Eliminate Exclusivity and Open Up Gold Imports

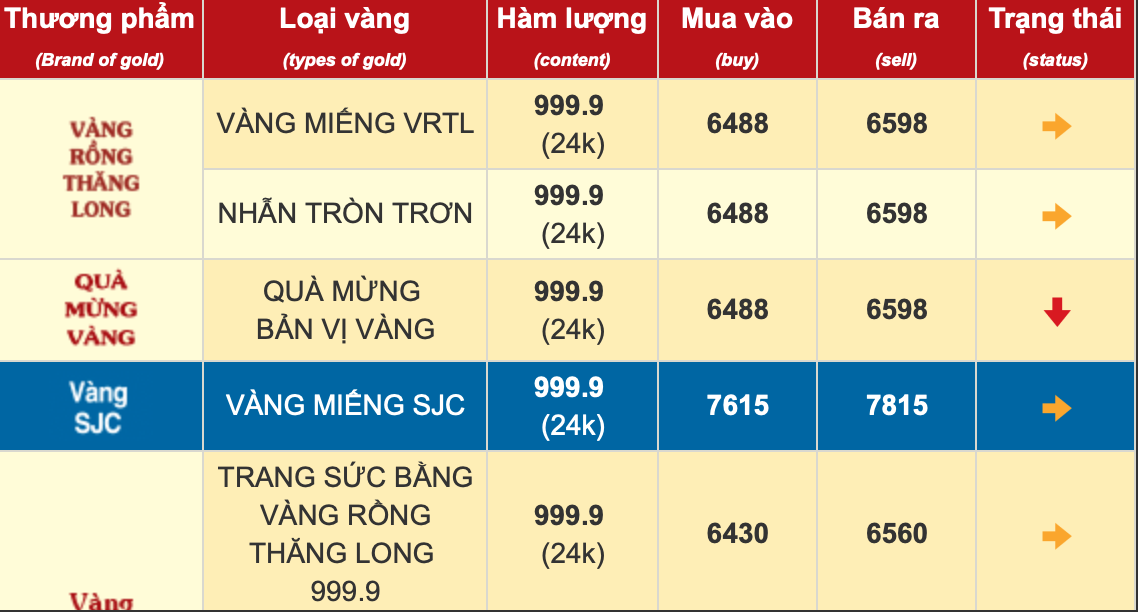

In an interview with Tien Phong Newspaper, economic expert Ngo Tri Long pointed out that Vietnam’s gold market has long been plagued by instability and distortions. As of the end of May, the gap between domestic SJC gold prices and global gold prices reached a staggering 15-17 million VND per tael.

The main culprit behind this disparity is an administrative management model, exclusive import rights, and a lack of connectivity between gold bar, gold jewelry, and gold account segments. Speculation, price manipulation, and gold smuggling are on the rise, eroding market confidence and impacting exchange rates, the balance of payments, and the stability of the national financial system.

Addressing these issues, on May 28, Party General Secretary To Lam chaired a meeting with the Central Committee for Policy-Strategy, emphasizing the need for a comprehensive overhaul of gold market management.

It’s time to reform gold market policies (Photo: Nhu Y)

Following the directives of General Secretary To Lam, the gold market is shifting from a “command-and-control” approach to a “market-building with control” model. This means respecting supply and demand dynamics, fostering healthy competition, and maintaining the state’s role in managing systemic risks. These instructions not only lay the groundwork for revising Decree 24/2012 but also suggest strategic reforms.

“The gold market can no longer be governed by rigid administrative tools as in the past. While policies to tighten supply, monopolize gold bar production, and restrict gold imports have helped stabilize exchange rates and curb dollarization, they have also led to serious consequences,” said Mr. Long. “The record-high gap between domestic and global gold prices has distorted the market, fueled speculation and smuggling, and harmed consumers, who have to buy gold at unreasonably high prices and lose faith in legal investment tools.”

According to Mr. Long, the General Secretary emphasized that the state should not replace the market but rather establish a level playing field and implement controlled regulations to promote the healthy development of the gold market. This will transform gold from a policy burden to a valuable resource.

In addition to eliminating exclusivity in gold bar production, Mr. Long suggested that the exclusive import rights of the State Bank of Vietnam for gold materials be reconsidered. While this mechanism once played a crucial role in macroeconomic stability and market control, it has become limiting in the current context.

“It is necessary to amend the policies and allow qualified enterprises to import gold to promote competition, stabilize the market, and protect consumers’ rights. Instead of relying solely on auctions, we should allocate controlled quotas based on actual capacity, business efficiency, legal compliance, and transparent audits,” Mr. Long emphasized. “This approach ensures fairness, efficiency, and transparency while enhancing healthy competition and curbing market speculation and monopolies.”

Establishing a Gold Exchange

Mr. Long pointed out that while countries like China, India, and Thailand have established national gold exchanges or encouraged the formation of gold investment funds, Vietnam has persisted with an exclusive and manual system.

Singapore’s establishment of the Singapore Gold Exchange (SGE) in 2014 attracted a significant number of foreign investors and enhanced its domestic pricing capabilities. India’s “Gold Monetisation Scheme” collects gold from its citizens, pays them interest in gold, and channels the metal back into the jewelry industry. Thailand boasts over 200 gold businesses, with prices closely aligned with global market standards, ensuring that domestic prices closely track international ones.

“It’s time for Vietnam to adopt a market-oriented gold management policy that aligns with international practices, unlocking the potential of the tens of billions of dollars’ worth of gold lying idle in the hands of the public,” said Mr. Long. He proposed the establishment of a National Gold Exchange, possibly integrated into Ho Chi Minh City’s International Financial Center, to facilitate centralized and transparent trading and curb black-market transactions.

Mr. Long affirmed that Vietnam’s gold market is at a historical turning point, with the new ideas put forth by General Secretary To Lam paving the way for transforming gold from a passive reserve asset into a driver of economic development.

Echoing the idea of a gold exchange, Mr. Pham The Anh, an economist at the National Economics University, agreed that now is the right time to explore the legal framework for such a platform. A gold exchange would reduce reliance on physical gold, providing a trustworthy trading environment for investors.

Mr. The Anh added that the State Bank of Vietnam’s task is to amend Decree 24 on gold market management. The recent volatility in the gold market reflects the instability of the macroeconomy. While domestic gold prices are influenced by global prices, they have shown signs of greater instability. Eliminating exclusive gold brands will foster a freer and more competitive market.

“Gold is an asset with intrinsic value, and people should buy it based on that, not because of a seal of approval,” concluded Mr. The Anh.

Is the Solution to Selling Gold Bars Effective? (*): Taxation to Curb Speculation

The economic experts have proposed a gold transaction tax policy to the state. This policy aims to create equality among other investment channels and curb speculative investments and hoarding, thus stabilizing the market.