TID’s 2025 Annual General Meeting was held on the morning of June 11th. Screenshot

|

Tariffs have minimal impact

At the 2025 Annual General Meeting of TID Joint Stock Company (UPCoM: TID), held on the morning of June 11th, Mr. Tran Trung Tuan, Member of the Board of Directors and General Director of TID, shared that the company’s main business is in the services sector. Only a small portion of their business involves exporting agricultural products, specifically coffee, and the majority of their exports go to European and Asian countries rather than the US. As a result, the company is not significantly affected by US tariffs.

However, he acknowledged that the tariffs could impact some of the businesses operating within TID’s industrial parks that export goods to the US. These businesses will need to carefully consider their strategies regarding industry selection, tax refund policies, and export market orientation to mitigate risks associated with trade barriers.

TID is currently attracting investments in diverse industries, targeting the Asian market and high-value-added services to reduce dependence on any single market.

Mr. Tran Trung Tuan – Member of the Board of Directors and General Director of TID

|

Ms. Dang Thi Thanh Ha, Chairwoman of the Board of Directors of TID, added that direct exports to the US account for a meager 2% of their total exports, with 40% going to the European market. Therefore, the company’s current business strategy will not be significantly impacted by the US policies.

Green Development Orientation and Industrial Park Land Expansion

Regarding industrial real estate, the Chairwoman shared that the company plans to expand its land bank for industrial park development when market conditions and government policies are favorable.

On the progress of the Nui Dong Dai and Phu Thanh – Long Tan residential area projects, the company’s subsidiaries are navigating legal procedures, addressing common obstacles related to land and investment laws, and awaiting decisions from state management agencies.

Prosecution proposed for former Chairman and General Director of the Total Belief Corporation

Chairwoman of the Board of Directors of TID – Dang Thi Thanh Ha

|

In the oil and gas sector, the General Director shared that the company focuses on providing fuel that meets emission reduction standards, catering to factories, heavy trucks, and generators. They are also prepared to partner and have the infrastructure in place to install electric vehicle charging stations. Additionally, they are committed to upgrading their gas stations and fuel supply points to modern standards, including energy provision for electric vehicles.

For the agricultural produce sector, the company adopts a “buy and sell immediately” business model to ensure efficiency and avoid inventory costs and logistics expenses.

“The company employs multiple business models, including domestic and export sales. For exports, we prioritize air freight to expedite capital recovery and avoid storage and transportation costs,” said Mr. Tuan.

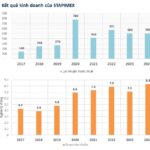

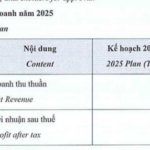

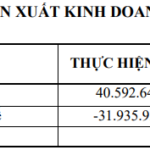

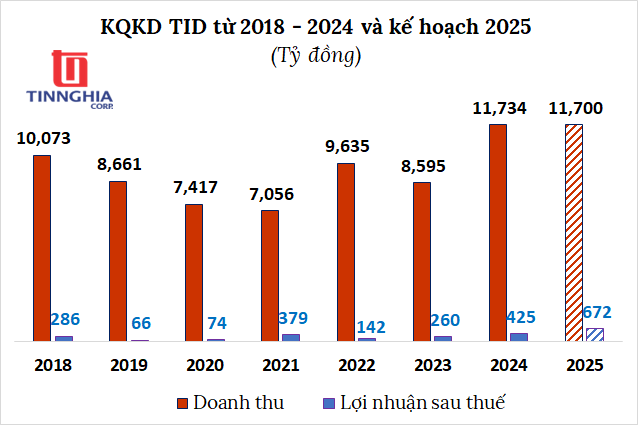

Record-High Profit Plan

The General Meeting approved the business plan with a total revenue of VND 11,700 billion, a 4% decrease compared to the 2024 performance. However, the after-tax profit is expected to reach VND 672 billion, a remarkable 58% increase and the highest profit level in the company’s history. The company also plans to pay dividends for 2024 and 2025 at 11% and 12%, respectively.

In the coffee sector, TID aims to export and sell domestically approximately 70,000 tons, with a revenue of VND 6,300 billion. The coffee price is forecasted to drop to an average of VND 90,000/kg in 2025, down from VND 120,000/kg in 2024. TID also plans to lease out 66.5 hectares of industrial land in 2025.

In the first quarter of the year, TID achieved impressive results with a total revenue of over VND 4,769 billion, a 70% increase compared to the same period last year. The after-tax profit reached nearly VND 309 billion, a more than sevenfold increase and the highest quarterly profit in the company’s history. This outstanding performance is attributed to increased financial revenue from capital transfers and sales on credit, coupled with reduced management expenses. Compared to the yearly plan, TID has already achieved 41% and 46% of the targets, respectively.

Source: VietstockFinance

|

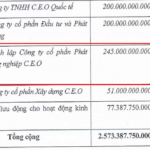

To achieve its goals, Mr. Tuan shared that the company will divest from non-core businesses, focus on its key industries, and optimize capital usage. Additionally, they will enhance debt collection, address provisioning issues, and improve financial efficiency.

Mr. Tuan also noted that both central and local governments are actively reforming administrative procedures to facilitate business growth. This presents an opportunity for Tin Nghia and other private sector entities to thrive and foster linkages between industrial park infrastructure, oil and gas services, logistics, and exports.

The General Meeting also approved the dismissal of three Board members, namely Mr. Tran Hoai Nam, Nguyen Thanh Dat, and Tran Ngoc Tho. In their place, Mr. Nguyen Cao Nhon, Deputy General Director of TID, was elected to the Board of Directors for the 2021-2026 term. Additionally, there were changes in the Supervisory Board, with the dismissal of Mr. Tran Tan Nhat and Nguyen Quoc Ky, and the election of Ms. Le Kim Thao and Ms. Mai Thi Tham Hong.

– 13:19 06/11/2025

The Leading Vietnamese Shrimp Exporter Faces Abnormal High US Tariffs of 35.29%

“This is an unprecedented event; in the 19 years that Vietnam has been involved in the administrative reviews of the anti-dumping lawsuit regarding shrimp exports to the US, no company has ever faced preliminary double-digit tax rates,” said a representative of VASEP.

“LDG Schedules 3rd Annual General Meeting for 2025”

The LDG Group is pleased to announce that it will be holding its 3rd Annual General Meeting of Shareholders for the year 2025 on June 26, 2025. This important event will be conducted virtually, allowing shareholders to participate and engage with the company’s latest developments from the comfort of their homes.

Is Public Investment the Key to Countering Tariff Challenges?

In the face of challenging US trade policies, experts and infrastructure businesses believe that public investment will be the key driver to sustain Vietnam’s economic growth. However, to achieve the desired goals, there is a need to create a ripple effect on private investment, FDI, and consumer spending.

The Pen Is Mightier: Crafting a Compelling Headline

“Chairman of EIN Resigns: A Year of Leadership Cut Short.”

“Mr. Bui Tuan Anh has stepped down from his position as Chairman of the Board of Directors of Electricity Investment – Trading – Service Joint Stock Company (UPCoM: EIN), effective June 5th, citing personal reasons. This development comes ahead of EIN’s upcoming 2025 Annual General Meeting of Shareholders, scheduled for June 11th.”