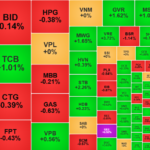

The stocks that caused the market adjustment yesterday have returned to lead the index. VHM took the lead, contributing over 1.8 points to the main index. The VIC, VHM, and VRE trio all saw price increases, with VRE experiencing the highest growth of 3.7%, although its impact on the market was not significant.

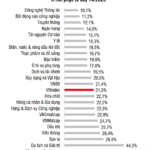

Retail stocks surge with DGW hitting the ceiling price. FRT, MWG, and others lead the market. In their June strategy report, SSI Research suggested that the short-term impact of the campaign against counterfeit and pirated goods will accelerate the shift from traditional to modern trade. Modern drugstore chains and supermarkets are expected to be the main beneficiaries as consumers seek out reliable retailers.

Additionally, SSI Research noted that the removal of the turnover tax for business households with a turnover of over VND 1 billion will increase competition for traditional markets. According to Decree 70, from June 1st, business households must be equipped to issue invoices when selling goods, thereby reducing tax evasion.

Bank stocks have also returned to lead the market, with TCB, STB, VPB, MSB, and HDB among the gainers. Securities stocks witnessed a dominant green trend with VIX, VND, ORS, HCM, and VCI in the green. On the HNX, VFS hit the ceiling price.

Meanwhile, some sectors continued to be polarized, with the oil and gas, construction, and technology sectors dominated by red. Oil and gas stocks like POW, PVS, PVD, BSR, and PLX were in the red.

At the close of the trading session, the VN-Index rose 5.66 points (0.43%) to 1,316 points. The HNX-Index fell 0.09 points (0.04%) to 226.4 points, while the UPCoM-Index remained unchanged at 98.19 points.

Liquidity increased, with the trading value on HoSE exceeding VND 18,280 billion. Foreign investors net bought VND 261 billion, focusing on EIB, VIX, and GEX.

Technical Recovery, But Is the Market Risking a “Bull-Trap”?

The VN-Index continued to be heavily influenced by a few key stocks, with VHM taking center stage today. Investors took advantage of the technical rebound to exit their positions, resulting in a gradual weakening of the market throughout the session. The VN-Index failed to reclaim the 1320-point threshold, while trading volume remained subdued.

Stock Sell Pressure Rises After Strong Recovery: Which Stocks to Pick for June?

“According to the strategic report by SSI Research, there could be increased selling pressure after the market’s strong recovery. The differentiation may continue in June, with cash flow potentially favoring defensive stocks, equities with strong Q2 earnings growth, and those less impacted by tariff-related news.”

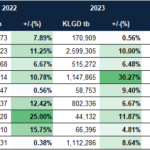

Which Stocks Tend to Rise in the Last Month of a Quarter?

The VN-Index rose by almost 9% in May, and investors are optimistic about its continued growth. However, a look at recent years reveals that declining stocks tend to dominate in June.