The stock market traded in a relatively choppy range during the June 4 session. The VN-Index continued to climb at the opening, reaching the 1,350-point mark, before facing corrective pressure. At the close, the VN-Index edged slightly lower by 1.51 points (-0.11%) to settle at 1,345.74, retesting the March 2025 high. Foreign trading turned balanced with a net sell position of approximately VND 49 billion across the entire market.

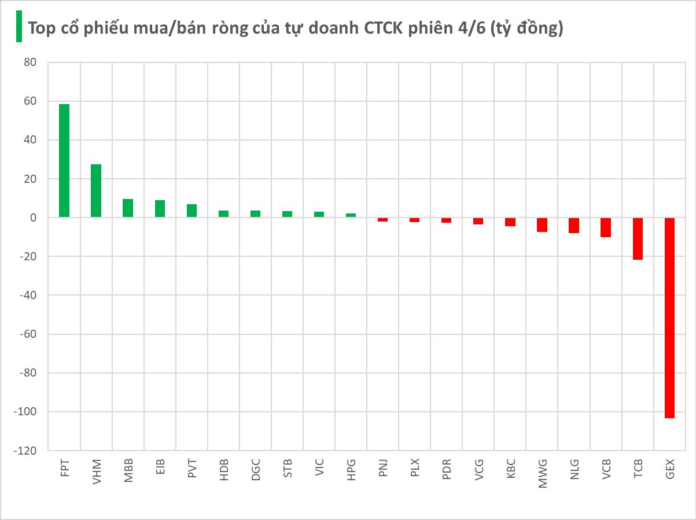

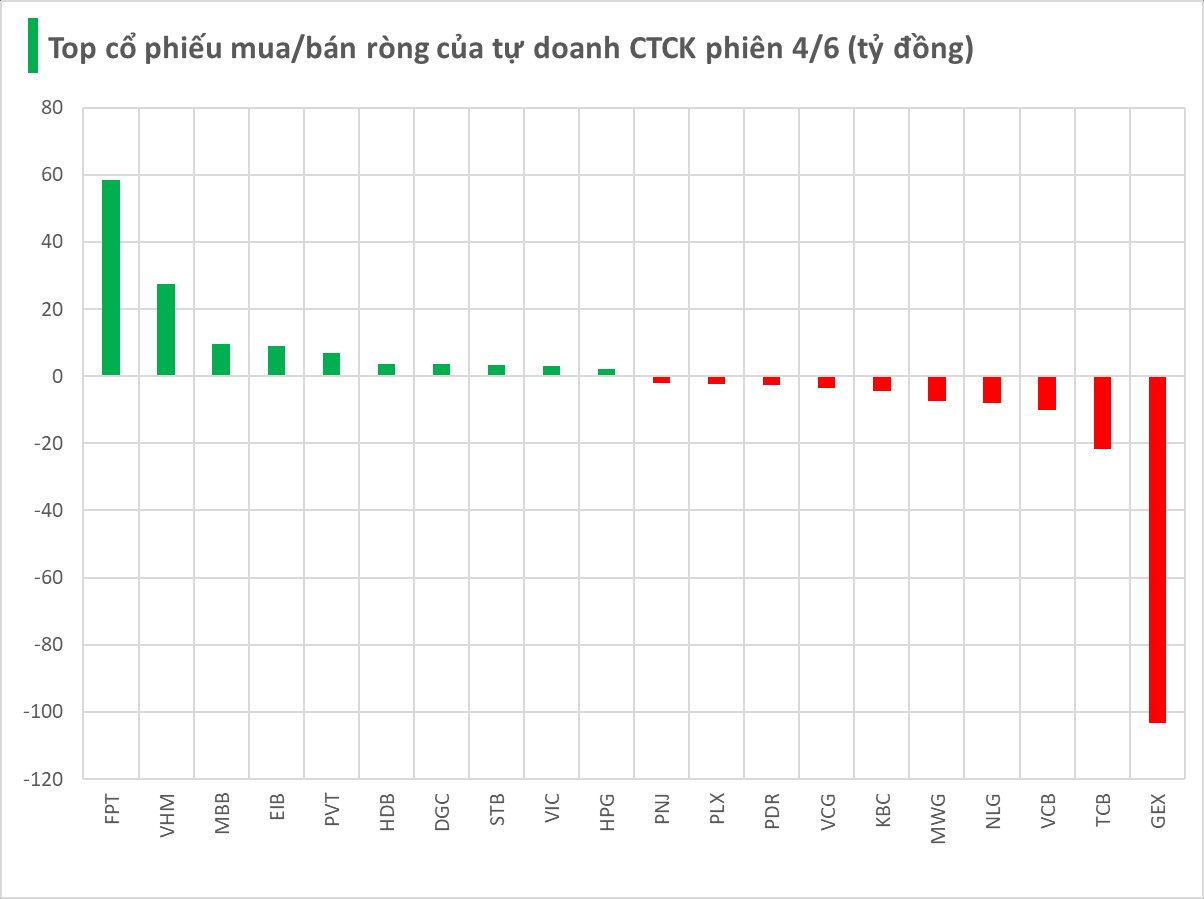

Securities companies recorded a net sell position of VND 27 billion on the HoSE.

Securities companies focused their trading on FPT, resulting in a net buy position of VND 58 billion. This was followed by VHM, MBB, and EIB, with net buy positions of VND 27 billion, VND 10 billion, and VND 9 billion, respectively. Additionally, net buying was observed in PVT, HDB, DGC, STB, VIC, and HPG…

On the other hand, the securities companies offloaded GEX the most, with a net sell position of VND 103 billion. TCB and VCB followed with net sell positions of VND 22 billion and VND 10 billion, respectively. NLG, MWG, KBC, VCG, and a few others were also among the sold-off stocks in today’s session.

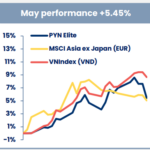

The VN-Index Recovers Its Score, but Liquidity Takes a Dip in May

The VN-Index ended May at 1,332.6 points, an impressive 8.7% increase, but liquidity took a downturn. Volume and value traded decreased by 8% and 7%, respectively, compared to the previous month of April 2025.

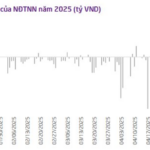

The Foreign Sell-Off Continues: Nearly $20 Million in Outflows and the Stocks Feeling the Heat.

The afternoon session saw a strong net buying trend for MSN across the market, with a total value of 118 billion VND. This significant buying activity indicates a potential shift in market sentiment and highlights the stock’s resilience and appeal to investors. As one of the leading stocks in the industry, MSN’s performance continues to be a key focus for market participants.