In early 2025, authorities intensified their crackdown on counterfeit and fake goods, while also tightening tax regulations to ensure transparency in business operations. The pharmaceutical industry, being an essential sector, was a key focus of these efforts. The Ministry of Health conducted an intensive campaign from May 15 to June 15, 2025, targeting drugs, cosmetics, health supplements, medical devices, and disinfectants and insecticides.

Traditional medicine markets, once bustling hubs for pharmaceutical trade, have recently witnessed a decline in activity with fewer customers. This is largely due to the struggle many businesses face in meeting the new requirements for invoices, documents, and proof of product origin. Additionally, consumers are becoming more cautious, which has significantly reduced foot traffic to traditional pharmacies.

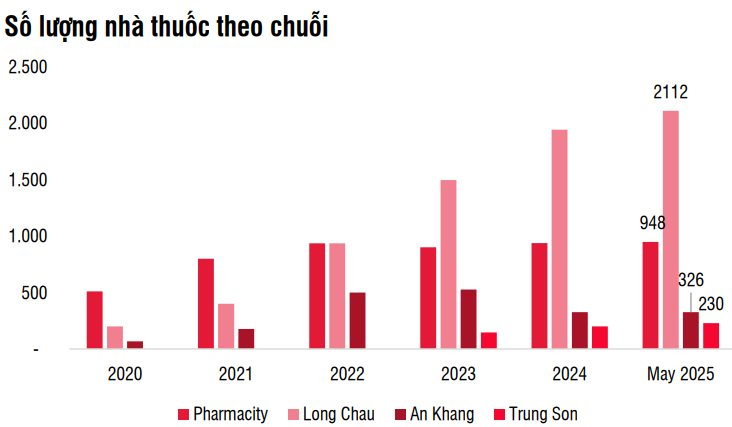

In this context, modern pharmaceutical retail chains have a significant opportunity to expand their market share. With professional management systems, transparent supply chains, and strict adherence to tax regulations, chains like Long Chau, An Khang, and Pharmacity are not only meeting the requirements of regulatory authorities but also building trust with consumers.

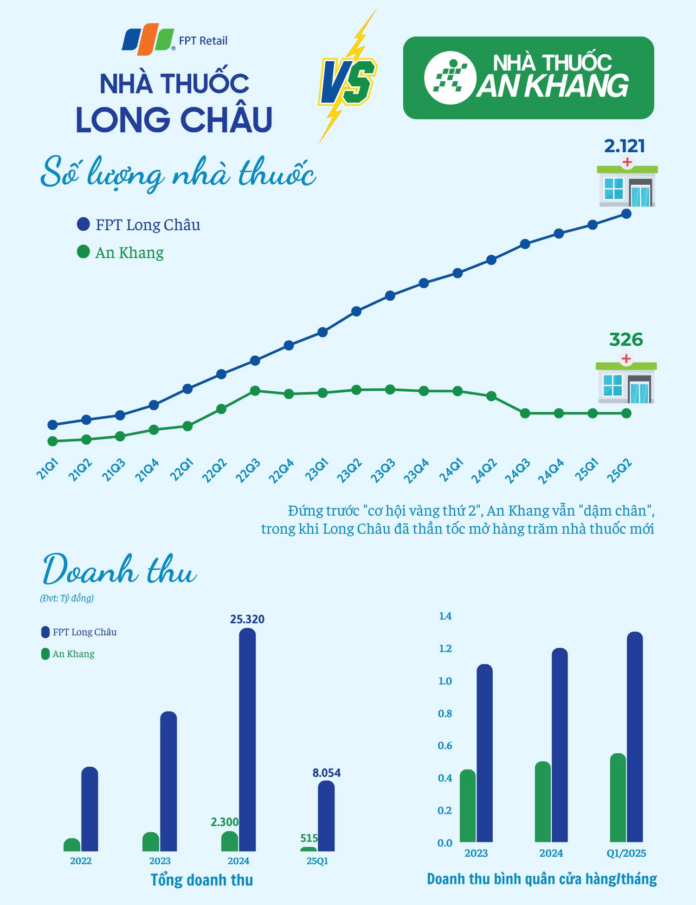

Contrasting responses from two prominent pharmacy chains: Long Chau accelerates, An Khang remains cautious

In a statement made in late May, Mr. Doan Van Hieu Em, CEO of the An Khang pharmacy chain under The Gioi Di Dong (MWG), emphasized that the current context presents a “second golden opportunity” for the pharmaceutical retail industry. The first opportunity arose during the Covid-19 pandemic when there was a surge in demand for health-related products. However, An Khang missed this market boom.

