A Month in Review: Markets’ “Breakdown” and the Aftermath of Fear

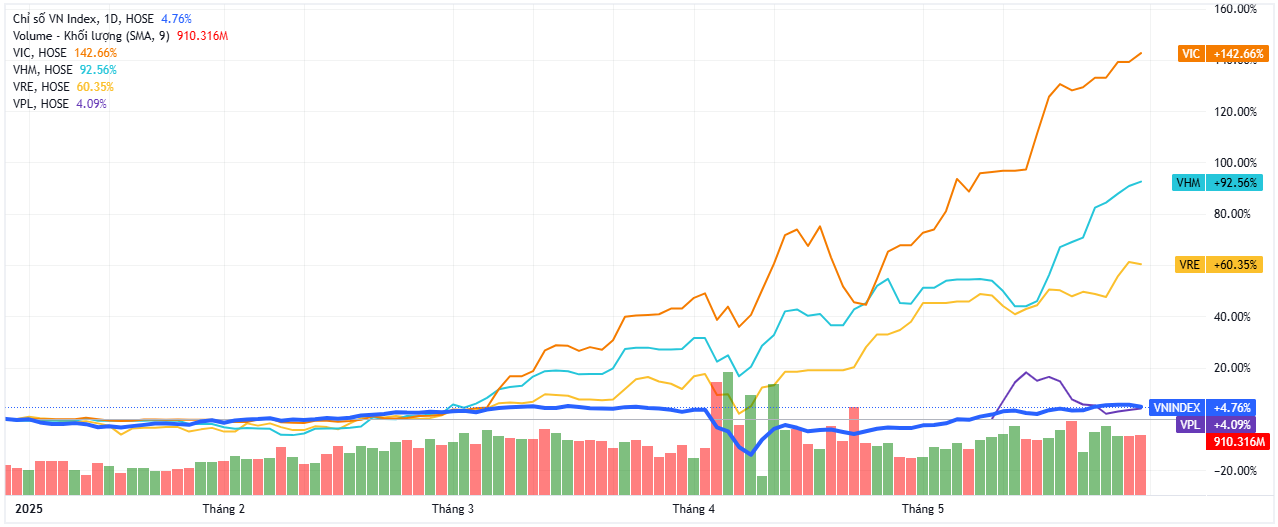

As of late May 2025, the VN-Index had returned to its April starting point with a rapid upward trend, ranking among the world’s best-performing stock markets. However, this sprint masked underlying imbalances.

The index was predominantly propelled by the Vin Group stocks, which witnessed notable surges amid escalating margin loans and persistent foreign capital outflows.

A Wake-up Call?

April 2nd marked a “liberation day,” as President Donald Trump declared retaliatory tariffs imposed by the US on several trading partners, with Vietnam facing tariffs as high as 46%. The Vietnamese stock market took an immediate nosedive, shocked by this unexpected turn of events.

That day served as a wake-up call for investors, dispelling the notion that Vietnam was, is, and will continue to be a significant beneficiary of the trade war.

However, following Trump’s announcement of tariff postponement, the VN-Index fully recovered, surging 21.8% from its April 9th low to the May 30th close. Additionally, Vietnam ranked 6th among the strongest global markets in the past month, climbing 9.4%.

But things didn’t merely revert to their previous state. Over the past month, as tariffs battered the stock market, four stocks, VIC, VHM, VPL, and VRE, moved in the opposite direction, supporting the market.

The “Newly Emerged” Quartet Propels the Market

From April 9th to May 30th, the VN-Index climbed 238.3 points, with the aforementioned quartet contributing a cumulative 35.5% (84.65 points). Furthermore, for the year 2025, this group has contributed 110.9 points, while the VN-Index has risen only 65.8 points.

|

Boom

VIC, VHM, and VRE stocks outperform the market Data as of May 30, 2025. Source: VietstockFinance

|

In this phase, VIC and VHM garnered attention as VinSpeed, a related company, proposed to invest in the $67 billion North-South high-speed rail project. Meanwhile, VPL, Vinpearl’s stock, was listed on the exchange as the market was still reeling from tariff shocks. Vinpearl’s market capitalization immediately equaled that of Hoa Phat Group and MB Bank, surpassing Vinamilk, The Gioi Di Dong, and ACB Bank.

In the last two months, VIC surged nearly 142.7%, VHM rose 92.6%, and VRE climbed 60.4%. However, the tech-stock-like gains of the Vin Group seemed unwelcomed by foreign investors. VIC experienced the most substantial net selling (VND 3.7 trillion) by foreign investors, while VHM (VND 2.6 trillion) ranked third.

