Spot silver prices surged 4.2% to $35.9 per ounce, the highest level since February 2012. Alexander Zumpfe, a senior trader at German refiner Heraeus Group, attributed the rally to a combination of technical momentum, improved fundamentals, and broader investor interest.

“After lagging gold for several weeks, silver is now catching up,” said Zumpfe. This indicates “fresh interest from momentum-chasing investors shifting to silver,” he added.

Silver prices over the past year.

The two precious metals often move in tandem when geopolitical tensions arise. Gold has surged 44% in the past 12 months as the US-led trade war expanded, bolstering gold’s appeal as a safe-haven asset, and central banks maintained high purchasing levels. Silver, meanwhile, has only gained about 20%.

According to analysts, the white metal is also supported by significant inflows into silver-backed exchange-traded funds, with holdings rising by 2.2 million ounces on June 4. Money managers also increased their bullish bets on Comex silver futures in the week ending May 23.

In addition to its value as a safe-haven asset, silver is prized for its industrial input applications, including green energy technology. The metal is a key component in solar panels.

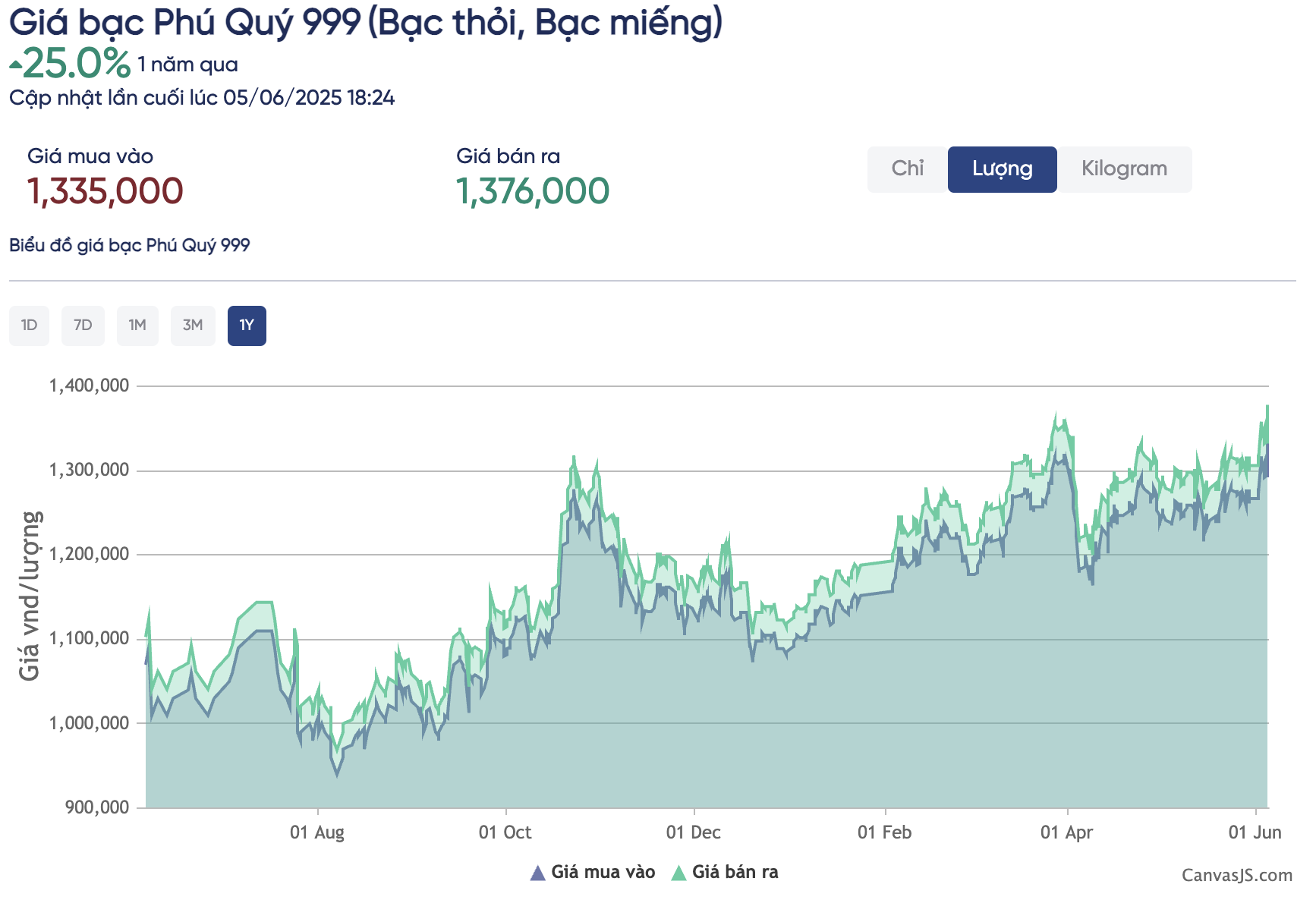

Silver bar prices in Vietnam over the past year.

In Vietnam, silver bar prices also rose 2.7% today and 5% over the past seven days. Phu Quy 999 silver bar prices for one tael are currently trading at VND 1.376 million (sell) and VND 1.335 million (buy) – as of the evening of June 5. The one-kilogram silver bar is priced at VND 36.69 million (sell) and VND 35.59 million (buy).

The Rich Dad Author: ‘Why I’m Buying This Ultimate Bargain Instead of Bitcoin, Starting Tomorrow’

“Just over two months ago, Robert Kiyosaki predicted that this particular asset would double in value by the year’s end. Now, he believes this investment channel could potentially triple.

Gold: From Traditional Reserve to Modern Financial Weaponry

For centuries, gold has been a core component of the global monetary system, offering a lower-risk asset class compared to many other alternatives. In today’s volatile geopolitical climate, with soaring inflation and strained global trade, nations are re-evaluating their approach to this precious metal.

“PNJ Responds to State Bank’s Gold Business Inspection Findings: Addressing Shortcomings Since 2024”

PNJ acknowledges the findings of the Banking Inspection and Supervision Agency and assures that it will fully comply with the agency’s decisions. The company has taken proactive measures to address the shortcomings and rectify any consequences that may have arisen.