A recent report by Agriseco Research indicates that the stock market enters June with intertwined challenges and opportunities.

Firstly, tariff-related information will likely become more prevalent and unpredictable, creating pressure on investor psychology. Additionally, after a strong surge in May, many stock groups have reached new highs, leaving limited room for further price increases.

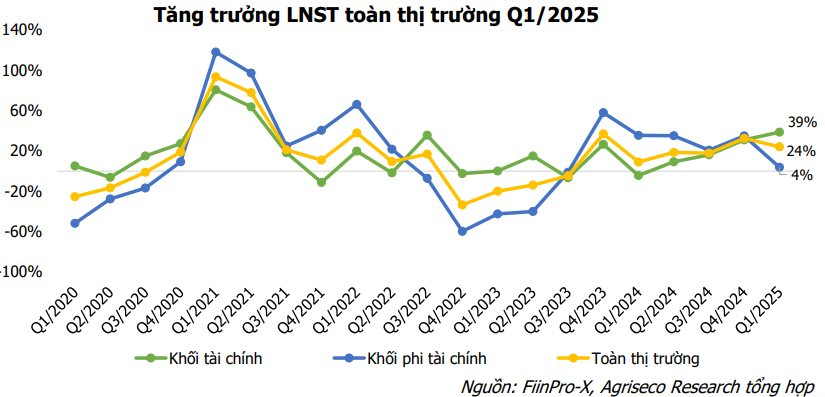

Nevertheless, Agriseco believes that there are supportive factors for the market, such as expectations for an upgraded stock market status and the second quarter of 2025’s business results season, which is expected to continue the growth trend. The analytics team forecasts the VN-Index to fluctuate between 1,300 and 1,350 points, with capital flowing and diversifying among stock groups with distinct investment stories.

Based on this analysis, Agriseco Research has constructed a June investment portfolio, focusing on enterprises with robust financial foundations, reasonable valuations, and prospects for profit growth in the second quarter of 2025.

In the banking group, Agriseco assesses the growth potential of HCM City Development Joint Stock Commercial Bank (HDBank, ticker: HDB) . Specifically, the net interest margin is expected to improve from the second quarter of 2025, driven by key factors such as a lower loan-to-deposit ratio and short-term capital for medium and long-term loans compared to the general level, combined with a continued improvement in the CASA ratio, which will help reduce funding costs and support NIM expansion. Another driver comes from a large ecosystem of customers through enterprises like Vietjet, Vinamilk, and Petrolimex, which maintain robust growth, enabling HDB to increase revenue from providing financial products.

Additionally, HDBank is expected to continue its credit growth momentum, backed by the supportive Resolution 68; a recovering consumer lending market; sustained market share in Southern real estate credit; and continued disbursement for residential real estate, industrial park, and public investment projects.

In the real estate group, Agriseco’s analytics team points out the growth potential of Ba Ria-Vung Tau Housing Development Joint Stock Company (ticker: HDC) through project launches and equity sales. The company’s 2025 profit is expected to surge compared to 2024 due to three main drivers: (1) Handover of The Light City Phase 1 and Ngoc Tuoc 2; (2) Financial gains from divesting the Dai Duong Project. HDC is expected to recoup over VND 1,000 billion in transfer value and gradually recognize it in 2025-2026; and (3) Recognition of transfer value from the Thong Nhat Project to the affiliated company HUB.

In the short term, HDC is expected to benefit from information about divesting large-scale project equity. Simultaneously, market capital is shifting back to real estate stocks as the government promotes supportive policies for the industry, including legal unblocking, boosting public investment, and easing credit policies for residential real estate.

The 2025 Annual General Meeting of Shareholders approved a dividend plan of 12% for 2024 and 15% for 2025 and set a target for 2025 revenue to triple and net profit to increase more than sevenfold compared to the previous year, thanks to the transfer of the Dai Duong project. HDC also announced it would receive VND 1,082 billion in the 2025-2026 period. It is expected that this amount will help HDC fulfill its financial obligations and implement large-scale projects.

