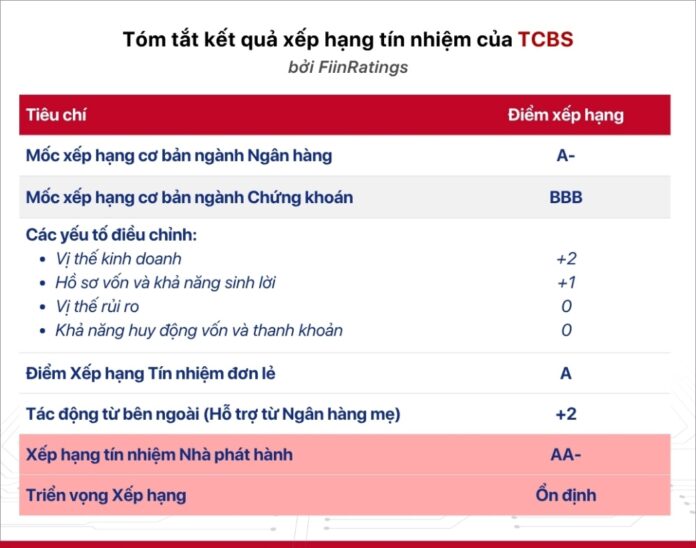

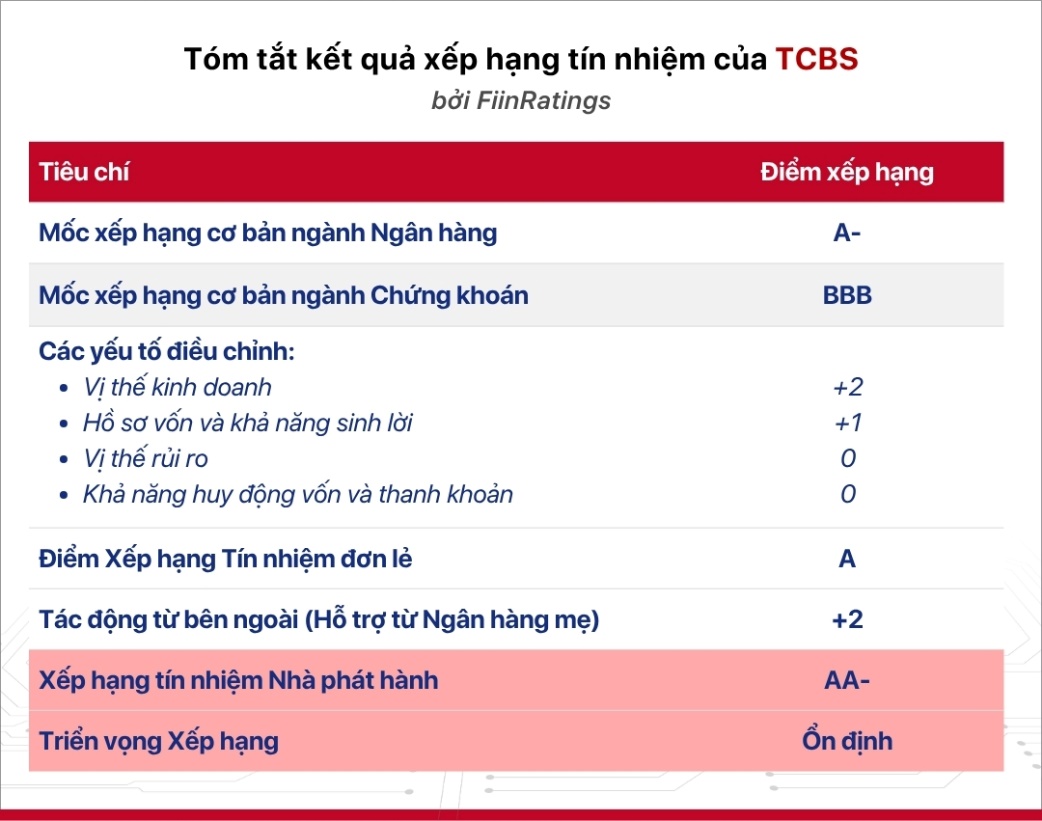

With an AA- rating (Very Good), TCBS’s ranking is five notches above the basic Securities industry rating of BBB (Good).

