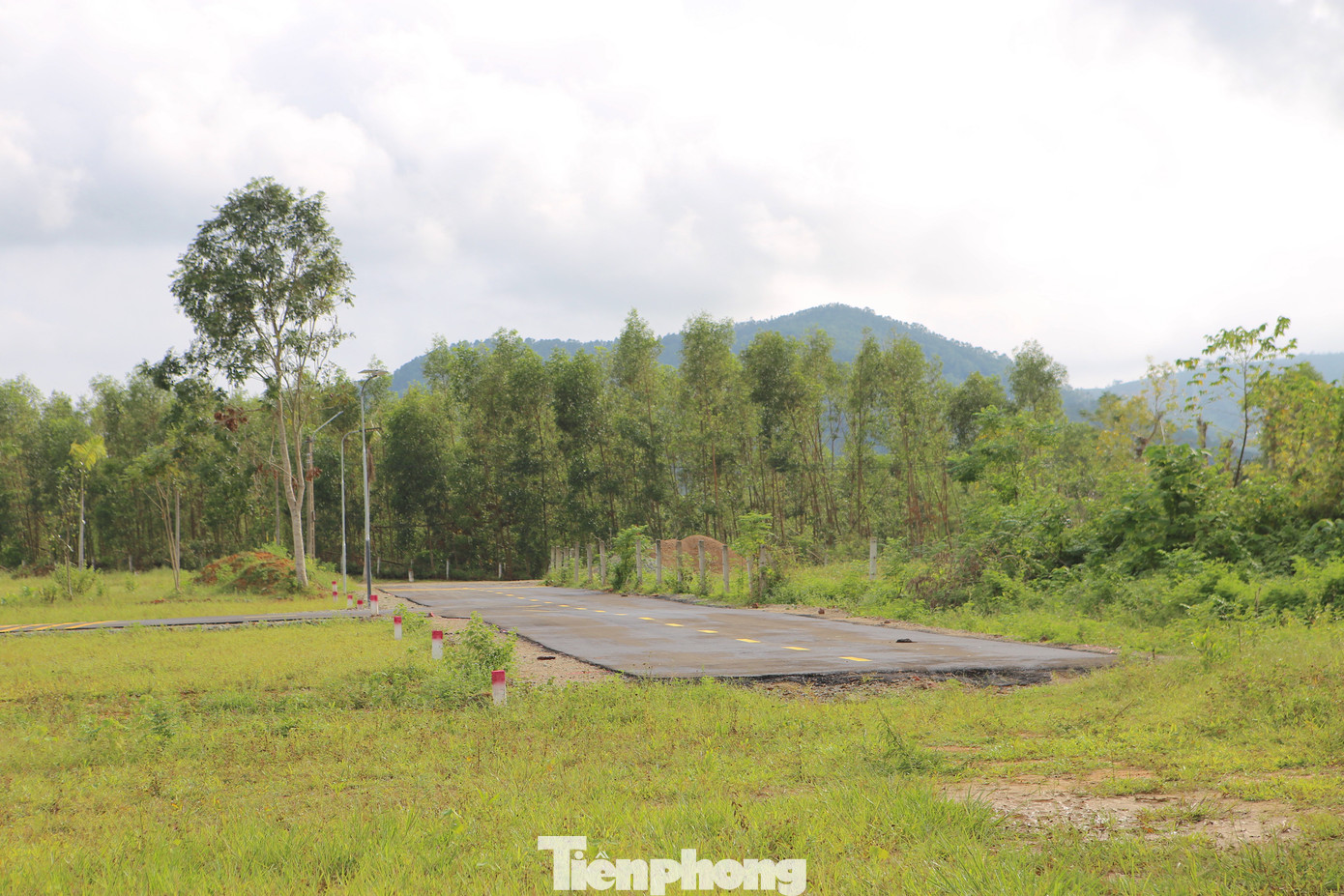

However, many subdivided plots have internal roads but cannot connect to the provincial road due to lack of permits, resulting in “dead-end” roads. According to regulations, connecting roads from residential areas to provincial or national roads must be approved by competent authorities.

Nevertheless, these plots are aggressively marketed on social media, with claims of “potential land, riding the industrial zone wave” and “clear legal status, separate land books for each plot.”

Due to lack of proper planning, many roads in subdivided land areas end in dead-ends.

In Nam Son village, former Ngoc Son commune, land near Provincial Road 550 has been divided into dozens of plots, lacking water and with rudimentary electricity. Brokers claim that almost all plots have been sold, with only 6 remaining. These plots, ranging from 120-130m², are priced at 680 million VND, with clear legal status and 100% residential land. However, water and electricity connections are still pending.

Speaking with Tien Phong, the leader of Toan Luu commune’s People’s Committee stated that the rampant acquisition of garden land and long-term cropland for conversion, subdivision, and sale of land plots primarily occurred in the former Ngoc Son commune before its merger into Toan Luu commune.

Many long-term cropland areas are being acquired by brokers, converted, and then subdivided for aggressive sale.

According to this official, previously, some land areas were subdivided with internal roads only 4m wide, failing to meet infrastructure standards. Currently, the commune requires subdivided areas to have roads at least 7m wide to ensure uniformity and align with future local infrastructure and landscape development.

“Land subdivision and parcel splitting are handled by the Land Registration Office, and the commune has no decision-making authority. However, the commune is responsible for infrastructure management. We are requiring that any subdivision or splitting must ensure landscape integrity and infrastructure uniformity to prevent small-scale, fragmented subdivision that detracts from rural aesthetics,” the leader stated.

The official also expressed concern about the excessive subdivision of land plots. Some plots are only about 5m wide, which is unsuitable for long-term rural living and construction.

“In my opinion, a solution is needed to prevent overly small and narrow subdivisions that do not meet the long-term practical needs of rural areas,” the official noted.

The commune leader also mentioned that connecting residential areas to provincial or national roads requires approval from competent authorities. The commune has no permitting authority, and residents cannot open roads independently.

“This is a tactic by land brokers. There is no real demand, and no successful transactions have been observed,” the commune leader concluded.

Land Speculators Flock to Rural Areas Following Announcement of Industrial Zone Planning

Following the announcement of the zoning plan for the construction of the Western Industrial Zone in Ha Tinh (located in Toan Luu commune), land prices in the area surged unexpectedly. A flood of people and vehicles descended upon the once-serene countryside, transforming it into a bustling hub of activity.

Why Savvy Investors Continue to Pour Money into Danang Land

The Da Nang land market has witnessed a significant upward trend since the beginning of the year, with some areas experiencing a staggering 20-30% increase in land prices. This indicates a strong return of investment capital. Despite the surge, land prices remain only half of those of many apartment projects, and with superior liquidity, it has caught the special attention of investors.