Vietnam’s pharmaceutical market is valued at approximately $7 billion, with per capita drug consumption reaching $70, a tenfold increase since 2000. According to statistics from Rong Viet Securities (VDSC), there are currently around 50,000 pharmacies in the market. Meanwhile, ABS forecasts that the retail pharmaceutical market in Vietnam will grow at a CAGR of about 15.8% over the next four years.

Demographic and average income factors, along with the increasing demand for pharmaceuticals and dietary supplements, especially after the Covid-19 pandemic, have boosted the expansion of domestic pharmacy chains. The retail drug industry is gradually modernizing and moving towards chain operations, leaving behind its traditional and fragmented past.

The Big Three in the Pharmacy Race: Long Chau Accelerates, While Pharmacity and An Khang Restructure

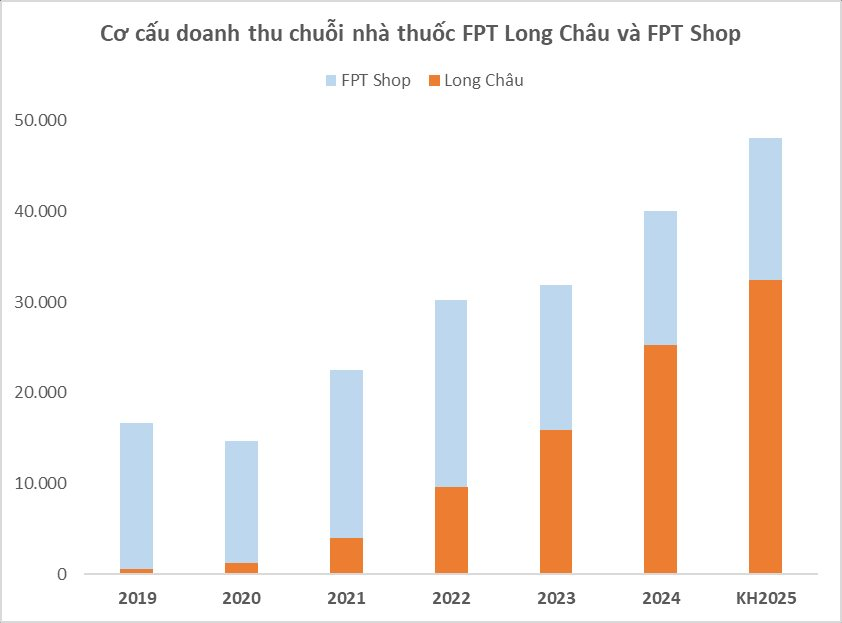

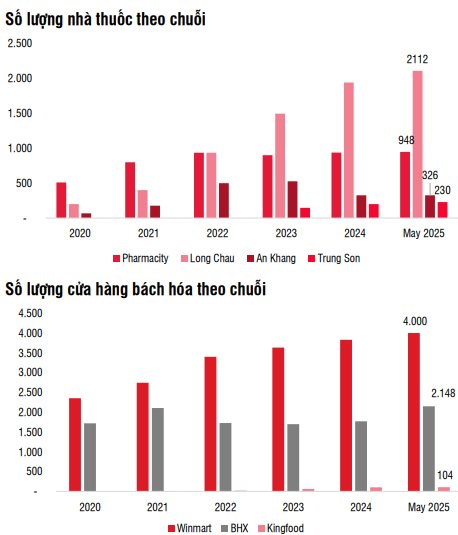

Statistics reveal the breakneck speed at which modern pharmaceutical retail chains are expanding in Vietnam. The most notable is Long Chau Pharmacy, a subsidiary of FPT Retail (FRT), which has become the market leader in terms of store count and growth rate. Starting with just eight stores in 2017, Long Chau has skyrocketed to 2,117 stores as of June 2025, a more than 260-fold increase in eight years. Aside from its rapid expansion, Long Chau has also demonstrated impressive financial performance, contributing significantly to FRT’s consolidated revenue. In 2024 alone, the chain recorded a 59% growth in revenue compared to 2023, reaching VND 25,320 billion and accounting for 63% of the company’s total revenue.

For 2025, the pharmacy chain continues to be viewed as the primary growth driver, targeting revenue of VND 32,400 billion, representing a roughly 28% increase from the previous year. Compared to Vietnam’s pharmaceutical market size of approximately VND 200,000 billion, the chain is estimated to hold nearly 20% market share.

Pharmacity, a prominent modern pharmacy chain in Vietnam, once experienced rapid growth, surpassing 1,100 stores nationwide by September 2022. However, after this heated growth phase, the chain entered a restructuring phase to enhance operational efficiency. The number of stores was streamlined to nearly 950, focusing on high-performance areas in central locations.

In a separate development, An Khang Pharmacy, owned by The Gioi Di Dong (MWG), initially expanded rapidly, reaching 527 stores in a short period. Its management even set an ambitious goal of expanding to 2,000 stores nationwide by the end of 2023. Nevertheless, intense competition and high operating costs led to a shift in strategy. An Khang chose to consolidate, reducing its footprint to 326 stores primarily located in Ho Chi Minh City and several southern provinces. Over the past two years, the chain has maintained this number of stores, adopting a cautious approach while optimizing operations, improving technology, and awaiting the right moment to resume expansion.