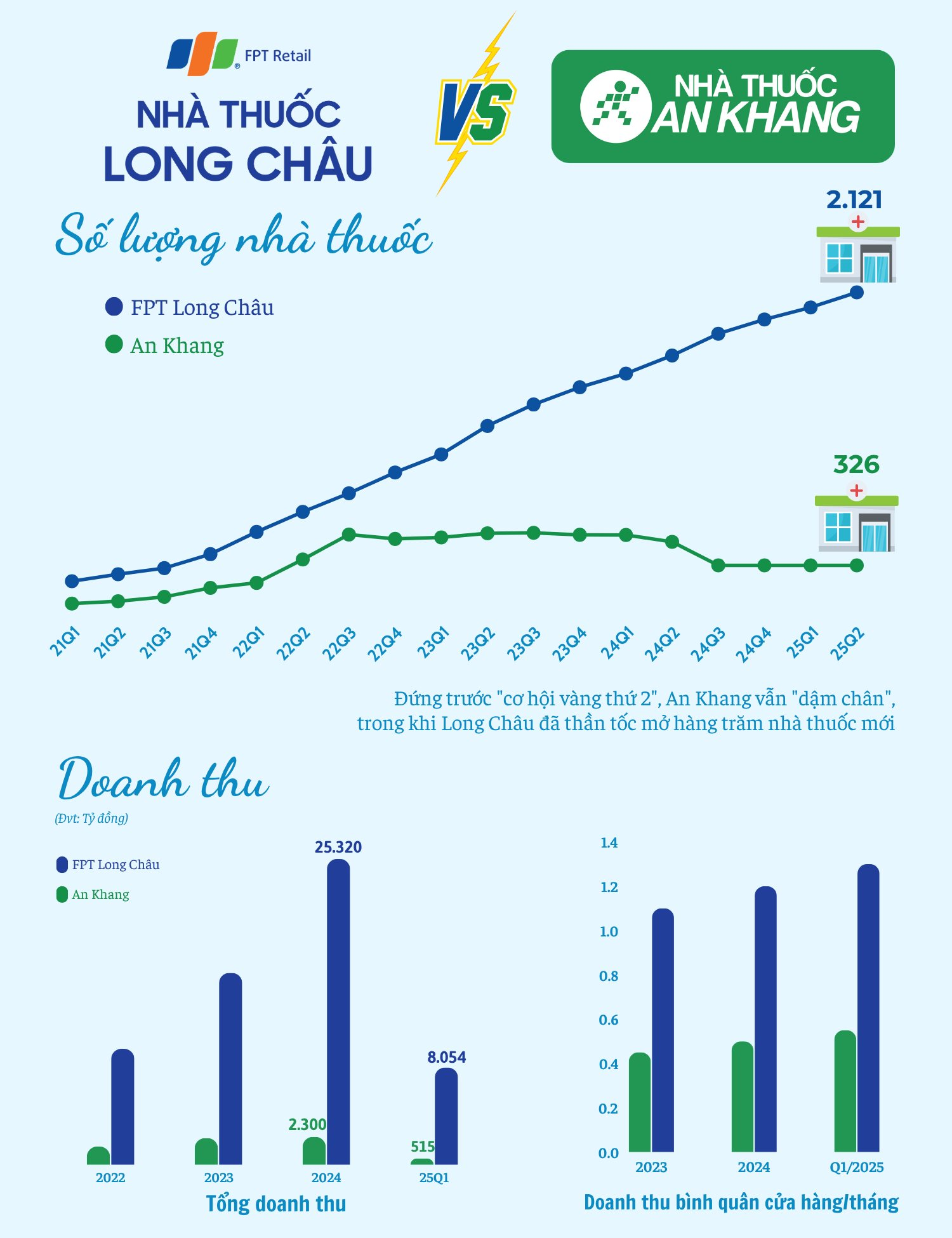

Nevertheless, it hasn’t been easy for all pharmaceutical retail chains to seize this opportunity. Despite Mr. Hieu Em’s assertion that An Khang is waiting for its chance and that the second golden opportunity is presenting itself, the scale of this pharmacy chain has remained stagnant. As of June 10, 2025, An Khang operates 326 stores, the same number it had at the end of 2024. No new pharmacies have been opened in the past six months.

