Trump Organization Ventures into Vietnam: A Strategic Business Move

In a notable event two weeks ago, Eric Trump, son of former US President Donald Trump, met intimately with Prime Minister Pham Minh Chinh in Vietnam. Trump Organization is currently developing a $1.5 billion golf and resort project in the country, with a land lease extending to 2075.

This raises an intriguing question: If President Trump intended to uphold the 46% import tariff on Vietnamese goods, potentially hindering the country’s competitiveness, why would his family’s business venture into Vietnam with such substantial investments?

PYN Elite’s leader, Petri, offers a plausible explanation. He suggests that investors in the stock market understand that the tariffs imposed by President Trump will likely be adjusted to ensure Vietnam’s growth story continues.

Booming Exports to the US but Uncertainty Looms

Exports to the US have surged by 34%. However, Petri forecasts a decline in the coming period. Even a reasonable tariff agreement may not be enough to counter this trend as US warehouses are already stocked due to previous tariff concerns, and consumer demand is showing signs of slowing down.

Nevertheless, a fair trade deal with the US would boost Vietnam’s stock market and strengthen its currency.

PYN Elite’s Portfolio: Betting on Domestic Growth

Petri finds Vietnam’s stock market attractive, with a P/S ratio of just 1.3, while the economy continues to grow, boosting the revenue of listed companies. The projected P/E ratio for 2025 is around 11 times.

Vietnam’s mid-term economic outlook is bolstered by political stability and consistent development policies. However, the tariff storm instigated by the US casts uncertainty over the market’s performance in 2025, with factors like slowing US economic growth, global trade disruptions, USD trends, and geopolitical tensions, especially the US-China trade conflict, creating a murky picture.

“The market will certainly not move smoothly this year, especially with the expected instability in the next six months. However, there is no reason to be overly concerned about Vietnam or the PYN Elite portfolio, even if there are a few bumps along the way. Listed companies with moderate debt levels in a country with reasonable public debt will be able to recover quickly from any fluctuations,” Petri commented.

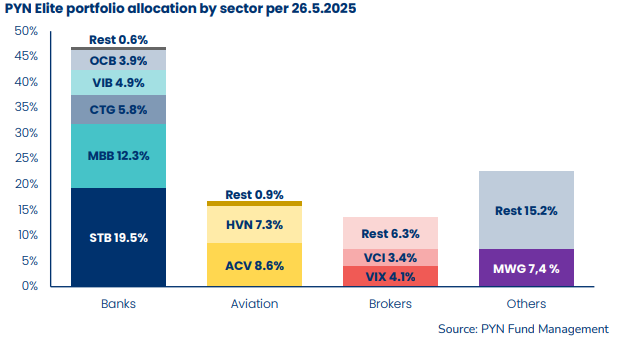

Amidst the unpredictable fluctuations, PYN Elite maintains a strong belief in Vietnam’s long-term prospects. Their investment portfolio focuses on sectors aligned with domestic consumption and growth, including banking, securities, and aviation.

June – A Turning Point for US-Vietnam Trade Relations?

“The energetic President Trump has made predicting near-term macroeconomic developments extremely challenging. It is likely that America’s selfish political calculations and opportunistic stance towards the rest of the world will lead to a new wave of economic growth as countries are forced to seek new trading partners, boost domestic growth, and increase investment in research and development (R&D) to reduce dependence on the US,” Petri stated.

Trump has made controversial statements about Vietnam’s economic relationship with China, accusing them of colluding against the US. However, he has also expressed his love for Vietnam on multiple occasions.

Petri believes Vietnam will diversify its trade partnerships but still considers the US an important ally, especially in technology. Recent developments in tariff negotiations between the two countries are positive, indicating the possibility of a reasonable trade agreement in June.

– 22:05 06/06/2025

“My Investment Appetite”: “I Prefer Stocks Because They’re Transparent, Merit-Based, and Free From Schmoozing.”

“I prefer the title ‘savvy investor’ to ‘stock market queen,’ because it reflects my belief that anyone can create wealth through wise financial decisions. It’s not about royalty or privilege; it’s about empowering individuals to take control of their financial destiny and turn their money into a productive asset.”

Cracking Down on Aviation Security Threats: 49 Violations Addressed by the Ministry of Public Security.

Since taking on the task of ensuring aviation security, the Ministry of Public Security has received and handled information regarding 49 aviation security breaches across 22 airports nationwide.

Stock Market Blog: Time for a Breather

The market witnessed another dump similar to last weekend, and the VNI index once again struggled to demonstrate any real breakthrough potential. This time, the difference lies in the shorter, more intense surge in small-cap stocks, followed by a fierce sell-off, making intraday trades significantly riskier.