Another prospective enterprise in the real estate sector is Vietnam Construction and Import-Export Joint Stock Corporation (ticker: VCG) . In 2025, Agriseco anticipates that the real estate segment will significantly contribute to profit structure due to the accelerated implementation and handover of numerous key projects with high-profit margins, such as the Vinaconex Diamond Tower and Cat Ba Amatina projects.

Simultaneously, Vinaconex is poised to benefit from the trend of boosting public investment as it consecutively wins significant project bids, including Packages 4.7 & 4.8 of the Long Thanh International Airport Project and the Hanoi Ring Road 3.5 Project. The total value of the construction projects won by VCG is estimated to exceed VND 11,600 billion. Other business segments, such as industrial parks and clean water, will continue to drive VCG’s revenue growth in 2025.

Regarding securities stocks, the narrative of benefiting from the market upgrade process is often highlighted. Agriseco believes that SSI Securities , as the leading securities company, will be an early beneficiary due to its position and capacity to meet international standards.

Additionally, the expected Q2 2025 business results will show growth as the company has completed its role as an underwriting advisor for VPL (a relatively large deal), thereby supporting the investment banking segment’s revenue recognition in this quarter. At the same time, sustained high market liquidity provides a favorable foundation for SSI to increase brokerage revenue and profits from margin lending activities.

A consistent presence in Agriseco’s potential stock list is Mobile World Investment Joint Stock Company (ticker: MWG) . Agriseco assesses that The Gioi Di Dong (including Topzone) and Dien May Xanh chains maintain growth and improve operational efficiency. The ICT segment sustains double-digit growth in a slowly recovering market, with average revenue per store improving by 15% compared to Q1/2024. In Q1/2025, MWG closed four TGDĐ stores and opened one new Dien May Xanh store, reflecting the company’s orientation toward streamlining ICT operations and enhancing efficiency.

Bach Hoa Xanh chain enters an expansion phase in 2025. As of April 2025, Bach Hoa Xanh opened 359 new stores, with approximately 50% concentrated in the central provinces.

Erablue chain achieves a new milestone in the Indonesian market. Erablue has been profitable since 2024, providing a foundation for robust expansion in 2025. As of May 2025, Erablue operates 115 stores and aims to reach 150 stores by the end of the year.

Finally, Agriseco anticipates that Q2 2025 business results of Hoa Phat Group (ticker: HPG) will grow due to increased steel consumption in a favorable context. Projects approved for construction in Q1/2025 increased by 144% compared to the previous quarter and 136% over the same period last year (according to the Ministry of Construction). Public investment disbursement as of April 30, 2025, was VND 18,000 billion higher than the same period last year and will continue to be promoted in the coming months. Additionally, the gross profit margin is expected to improve due to reduced input costs, such as lower coke and iron ore prices compared to steel output prices in the previous year.

The growth potential also stems from high-quality steel projects, notably the collaboration with SMS Group to implement a 700,000-ton-per-year rail and shaped steel production line, expected to yield the first products in Q1/2027. The management team forecasts a total steel demand of about 10 million tons for rail projects in the coming period, creating a growth driver for the corporation’s future revenue.

Unlocking the Potential: Thanh Hoa’s Tourism Boom and the Real Estate Renaissance

The real estate market in Thanh Hoa is experiencing promising growth, with a record-breaking influx of tourists and groundbreaking infrastructure developments. This dynamic duo of factors is set to fuel a vibrant and thriving market in the upcoming years.

Market Beat June 5th: Late Rally Sees VN-Index Trim Losses to Just Under 4 Points

The VN-Index faced significant pressure in the latter half of the morning session, extending into the afternoon with a dip to 1,336 points. However, a resilient recovery began at 1:40 pm, with the index steadily climbing to close at 1,342.09 – a marginal loss of just 3.65 points. This volatile movement around a strong resistance level was anticipated and reflects a dynamic market.

“Equity Liquidity Crunch: Small-Cap Stocks Feel the Pinch”

The market continues to show no signs of breaking through, despite the VN-Index hovering around the 1340-point mark. The main culprit is the largest bloc of blue-chip stocks turning southward. Meanwhile, overall liquidity has also taken a significant hit, and opportunities are now scarce outside a handful of mid-to-small-cap stocks.