According to FiinRatings, the AA- Issuer rating of TCBS with a Stable outlook reflects the company’s credit profile, which is expected to remain stable over the next 24 months, thanks to its strategic core role within the Techcombank ecosystem and its strong intrinsic business position.

TCBS’s inaugural Issuer rating is AA- (Very Good)

TCBS’s Strong Business Position and Strategic Role within the Techcombank Ecosystem

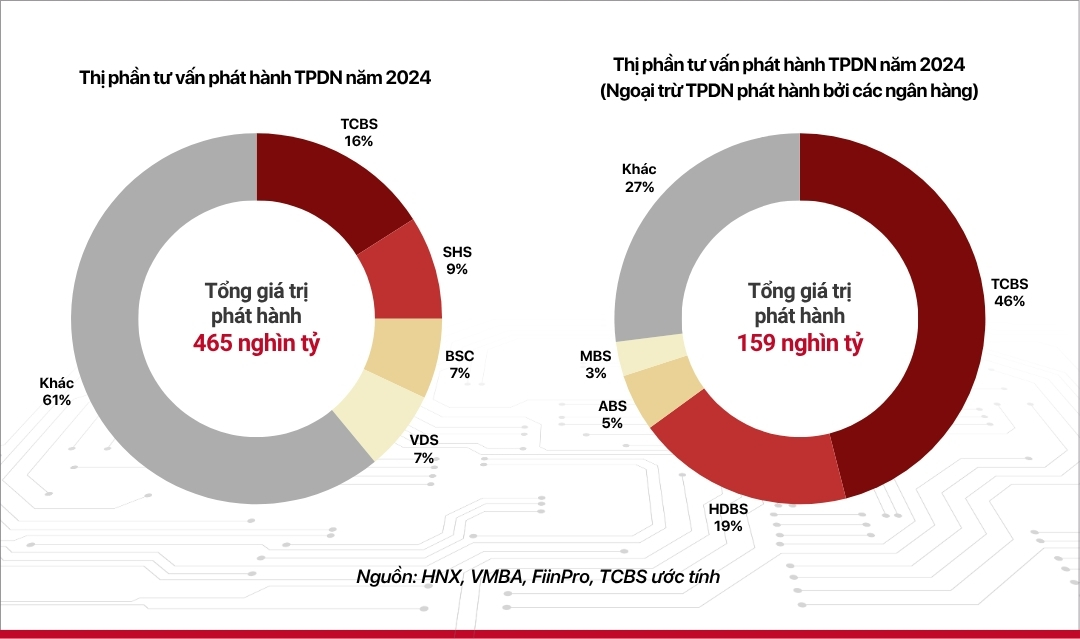

“TCBS’s business position is rated ‘Very Good’, reflecting its standing as a leading company in brokerage, margin lending, and investment banking,” according to FiinRatings’ rating report.

In 2024, TCBS held the top position in market share for corporate bond issuance advisory services, accounting for 46% of total market issuance (excluding bank bonds). As of the end of Q1/2025, the company continued to be among the leading groups in margin lending market share, with loan balances reaching VND 30.5 thousand billion, an 18% increase compared to the end of 2024.

“TCBS has aimed to build a business model with diverse revenue streams, ensuring stability and sustainable growth. In the medium and long term, we expect TCBS to maintain its current business position and revenue model thanks to its market share advantages, leading technology platforms, professional management team, and strong support from its parent bank,” FiinRatings commented.

According to FiinRatings, TCBS plays a core role in the operational strategy of its parent bank, Techcombank. Based on the publicly available financial reports of Techcombank and TCBS, FiinRatings assessed that TCBS contributes significant economic benefits to Techcombank, with an estimated contribution of approximately 15%-20% of the total revenue of the Techcombank Group.

Strong Capital Profile and Superior Profitability Affirm TCBS’s Solid Financial Foundation

According to FiinRatings, TCBS’s capital structure is rated “Good” due to its consistently large capital scale and relatively low financial leverage compared to the industry average.

