Hoang Anh Gia Lai Joint Stock Company (stock code: HAG) announced the successful completion of a private share issuance aimed at debt conversion. Led by Chairman Doan Nguyen Duc (known as Bau Duc), the company distributed 210 million common shares to a group of creditors, effectively converting a debt totaling VND 2.52 trillion. The conversion value was set at VND 12,000 per share.

This price is lower than the market price of HAG shares, which closed at VND 15,900 per share on September 26th.

The list of creditors participating in this debt conversion includes one organization, Huong Viet Investment Consulting Joint Stock Company, and five individual investors: Ms. Nguyen Thi Dao, Mr. Phan Cong Danh, Mr. Nguyen Anh Thao, Mr. Ho Phuc Truong, and Mr. Nguyen Duc Trung.

Upon completion of the transaction, this investor group will hold a combined 16.65% of Hoang Anh Gia Lai’s chartered capital. According to the issuance terms, all 210 million shares will be restricted from transfer for one year.

Bau Duc’s HAG successfully distributed 210 million common shares to a group of creditors.

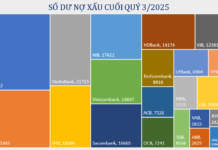

HAG’s consolidated financial report as of June 30th shows total liabilities of VND 15.63 trillion, 1.5 times higher than equity. Converting debt into equity helps reduce borrowing pressure and strengthens the balance sheet.

Within HAG’s debt structure, financial loans account for VND 9.32 trillion. Interest expenses for the first half of 2025 totaled VND 360 billion, averaging approximately VND 2 billion daily.

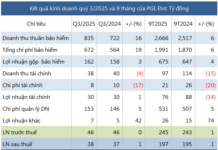

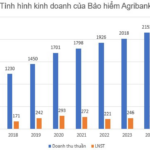

In the first six months of this year, Hoang Anh Gia Lai Joint Stock Company reported a post-audit net profit of nearly VND 834 billion, a 74% increase year-on-year, ending accumulated losses and recording an accumulated profit of nearly VND 400 billion as of June 30th.

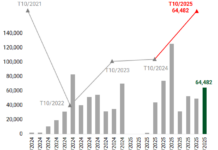

Revenue rose 34% to VND 3.707 trillion, primarily driven by banana sales. By the end of Q2, HAG achieved 58% of its annual profit target, which is expected to be revised upward to VND 1.5 trillion.

However, in HAG’s 2025 semi-annual audited financial report, Ernst & Young Vietnam noted that short-term debt exceeded short-term assets by VND 2.767 trillion, indicating potential risks to continued operations. HAG also violated certain bond covenants and failed to repay overdue principal and interest on bonds.

In response, HAG stated that cash flow over the next 12 months is expected from partial liquidation of financial investments, loan recoveries from partners, private bond issuances, bank credit, and debt restructuring plans.

Hoang Anh Gia Lai Joint Stock Company is working with lenders to adjust violated terms and seek shareholder approval for converting part of the debt into equity.

Vinaship Announces 6% Cash Dividend Payout

Vinaship is set to distribute nearly VND 20.4 billion in cash dividends at a rate of 6%, with VIMC and Viconship expected to receive the largest share of the dividend payout.