The market has witnessed another sell-off similar to last weekend, and the VNI continues to display a lack of genuine breakthrough ability. The difference this time is that the rally in small-cap stocks was shorter-lived, with more intense selling pressure and riskier T+ trading.

Selling pressure persisted throughout today’s session, with intense selling towards the end. The large-cap stocks provided little support, except for HPG, which also faced consistent selling pressure from mid-morning until the end of the day, with massive liquidity.

The ratio of profitable T+ trades is declining rapidly, indicating a shift towards safer trading strategies. The best opportunities in the past two weeks have been in individual stocks, and even though penny stocks appear strong, they are not consistent. Only skilled speculators who pick the right stocks make profits, while most others break even or incur losses. This is not a genuine penny stock wave.

Looking back at the market’s rally towards the peak since May 27, the fluctuations have not led to any significant changes, resulting in a range-bound market. Ten trading sessions are relatively many, and if the trend doesn’t shift, a distribution phase is likely forming. If the remaining liquidity is sufficient to provide support and facilitate rotation, the market needs a breather to consolidate. Otherwise, further discounts are necessary to attract the return of profit-taking funds.

The recent rally was a response to the shock of the countervailing tax measures, and the opportunities were unexpectedly substantial, with waves even surpassing the first quarter of 2025. However, perpetual rallies eventually lead to revaluation, especially when there are no genuinely positive developments. Initially, the rally was fueled by skepticism and multiple attempts to shake off the market, but as skepticism transformed into conviction, complacency set in. Holding a substantial position in any stock can influence subjective assessments, and it’s crucial to avoid both extremes of perception.

Currently, short-term opportunities are scarce, and it’s prudent to await further developments for long-term strategies. The third round of negotiations is of utmost importance, and inevitably, there will be ‘insider’ information creating information asymmetry. However, this is an inherent part of the market. The critical aspect is ensuring that this asymmetry doesn’t alter the overall trend but only benefits a select few. Accepting this as their strength and understanding that their advantage will eventually ‘trickle down’ to the rest of the market is essential to actualizing gains. Therefore, adopting a slower, safer strategy is not a detrimental choice.

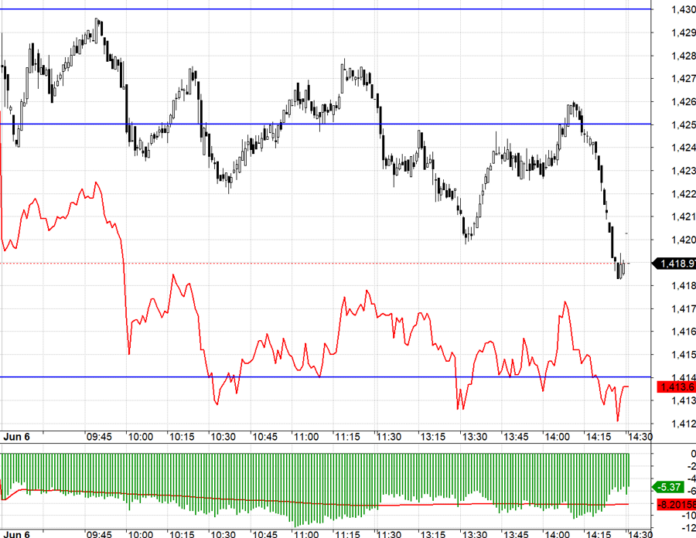

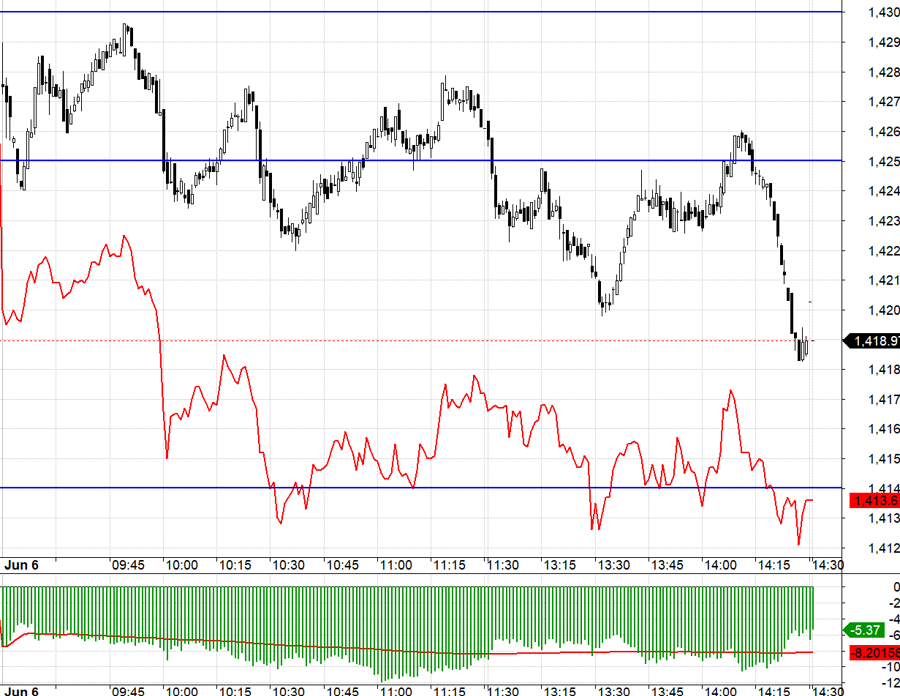

Today’s futures market witnessed a wide discount, and the lack of leading stocks hindered any intraday recovery momentum. Neither short nor long positions offered favorable conditions. The underlying is showing signs of weakness, suggesting an impending short-term correction. As the futures market has already priced in this expectation, short positions will be unfavorable unless the VN30 index provides a clear trend indication. Thus, the strategy is to wait and observe.

VN30 closed at 1418.97. The nearest resistance levels for the next session are 1420, 1428, 1438, 1442, 1451, and 1458, with the strongest resistance at 1465. The support levels are 1415, 1408, 1398, 1390, 1384, and 1378.

“The stock market blog reflects personal opinions and does not represent the views of VnEconomy. The perspectives and assessments are solely those of the individual investor, and VnEconomy respects the author’s style and perspective. VnEconomy and the author are not responsible for any issues arising from the published assessments and opinions.”

Market Pulse June 6: VN-Index Ends Week on a Sour Note, Energy Sector Stages a Comeback

The market closed with declines, as the VN-Index fell by 12.2 points (-0.91%) to 1,329.89, while the HNX-Index dropped 2.58 points (-1.12%) to 228.61. The market breadth inclined towards decliners, with 514 stocks decreasing against 246 advancing stocks. Moreover, within the VN30 basket, 22 stocks declined, 5 increased, and 3 remained unchanged, indicating a dominant red hue.

The Stock Market Blues: Triple Trouble for Stocks as Selling Pressure Mounts and VN-Index Slips Below 1340 Points

The third consecutive session of decline witnessed a surge in liquidity, with an extremely negative breadth indicating that sellers are dominating the market. Most blue-chips are exhausted, while mid and small-cap speculative stocks are also facing heavy selling pressure.

Market Beat June 5th: Late Rally Sees VN-Index Trim Losses to Just Under 4 Points

The VN-Index faced significant pressure in the latter half of the morning session, extending into the afternoon with a dip to 1,336 points. However, a resilient recovery began at 1:40 pm, with the index steadily climbing to close at 1,342.09 – a marginal loss of just 3.65 points. This volatile movement around a strong resistance level was anticipated and reflects a dynamic market.