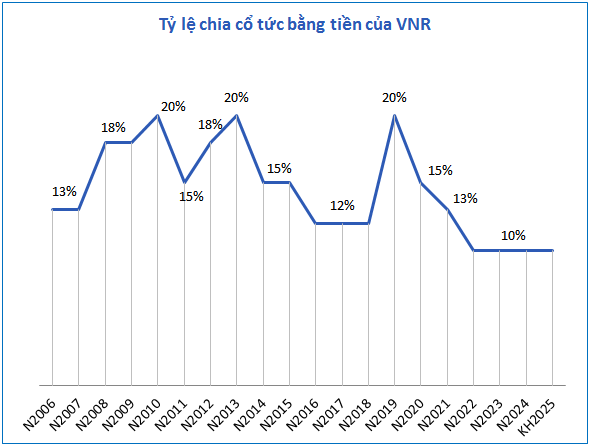

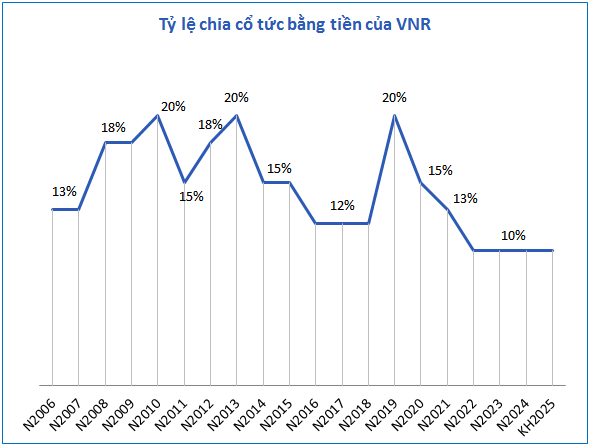

As planned, VNR will pay a cash dividend of 10% (equivalent to VND 1,000/share). With nearly 182.4 million shares outstanding, the company expects to pay out over VND 182 billion in dividends.

Source: VietstockFinance

|

Previously, at the 2025 Annual General Meeting of Shareholders, shareholders approved the 2024 profit distribution plan, including a 10% cash dividend and a 10% stock dividend.

| VNR’s annual net profit |

Thus, VNR maintains its dividend policy of a combination of cash and stock dividends at 20% for the third consecutive year, despite the company’s 2024 profit decrease compared to 2023 due to compensation for Yagi storm.

Source: VietstockFinance

|

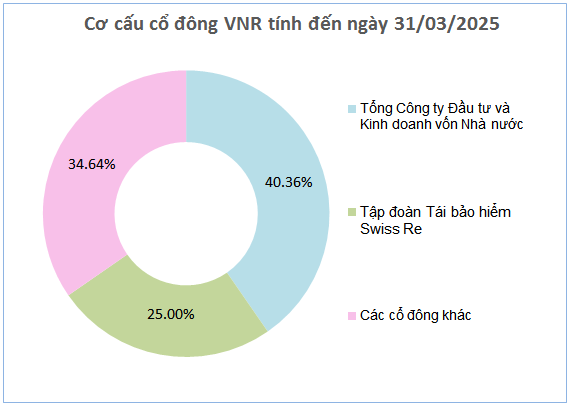

As of March 31, 2025, the State Capital Investment Corporation (SCIC) was the largest shareholder, holding 40.36% of the capital, and is expected to receive nearly VND 74 billion in cash dividends in this payout. The second largest shareholder is Swiss Reinsurance Group, with a 25% stake, equivalent to approximately VND 46 billion in dividends.

| VNR’s net profit by quarter |

In terms of business operations, in Q1/2025, VNR’s reinsurance premium revenue increased sharply by 53% to VND 1,392 billion. However, gross profit from insurance activities decreased by 62% to VND 31 billion due to a 44% increase in compensation expenses to VND 219 billion, leading to an 81% increase in total insurance business expenses.

The financial investment segment also saw a decline, with revenue down 33% to VND 85 billion, while financial expenses quadrupled to over VND 12 billion. As a result, gross financial profit decreased by 41% to nearly VND 73 billion. VNR’s net profit for Q1/2025 halved to VND 73 billion.

For 2025, VNR targets a pre-tax profit of VND 503 billion, up 8% from 2024. After the first quarter, the company has achieved about 17% of its target.

Regarding the upcoming Extraordinary General Meeting, VNR will propose to shareholders the dismissal of Ms. Nguyen Thi Huong Giang from the Board of Directors for the 2025-2030 term. Notably, Ms. Giang also recently stepped down from her position as General Director of Total Petroleum Insurance Joint Stock Company (PJICO) since May 15, after three years in the role.

– 16:58 06/06/2025

“Leading Battery Brand Announces First Interim Dividend for 2025: A Generous 20% Payout”

The Hanoi Battery Joint Stock Company (HNX: PHN), proud owners of the renowned Bunny Battery brand, is thrilled to announce an interim cash dividend for the first quarter of 2025, offering a generous 20% dividend payout ratio, equivalent to VND 2,000 per share. Shareholders will be delighted to know that the record date for this dividend is set for June 13th, with payments expected to be made by June 24th.

The First Vietnamese Stock Soars Post-Listing: A Surprising Surge Thanks to Critical Information

The stock has just skyrocketed to a new all-time high, with a market capitalization of a record-breaking $1.4 billion.

Unlocking THACO’s 2025 Vision: Strategically Navigating Challenges to Boost Profits and Transform Performance

In 2024, THACO recorded a remarkable consolidated after-tax profit of VND 3,228 billion, with the majority of this success attributed to the outstanding performance of Thaco Auto. Thaco Auto’s impressive contribution stood at VND 4,410 billion in consolidated pre-adjusted tax profit, showcasing its pivotal role in driving THACO’s overall profitability.

“SIP to Issue Nearly 32 Million Shares in Dividend Payout”

The Ho Chi Minh City Investment and VRG Joint Stock Company (HOSE: SIP) has announced that the record date for shareholders to receive the 2024 dividend in shares is expected to fall in July 2025.