TCBS’s leverage ratio is relatively low compared to the average of the Top 20 securities companies with the largest equity scale in the 2020 – 2024 period (average of Top 20: 1.5x in 2024 and 1.3x in 2023). With a safe level of leverage on its current equity scale, TCBS is expected to maintain its capital buffer and resilience in adverse market conditions.

TCBS’s capital raising capability and liquidity are rated “Adequate”, reflecting the company’s ability to access diverse sources of capital, ensuring business stability even during challenging periods, as assessed by FiinRatings.

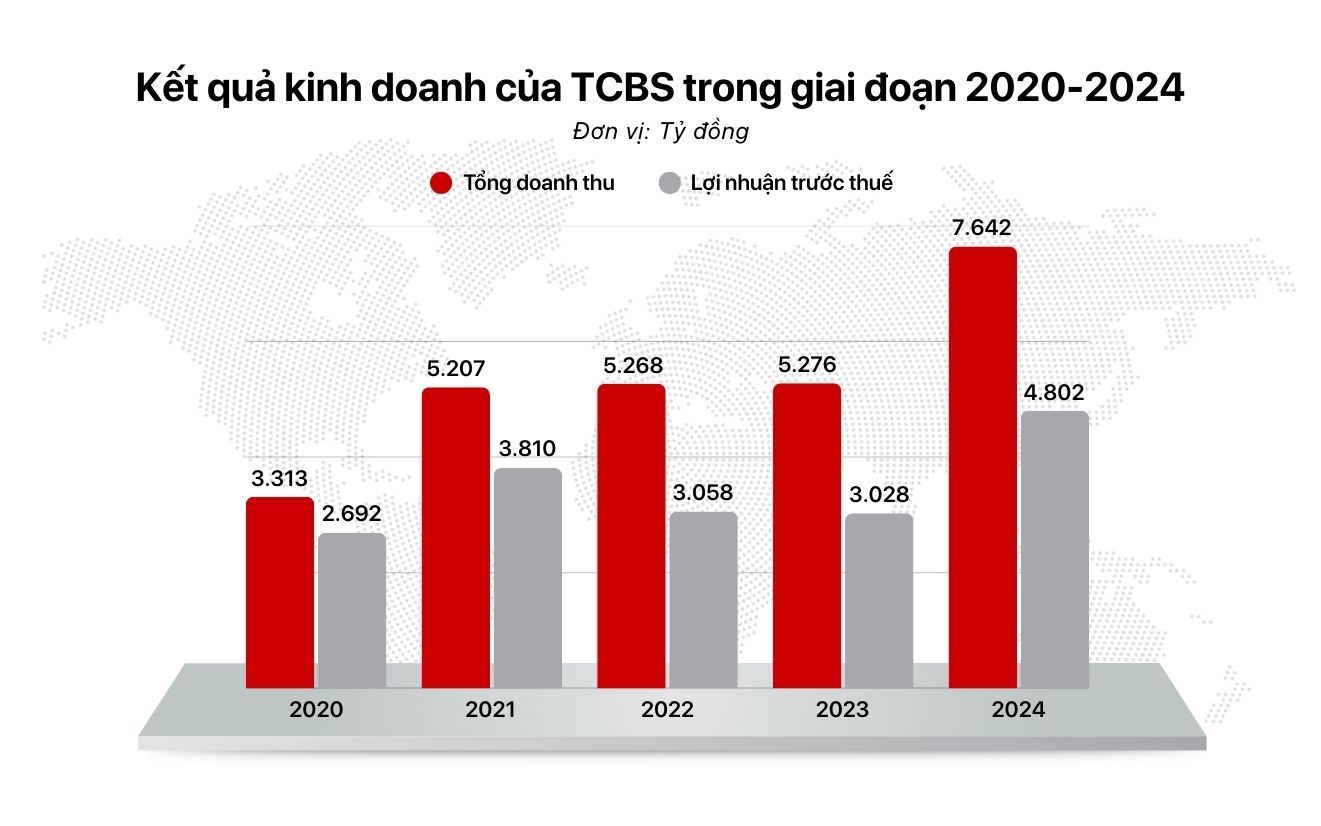

In terms of profitability, TCBS is a leading company in the industry, with pre-tax profits of VND 4,802 billion (up 59% year-on-year) in 2024. During the volatile and challenging market environment from 2020–2023, TCBS consistently maintained its position as one of the industry leaders in profit margins. Specifically, TCBS’s average return on assets (ROA) during this period reached 15.9%, significantly higher than the industry median of 4.9% for the Top 20 securities companies. Similarly, TCBS’s average return on equity (ROE) during the same period was 29.4%, considerably higher than the industry median of 12.3% for the Top 20. As of the end of 2024, TCBS’s ROA and ROE were 7.9% and 15.4%, respectively, compared to 6.9% and 13.9% at the end of 2023.

Comprehensive Risk Management and Technology Focus Lay the Foundation for Sustainable Development

FiinRatings assessed that TCBS has established and operated a robust and solid risk management framework across all business lines, with a core focus on technology investment. The company’s risk management system is deeply integrated with that of its parent bank, Techcombank, and continuously enhanced to meet stringent international standards.

TCBS implemented the “Three Lines of Defense” model with clear role definitions. Risk control activities are supported by modern technology infrastructure, enabling automatic data updates and processing during trading sessions. The automation of processes improves early detection and timely response to emerging risks while minimizing manual intervention.

FiinRatings acknowledged TCBS’s relatively conservative risk appetite and strict customer screening process, which contribute to mitigating potential risks. TCBS has demonstrated its ability to cope and maintain stability during crisis periods, reflecting the effectiveness of its risk management framework and overall risk control capabilities.

