In terms of impact, VHM is currently the most negative stock, causing the VN-Index to lose 1.5 points. This is followed by TCB and CTG, which also pulled the index down by over 1 point. On the other hand, HPG, PLX, and STB are the main pillars supporting the index, contributing about 1.5 points to the gain.

The differentiated performance is evident across sectors. On the downside, the industrial and real estate sectors are the “bottom-dwellers,” ending the morning session with approximately a 1% decline. This decline was largely driven by large-cap stocks such as ACV (-2.33%), HVN (-1.16%), VJC (-1.53%), VTP (-0.98%), and VCG (-1.35%). The real estate sector also saw notable declines in VHM (-2.08%), VRE (-1.48%), KBC (-1.71%), PDR (-1.92%), and KDH (-2.15%).

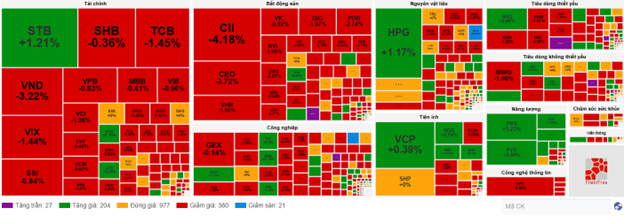

Similarly, in the financial sector, only STB stood out as a positive highlight, attracting superior buying interest. The rest of the sector mostly witnessed declines, especially securities stocks, which experienced significant selling pressure, including VND (-2.92%), VIX (-1.44%), VCI (-1.9%), MBS (-1.42%), CTS (-1.88%), and VDS (-3.14%).

On the positive side, the energy sector led the market with outstanding performances from BSR (+1.11%), PVD (+2.06%), PVC (+1.98%), PVB (+1.05%), and PSB (+2.38%).

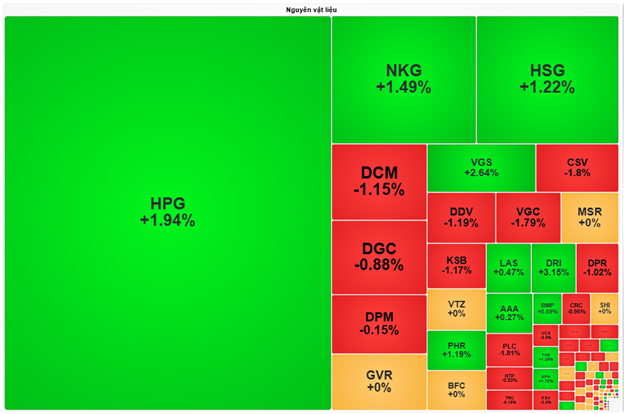

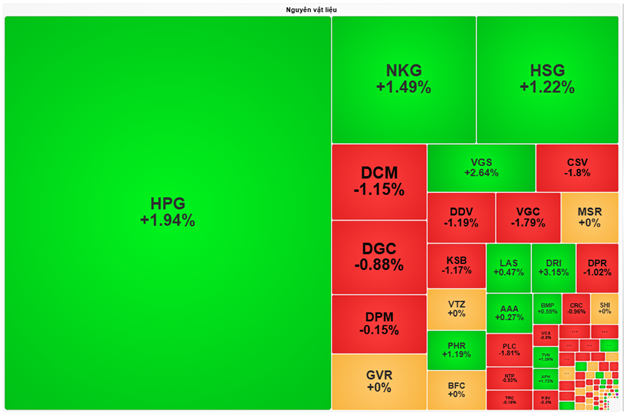

Steel stocks also made notable gains, breaking through with nearly a 2% increase and contributing to the slight green in the materials sector. HPG, HSG, NKG, TVN, and VGS all recorded increases ranging from 1-3%.

Source: VietstockFinance

|

10:40 AM: Financial sector undergoes heavy selling, PVD continues its recovery

The prevailing uncertain sentiment led the major indices to fluctuate around the reference level. As of 10:40 AM, the VN-Index declined by 7.49 points, trading around the 1,334 level. Meanwhile, the HNX-Index lost 1.8 points, hovering around 229.

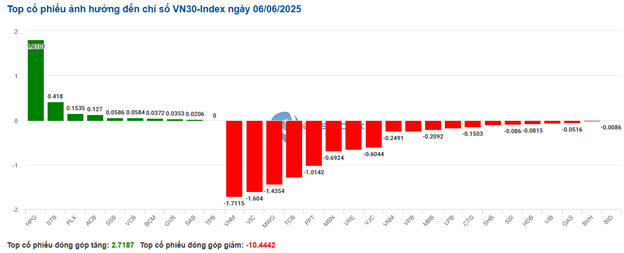

The red dominated the VN30 basket. Specifically, VHM, VIC, MWG, and TCB negatively impacted the overall index, deducting 1.71 points, 1.6 points, 1.43 points, and 1.28 points, respectively. Conversely, HPG, STB, PLX, and ACB were the pillar stocks that helped the VN30 retain more than 2.5 points.