Previously, An Khang surprised the market by completely withdrawing from the Northern market in late 2024. This was part of a “self-restraint” strategy to focus on restructuring and optimizing operating costs after a period of rapid expansion in 2021–2022 that fell short of initial expectations. Their failure to act promptly in the current favorable context may cause them to miss another rare “market moment” – a scenario their own CEO has identified.

In contrast to An Khang’s cautious approach, the FPT Long Chau pharmacy chain is demonstrating ambitious plans to dominate the pharmaceutical retail market. As of June 10, 2025, Long Chau operates 2,121 stores nationwide, an increase of nearly 100 pharmacies since the beginning of the second quarter of 2025. On average, they open 1-2 new stores per day, reflecting their aggressive nationwide expansion strategy.

Long Chau’s strengths lie in their strong focus on customer service and a diverse product portfolio, ranging from prescription drugs to nutritional supplements. In the first quarter of the year, Long Chau achieved impressive revenue of VND 8,054 billion, a 46% increase compared to the same period last year, contributing 69% to the total revenue of FPT Retail. This figure is almost 16 times higher than that of its competitor, An Khang. On average, each Long Chau pharmacy generates VND 1.3 billion in monthly revenue.

For the full year 2025, FPT Long Chau aims to open 430 new stores, including pharmacies and vaccination centers, to further expand its network and solidify its leading position in Vietnam’s pharmaceutical retail industry.

