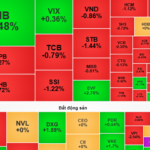

VN-Index struggled around the reference mark, closing in the red. The state of polarization was evident, with a dominant red hue in the large-cap group, but the decline was not significant. The main index closed slightly lower, down 1.5 points.

Today’s notable movement was observed in VPG (Vietnam Import-Export and Trading Investment Joint Stock Company), which plummeted to the floor price with no buyers. Investors rushed to sell VPG, driving the share price down to 10,400 VND per unit. By the end of the session, more than 7.6 million VPG shares were left unsold at the floor price.

This is the second consecutive session that VPG has dropped to the maximum extent allowed. The company’s market capitalization slipped below the 1,000 billion VND threshold.

VPG plunges to 10,400 VND per share.

At the close of trading, the VN-Index lost 1.51 points (0.11%) to finish at 1,345.74. In contrast, the HNX-Index climbed 1.89 points (0.83%) to 230.83, while the UPCoM-Index shed 0.31 points (0.31%) to close at 99.01. Liquidity weakened, with the value of transactions on HoSE reaching nearly 23,200 billion VND. Foreign investors net sold 54 billion VND, focusing on VHM, STB, DXG, and others.

Regarding VPG, the Ministry of Public Security recently initiated a criminal case for “Violation of regulations on the management and use of state assets, bribery, and related offenses” involving VTM and related units. Eight suspects have been prosecuted, including Mr. Nguyen Van Binh, former Chairman of the Board of Directors of Vietnam Import-Export and Trading Investment JSC, and Mr. Nguyen Van Duc, General Director, who were charged with bribery.

Previously, on June 3, Mr. Nguyen Van Binh had submitted his resignation from the position of Chairman of Vietnam but remained on the Board of Directors. His position was taken over by Mrs. Le Thi Thanh Le, his wife.

VPG, formerly a domestic transportation service company established in 2008 and listed on HoSE since 2014, primarily engages in trading iron ore, pellets, steel billets, domestic coal, imports, and additives for cement plants.

VPG is a leading supplier of raw materials to steel manufacturers in Vietnam, providing 1 million tons per year to factories such as Hoa Phat Hai Duong and Gang Thep Tuyen Quang. The company also supplies thermal coal to power plants under EVN and PVN.

Additionally, VPG operates in the real estate sector, focusing on Hai Phong, with projects like the commercial housing area in Vinh Niem Ward, Le Chan District, spanning over 2.4 hectares, and the 1.8-hectare residential development and urban renovation project at 80 Ha Ly, Ha Ly Ward, Hong Bang District, with a total investment of 800 billion VND.

In the first quarter of this year, VPG recorded net revenue of nearly VND 4,625 billion and after-tax profit of approximately VND 21 billion. In 2024, the company achieved a record-high revenue of over VND 16,257 billion but posted an after-tax profit of only VND 108 billion.

As of the end of March, the company had a charter capital of VND 884 billion, of which Mr. Nguyen Van Binh held 25.79%, and his wife, Mrs. Le Thi Thanh Le, owned 4.53%. As of March 31, 2025, VPG’s total assets stood at VND 7,524 billion.

“Stock Market Outlook: VN-Index Faces Adjustment Pressures for the Week of June 2-6, 2025”

The VN-Index witnessed a significant decline during the week’s final session, bringing an end to its four-week streak of consecutive gains. The index’s repeated tests of the old March 2025 peak (equivalent to the 1,320-1,340 range) indicate a crucial resistance level that the VN-Index must surpass to sustain its upward trajectory. Erratic trading volume fluctuations around the 20-day average reflect investors’ unstable sentiment. Moreover, consistent selling pressure from foreign investors has further intensified the burden on the VN-Index. Should this trend persist, the likelihood of a corrective phase looms large.

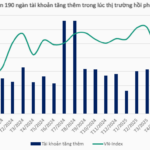

The Rise of Stock Market Enthusiasts in Vietnam: Over 10 Million Trading Accounts and Counting

As of May 2025, Vietnam’s stock market witnessed a significant surge in trading accounts, with almost 10.1 million registered accounts, according to the Vietnam Securities Depository and Clearing Corporation (VSDC). This marks an increase of 190,852 accounts compared to the previous month, showcasing a vibrant and growing investment landscape in the country.

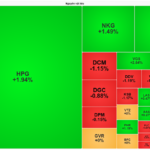

Market Pulse June 6: VN-Index Ends Week on a Sour Note, Energy Sector Stages a Comeback

The market closed with declines, as the VN-Index fell by 12.2 points (-0.91%) to 1,329.89, while the HNX-Index dropped 2.58 points (-1.12%) to 228.61. The market breadth inclined towards decliners, with 514 stocks decreasing against 246 advancing stocks. Moreover, within the VN30 basket, 22 stocks declined, 5 increased, and 3 remained unchanged, indicating a dominant red hue.