Source: VietstockFinance

|

Red prevailed across most sectors, with real estate being the weakest group in the market, declining by 0.91%. The red shade spread wider compared to the beginning of the session, with selling pressure concentrated in large-cap stocks: VIC down by 0.82%, VHM by 1.43%, VRE by 1.67%, and SSH by 0.34%.

Similarly, the industrial sector witnessed a decline, with red predominantly in transportation and seaport stocks: ACV down by 1.16%, VJC by 1.75%, HVN by 0.39%, and GMD by 0.68%.

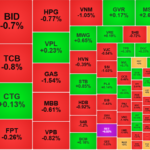

Meanwhile, the financial sector continued to face “turbulence” as most stocks recorded losses. Specifically, BID fell by 0.28%, TCB by 1.13%, CTG by 0.52%, and MBB by 0.2%. On the other hand, some stocks showed a slight recovery, such as VCB, up by 0.18%, ACB by 0.48%, and STB by 2.3%.

In contrast, the consumer staples sector performed positively, rising by 0.25%. This growth was driven by MCH, which increased by 1.41%, SAB by 0.1%, and QNS by 0.21%. Notably, HAG witnessed a strong surge from the beginning of the session. Additionally, on June 6, 2025, Hoang Anh Gia Lai Joint Stock Company held its annual general meeting of shareholders, presenting to shareholders the plan to issue a maximum of 210 million shares to convert Group B bond debt worth VND 2,520 billion.

Furthermore, the energy sector continued its recovery, led by PVS, which rose by 2.15%, and PVD, which climbed by 3.87%. From a technical perspective, PVD stock surged positively in the morning session of June 6, 2025, accompanied by trading volume exceeding the 20-session average, indicating more active trading. Additionally, the MACD indicator continued its upward trajectory after generating a buy signal earlier, further reinforcing the short-term recovery momentum. Currently, PVD has successfully broken through the neckline (equivalent to the 19,200-19,700 range) of the Ascending Triangle pattern while surpassing the SMA 50-day average and remaining above this level. If the outlook remains positive, the potential price target range is 21,800-22,000.

Source: https://stockchart.vietstock.vn/

|

Compared to the opening, sellers still hold the upper hand. There were 380 declining stocks versus 204 advancing stocks.

Source: VietstockFinance

|

Market Open: VN-Index fluctuates as real estate and financial sectors remain lackluster

The market started with a red blanket covering the two largest sectors by market capitalization: finance and real estate. Consequently, the major indices exhibited an uninspiring performance at the opening bell. Notably, the VN30 index had the most negative impact, with most of its constituent stocks declining.

The financial sector displayed differentiation, with the advantage tilting towards sellers. Notably, BID fell by 0.14%, TCB by 0.8%, CTG by 0.52%, and MBB by 0.41%. Only a handful of stocks managed to stay in the green, including ACB, which rose by 0.24%, EIB by 1.23%, SSB by 0.28%, and FTS by 0.54%.

The real estate sector fared no better, with Vingroup stocks dragging it down. Specifically, VIC declined by 0.92%, VHM by 1.17%, and VRE by 1.67%. Additionally, SSH fell by 0.45%, KDH by 0.5%, PDR by 0.82%, and some other stocks also contributed to the less-than-optimistic picture at the opening.

As of 9:30 AM, strong differentiation was evident, with over 1,000 stocks stagnant and the red slightly dominating with 223 declining stocks against 210 advancing stocks.

– 12:05 06/06/2025

Following the Money Trail: Foreign Investors Dump Stocks, Local Traders Scoop Up SSI and VHM

Despite net buying of almost VND 129 billion by domestic investors on the Ho Chi Minh Stock Exchange (HOSE), the market continued its downward trend for the second consecutive session, closing at 1,342 points due to net selling of over VND 490 billion by foreign investors.

The Liquidity Crunch: Small-Cap Stocks Swimming Against the Tide

The VN-Index’s upward trajectory continued to falter after yesterday’s pause, this time primarily due to a decline in buying power. Of the 10 largest stocks by market capitalization that make up this index, 8 witnessed negative performance, with a 17% drop in the VN30 basket’s liquidity. However, trading remained vibrant among medium and small-cap stocks, with numerous stocks witnessing robust gains.

Market Pulse June 4th: VN-Index Closes Slightly Lower, Foreigners Resume Net Selling

The market closed with the VN-Index down 1.74 points (-0.13%) to 1,345.51, while the HNX-Index bucked the trend and rose 1.25 points (+0.55%) to 230.19. The market breadth tilted towards decliners, with 379 stocks falling versus 340 advancing. The large-cap stocks also painted a gloomy picture, as reflected in the VN30 basket, where 21 stocks retreated, 6 advanced, and 3 remained unchanged.

The Ultimate Trading Stock Has Arrived

The VN-Index closed today’s session (June 3rd) at a year-to-date high of 1,347 points. The stock market witnessed a robust rally across securities as investors circulated rumors about the market upgrade progress. A notable highlight was the massive transaction by foreign funds, with over 37 million shares traded through a block deal in APG.