Golden Opportunities for Modern Pharmacy Chains

Modern pharmaceutical retail chains still have significant growth potential, especially as consumers increasingly prioritize quality and transparency. In the past, purchasing medications and supplements from traditional pharmacies was relatively straightforward and loosely regulated. However, the market is now undergoing a transformation, with tighter controls from production to distribution. Regulatory authorities have taken strong measures, such as enhanced tax collection and crackdowns on counterfeit and substandard products, to protect consumer rights and establish a transparent and fair legal framework for compliant businesses.

Modern pharmacy chains like Long Chau, An Khang, and Pharmacity adhere to various taxes, including corporate income tax, value-added tax (VAT), and import-related taxes. They also ensure compliance with state regulations regarding product origin and are committed to providing genuine products and professional services to their customers. Pharmaceutical products are typically sourced directly from reputable pharmaceutical companies, ensuring clear provenance and proper documentation.

In contrast, many traditional pharmacies struggle to comply with the new tax regulations and product traceability requirements. In practice, some fail to properly store invoices and documents related to drug batches and do not display prices as mandated by law. This not only exposes them to legal risks but also undermines their credibility in the eyes of consumers. As the market becomes increasingly transparent and competitive, operational shortcomings could lead to traditional pharmacies being left behind.

According to Mr. Doan Van Hieu Em, CEO of An Khang, this situation presents a “golden opportunity” for the pharmaceutical retail industry. He believes that during the period from 2018 to 2021, when consumer spending was robust and healthcare expenditures surged in the post-pandemic era, pharmacy chains had a chance to thrive but may not have received the necessary focus. This was due to businesses prioritizing the maintenance and preservation of their core business areas rather than expanding into new sectors like pharmaceuticals.

Mr. Hieu Em emphasizes that the current context has changed, and a second golden opportunity is emerging. Modern pharmacy chains with strong quality control and transparent systems, like An Khang, will become more appealing to consumers. According to the leader, An Khang has remained largely stagnant over the past two years, focusing on restructuring and optimization while awaiting this opportune moment.

Sharing a similar perspective, SSI Securities, in its latest report, attributes the short-term impact of the campaign against counterfeit and substandard goods, along with the removal of the flat-rate tax for businesses with revenues above VND 1 billion, to the acceleration of the shift from traditional to modern trade channels. Modern pharmacy chains and supermarkets are expected to be the primary beneficiaries.

Additionally, policies related to e-commerce platforms contribute to a healthier environment for legitimate businesses. According to the amended Law No. 56/2024/QH15, from April 1, 2025, e-commerce platforms are required to declare and pay taxes on behalf of individual businesses operating on their platforms. Consequently, shops selling imported goods that do not fully comply with tax regulations on e-commerce platforms will face higher tax obligations, narrowing the price gap with tax-compliant enterprises.

Given these conditions, SSI Research assesses that modern retail businesses will compete on a more level playing field and face less aggressive price competition. Enterprises that stand to benefit from these changes include The Gioi Di Dong (MWG), FPT Retail (FRT), Digiworld (DGW), and Masan’s (MSN) Winmart chain.

Breaking News: Pharmacity Recalls Four Products Linked to Counterfeit Manufacturer

Pharmacity is recalling four products: PMC Blood Activator, PMC Gingko Biloba, PMC Joint Care, and PMC Liver Support. The company is offering a full refund to customers who have purchased these products.

The Ultimate Recession-Proof Industry: A $70 Billion Behemoth, with Retail Giants Scrambling to Open Stores in Rural and Urban Areas Alike

The pharmaceutical retail market is often deemed “recession-proof”, owing to the consistent demand for pharmaceuticals, which remains imperative despite macroeconomic fluctuations. In the context of Vietnam, with its aging population and growing middle class, the demand for healthcare, and by extension, the pharmaceutical industry, is experiencing unwavering growth, as highlighted by Vietdata, a prominent provider of reports on the Vietnamese economy.

The Battle for Dominance in Vietnam’s Pharmacy Industry: Will the ‘Big Guns’ Ultimately Prevail?

In the heart of major cities such as Ho Chi Minh City and Hanoi, the trio of Long Chau, Pharmacity, and An Khang have almost entirely outcompeted smaller, independent pharmacies. And they’re continuing to do the same in the centers of smaller provinces. As a result, an intriguing power struggle is unfolding between local giants like Long Hien (Thanh Hoa) and A Dong (Ha Nam) and the formidable pharmaceutical retailer, Long Chau.

A Helping Hand for Flood Victims: Central Retail Vietnam Donates 10,000 Care Packages, Long Chau Offers Free Medicine, and Dat Xanh Provides Temporary Housing Assistance.

Recent storms and floods have wreaked havoc in many provinces and cities across Northern Vietnam. In the true spirit of compassion and solidarity, several businesses have stepped up to provide timely support and assistance to the affected communities.