“Amid the challenges facing the securities industry, we are proud that TCBS’s intrinsic capabilities are recognized as superior to the market average. Pursuing a Wealthtech strategy, TCBS focuses on maintaining its leading position in profitability and operational efficiency in 2025, optimizing business efficiency, and maximizing resources to create superior value for customers and shareholders,” shared Ms. Nguyen Thi Thu Hien, CEO of TCBS.

Ms. Nguyen Thi Thu Hien, CEO of TCBS

The Stock Market Boom: A Surge in Stock Prices

The VN-Index surged past 1340, thanks to a robust rebound from large-cap stocks, but the spotlight this morning belonged to the securities group. Dominating market liquidity, 5 out of the top 10 stocks traded were from the securities sector, and foreign investors’ net purchases also favored these securities stocks.

The Real Deal: How Techcombank Helps Turn Your Money Into a Profitable Daily Journey

Episode 5 of the ‘Unlocking the Auto-Wealth Creation Wave’ podcast series delves into the real-life financial stories of everyday people, from preschool teachers to hospital staff, salespeople, and small business owners. This episode also offers strategic insights from the mastermind behind the solution that is revolutionizing the financial habits of millions of Vietnamese.

“The Techcombank Strategy for the New Accelerated Phase: Aim High, Keep it Real.”

“Techcombank is embarking on a new phase of accelerated growth with a series of ambitious strategies. The bank has shared its plans, which include the IPO of TCBS, venturing into the digital asset market, establishing a life insurance company, enhancing its AI and data capabilities, and seeking strategic partnerships. These moves highlight Techcombank’s aspiration to lead the ‘digital ecosystem connectivity’ game in Vietnam.”

Which Bank Had the Highest Profit Before Provisions?

Before accounting for credit risk provisions, 10 out of the surveyed banks witnessed profit growth in Q1 2025 compared to the previous quarter (Q4 2024), whereas 17 banks experienced a decline during this period.

The Billionaire’s Assets Surge to Unprecedented Heights

“Vingroup’s stock surge: VHM and VIC soar to new heights. In a thrilling rally, Vingroup’s stocks witnessed a substantial surge with VHM and VIC reaching their peak. This exhilarating performance has propelled billionaire Pham Nhat Vuong’s net worth to a record-breaking $10.2 billion, according to the latest updates from Forbes.”