## Mirae Asset Welcomes New Leadership: A Dynamic Duo with a Wealth of Experience

Mirae Asset undergoes significant leadership changes, appointing two new key figures to its board. The annual general meeting approved the dismissal of Mr. Rhee Jung Ho from his position as a member of the Board of Directors and subsequently appointed Ms. Nguyen Hoang Yen as his replacement. Ms. Yen was then elected as the new Chairwoman of the Board for the term 2025–2026 and also took on the role of legal representative, succeeding Mr. Kang Moon Kyung.

Mr. Huh Hong Suk, previously the company’s Financial Director, stepped up to fill the role of General Director, taking over from Mr. Kang Moon Kyung for the same term. Both Ms. Yen and Mr. Huh bring a wealth of experience in finance and securities and have a long-standing association with Mirae Asset.

Although no longer serving as Chairman and General Director or legal representative, Mr. Kang Moon Kyung remains an integral part of the team as a member of the Board of Directors. With a strong connection to the company since its early days, Mr. Kang played a crucial role in the group’s foreign investment and strategy division in South Korea, which oversaw the establishment and management of the group’s entities worldwide, including Europe and the USA.

Mr. Kang Moon Kyung – Photo: Tuan Tran

|

In other news, the company has also announced a cash dividend plan, with June 4th set as the record date for entitlement. The dividend ratio stands at 9.5316% (equivalent to VND 953.16/share), and payment is expected to be made on July 7th. According to the Q1/2025 financial statements, the company has over 659 million shares in circulation, including 113.5 million preferred shares and over 545.5 million common shares. This translates to an estimated payout of VND 520 billion for the upcoming common stock dividend.

It is worth noting that the majority of these dividends will go to the affiliated shareholder group, which includes Mirae Asset Securities (HK) Limited, holding 99.8% of the capital, Mirae Asset Global Investment (HK) Limited with 0.1%, and PT Mirae Asset Sekuritas Indonesia with 0.1%.

Previously, on April 1st, 2025, the Board of Directors of Mirae Asset approved a resolution to distribute a fixed dividend for 2023 and 2024 to existing preferred shareholders at a rate of 7% (VND 700/share). This dividend was paid out on April 17th, and the sole beneficiary was the parent company, Mirae Asset Securities (HK) Limited.

Huy Khai

– 7:08 PM, June 5, 2025

A Fresh Start for Vietravel Airlines: The First Move of New Chairman Đỗ Vinh Quang with a Trio of Airbus Aircraft

“Vietravel Airlines is taking flight to new heights. Just over two months since the appointment of Mr. Do Vinh Quang as Chairman of the Board of Directors, the airline is now on the cusp of owning its private fleet, marking a significant milestone. Having primarily relied on leased aircraft for over six years, Vietravel Airlines’ upcoming acquisition signals a promising future ahead.”

The Great Talent Shuffle at VIX Securities

The VIX Securities has recently undergone a transition with the resignation of two board members, which was approved by the shareholders. Subsequently, the company has appointed two new individuals to fill these vacant positions. This strategic move is expected to bring fresh perspectives and expertise to the board, potentially driving new initiatives and fostering innovation within the company.

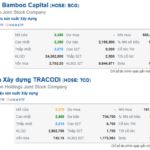

The Dynamic Duo of BCG and TCD: Restricted Trading and Stock “Plummeting”

On May 20, the Ho Chi Minh City Stock Exchange (HOSE) announced that it would transfer BCG from control to restricted trading from May 27, due to a delay in submitting its audited financial statements for 2024, exceeding the regulatory deadline by 45 days. On the same day, another stock belonging to the Bamboo Capital family, TCD, faced similar punitive action from HOSE for the same infraction.