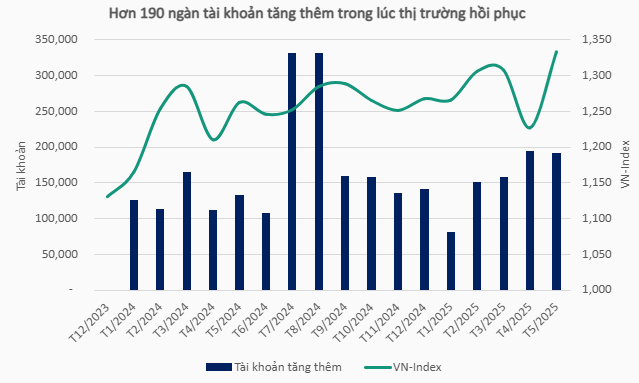

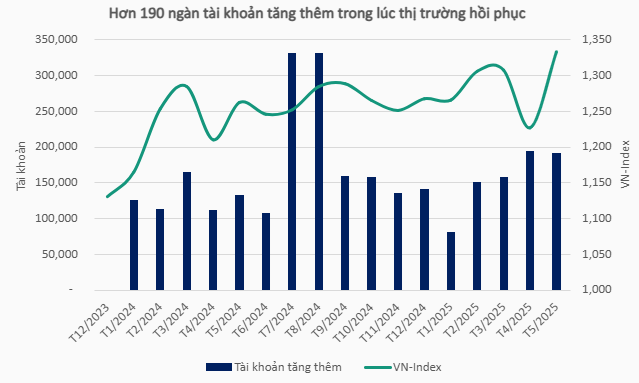

The surge in new accounts was predominantly driven by domestic individual investors, with 190,634 new accounts, while domestic institutional investors added 44 new accounts. In terms of foreign investors, there was a net increase of 174 accounts, comprising an increase of 186 individual accounts offset by a decrease of 12 institutional accounts.

The number of securities accounts surpassing the 10-million mark comes as the Vietnamese stock market witnessed a strong recovery from lows associated with tariff shock. The VN-Index ended May at 1,332.6 points, with trading values exceeding VND 21,656 billion per session.

Source: Author’s Compilation

|

– 5:00 PM, 6th June 2025

Market Pulse June 6: VN-Index Ends Week on a Sour Note, Energy Sector Stages a Comeback

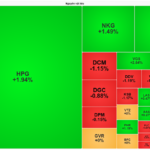

The market closed with declines, as the VN-Index fell by 12.2 points (-0.91%) to 1,329.89, while the HNX-Index dropped 2.58 points (-1.12%) to 228.61. The market breadth inclined towards decliners, with 514 stocks decreasing against 246 advancing stocks. Moreover, within the VN30 basket, 22 stocks declined, 5 increased, and 3 remained unchanged, indicating a dominant red hue.

Stock Market Outlook for June 6: Will Selling Pressure Persist?

“Trading volume for the 5-6 session decreased by approximately 20%, indicating a cautious sentiment among investors as selling pressure intensified.”

The US Economy Will Weaken This Year Due to Tariff Woes.

In the latest edition of ‘Gateway To Vietnam’, organized by SSI Securities on June 5th, experts delved into the intricacies of US tariff policies and their far-reaching implications. The discussion, titled “The Art Behind the Tariff Wave”, explored how these policies impact trade flows, investment patterns, and Vietnam’s economic growth prospects.