Vietnam’s stock market recorded its third consecutive corrective session, with the decline widening towards the end of the trading day. In terms of breadth, declining stocks far outpaced advancers, tripling the number of gainers on the HoSE alone. At the close on June 6th, the VN-Index fell over 12 points to 1,329.89. Liquidity improved from the previous session, with matched orders on HoSE reaching VND 20,313 billion.

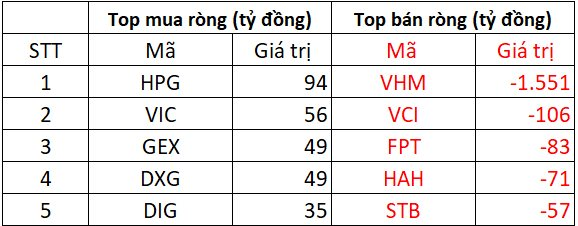

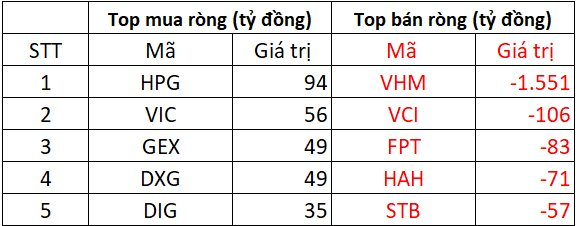

Foreign trading was a downside factor as foreign investors continued to offload Vietnamese stocks, with net sell orders spiking to VND 2,055 billion across all three exchanges. Specifically:

Foreign investors net sold VND 2,042 billion on HoSE

In the sell-off, VHM shares unexpectedly faced massive net selling by foreign investors, amounting to VND 1,551 billion. Following suit, VCI shares also witnessed net sell orders exceeding VND 100 billion. Additionally, stocks like FPT, HAH, and STB were aggressively dumped, resulting in net sell orders ranging from VND 57 billion to VND 83 billion.

Conversely, HPG emerged as the most sought-after stock by foreign investors, attracting net buy orders worth VND 94 billion. VIC also received net purchases of approximately VND 56 billion. GEX, DXG, and DIG witnessed net buying in the range of VND 35 billion to VND 49 billion per stock.

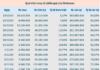

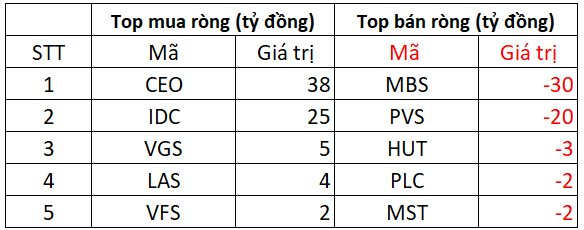

Foreign investors net bought nearly VND 21 billion on HNX

On the buying side, CEO and IDC stocks enjoyed robust net purchases of VND 38 billion and VND 25 billion, respectively. Meanwhile, VGS, LAS, and VFS witnessed net buying by foreign investors in the range of VND 2 billion to VND 5 billion.

Conversely, MBS and PVS faced net selling of around VND 20 billion to VND 30 billion. Stocks like HUT, PLC, and MST also experienced net sell orders in the billions.

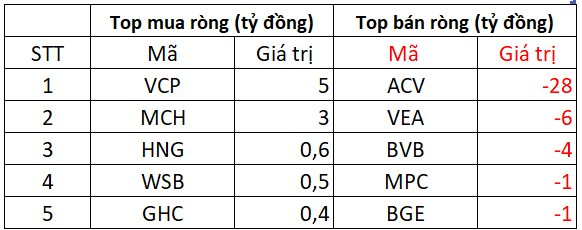

Foreign investors net sold approximately VND 34 billion on UPCOM

In terms of net buying, VCP and MCH stocks witnessed net purchases of VND 3 billion to VND 5 billion. Meanwhile, HNG, WSB, and GHC also experienced modest net buying.

On the opposite end, ACV faced significant net selling of VND 28 billion. Stocks like VEA, BVB, MPC, and BGE encountered net sell orders in the billions.

What Happened to the Stock Market Today?

The VN-Index fell by over 12 points, retreating to 1,334.5 points – its lowest level in almost two months. Selling pressure intensified across most sectors, plunging the market into a sea of red during today’s session (June 6th).

“Market Meltdown: VN-Index Plunges Below 1330 Points as Investors Bail Out”

Selling pressure soared in the afternoon session, plunging numerous mid and small-cap stocks into the red. While 107 tickers on the HoSE fell by over 1% in the morning, this number skyrocketed to 160 by the closing bell. The drop in the VN-Index fails to convey the full extent of the damage inflicted on individual stocks.

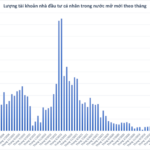

The Dedicated Domestic Team: An Unstoppable Force in Today’s Market

“Domestic institutional investors bought a net of VND 498.8 billion, of which VND 414.7 billion was net bought in matched orders.”