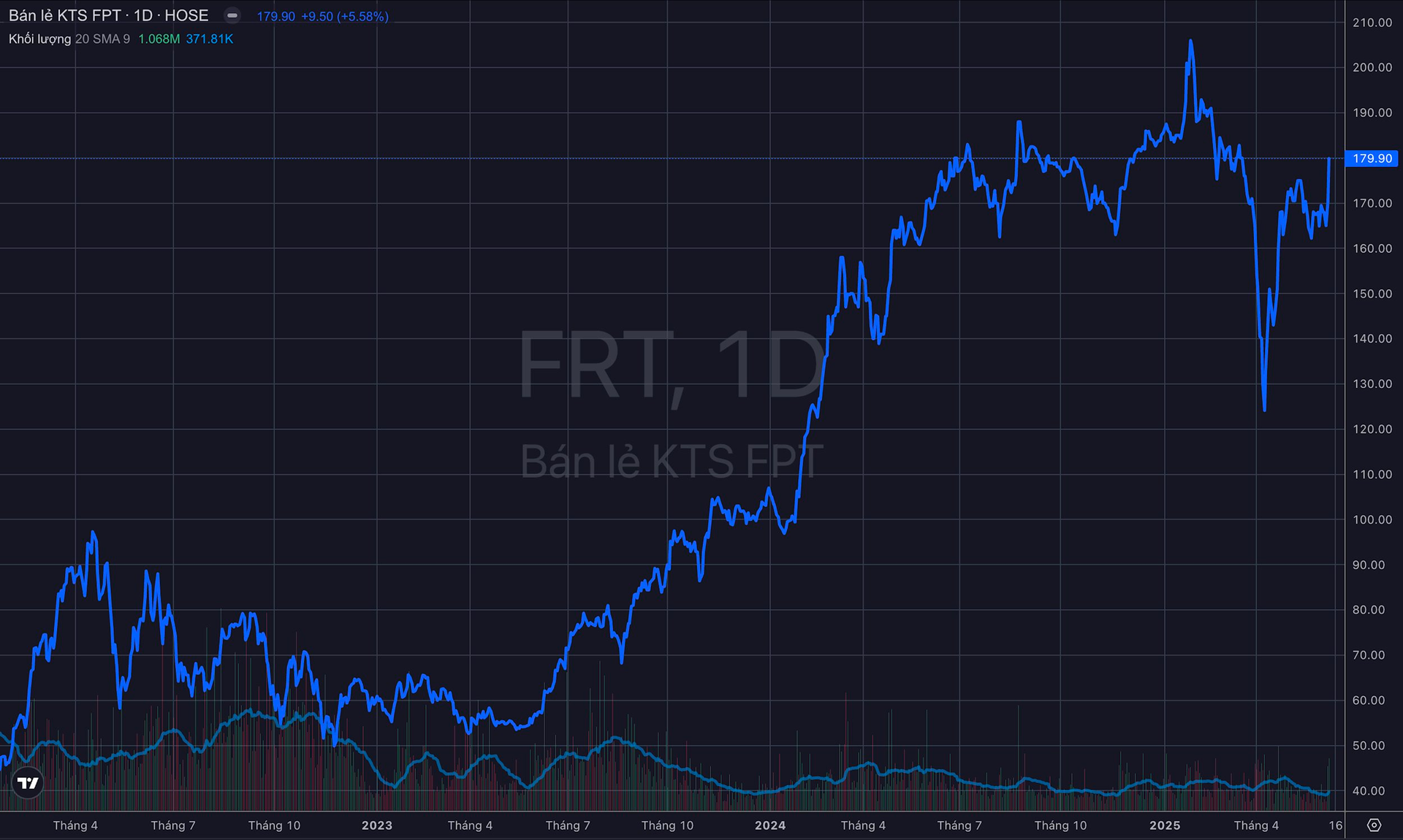

Reacting positively to this news, the share price of FPT Retail, Long Chau’s parent company, has been on an upward trajectory. The market price has surged to VND 179,900 per share, the highest level in the past three months, recovering all losses incurred after a deep correction in early April.

A shock to the traditional market presents an opportunity for modern pharmaceutical retail chains

The battle for market share in Vietnam’s pharmaceutical retail industry is intensifying. While traditional businesses struggle to adapt to new regulations, modern retail chains have a window of opportunity to expand their reach and strengthen their position.

SSI Securities Corporation, in its latest report, stated that the short-term impact of the campaign against counterfeit and fake goods, along with the removal of the flat-rate tax for businesses with a turnover of over VND 1 billion, will accelerate the shift from traditional to modern trade channels. Modern pharmacy chains and supermarkets are expected to be the primary beneficiaries of this transition.

Additionally, policies related to e-commerce platforms are creating a healthier environment for legitimate businesses. According to Law No. 56/2024/QH15, effective from April 1, 2025, e-commerce platforms are required to declare and pay taxes on behalf of individuals doing business on their platforms. As a result, shops selling undeclared imported goods on e-commerce platforms will have to pay higher taxes, narrowing the price gap with tax-compliant enterprises.

Given these conditions, SSI Research believes that modern retail businesses will be able to compete more fairly and won’t have to engage in aggressive price wars. The companies likely to benefit from these changes include The Gioi Di Dong (MWG), FPT Retail (FRT), Digiworld (DGW), and Masan’s (MSN) Winmart chain.

SSI: Established Businesses Like The Gioi Di Dong, FPT Retail, and Masan Benefit from the Crackdown on Counterfeit and Pirated Goods

According to SSI, one of the notable investment themes for June is the stocks of companies that benefit from the crackdown on counterfeit goods.

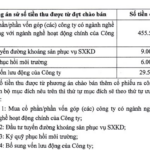

The Mineral Company’s Ambitious Plans: Offering Shares to Acquire Large Reserves with a 581% Upsurge

“Following the distribution of dividends in 2024, Minco will offer a rights issue, providing existing shareholders with the opportunity to purchase additional shares. Specifically, for every 100 shares owned, shareholders will be entitled to buy 581 new shares, representing a substantial increase of up to 581%.”

Xiaomi Expands Presence in Vietnam: Opens 1,000 sqm Office in Ho Chi Minh City’s Center as Smartphone and TV Sales Soar

As per the Xiaomi representative, the new office is a testament to their long-term commitment to the Vietnamese market.