Foreigners Sell, Locals Buy

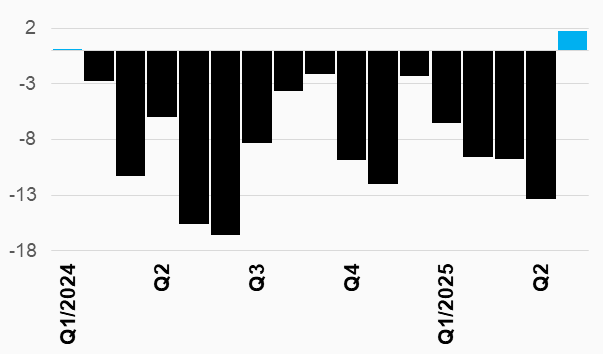

Regarding foreign investors, they resumed net buying in May across the entire market. However, considering the broader context, it’s challenging to be optimistic about this as a long-term signal. This investor group had aggressively sold in April, so May’s net buying could be a partial rebound. Towards the end of May, as stock prices recovered, foreign investors resumed net selling.

|

Heavy Selling, Light Buying

Foreigners net sold up to VND 13.4 trillion in April but only net bought back VND 1.75 trillion in May Unit: VND trillion

Source: VietstockFinance

|

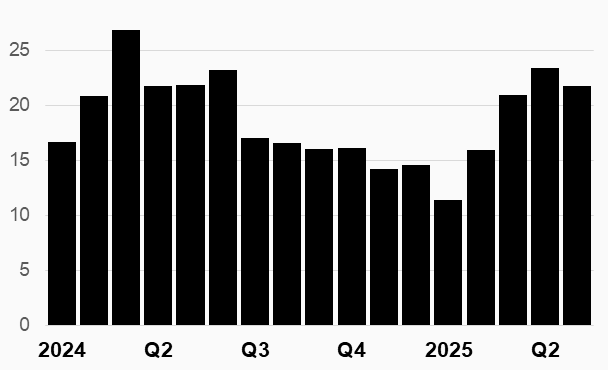

However, domestic individual investors, who dominate daily transactions, hold a contrasting view. Heightened uncertainty and external risks seem to fuel buying sentiment. Daily liquidity on the HOSE remained above VND 21 trillion in the past two months. The number of newly opened securities trading accounts in April 2025 also surged compared to the recent average.

Domestic investors’ confidence remains steadfast, despite significant unknowns regarding the actual progress of domestic reforms, tariff negotiation outcomes with the US, and their practical impact on businesses.

|

Liquidity Remains High

Average daily trading value (per month) on the HOSE remains robust despite heightened risks Unit: VND trillion/session

Source: VietstockFinance

|

Inflating Debt

The 46% tariff shock has temporarily passed, but the market still faces latent risks. One issue that domestic investors tend to overlook is the market’s current leverage level.

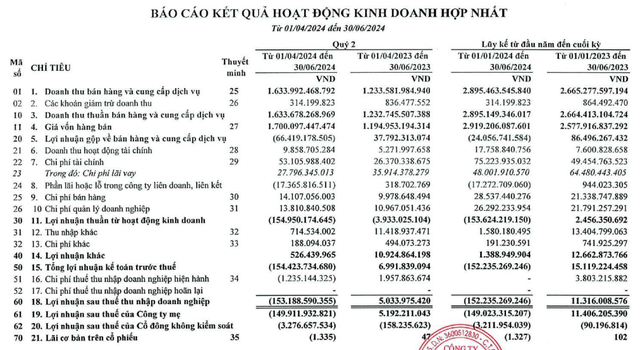

The trend of increasing margin loans from securities companies has persisted in recent years. Risks associated with these debts warrant attention, especially those involving insiders of listed companies.

A wave of forced selling could occur if the market experiences sudden negative fluctuations, as witnessed in early April. Leaders of several companies, including DIC Corp (HOSE: DIG), Nam Viet (HOSE: ANV), and Phat Dat (HOSE: PDR), have been subject to forced selling by securities companies.

We can’t know what would have happened if Trump hadn’t decided to postpone the tariffs or had delayed that decision by a few days.

Nonetheless, the recent volatility serves as a reminder that the risks of financial leverage are not hypothetical but very real. This is especially true in an era marked by frequent shocks due to Trump’s presence in the White House.

When stocks are on an upward trajectory, market participants often become complacent. However, this psychological state, combined with high debt leverage, renders stock prices more vulnerable than ever to fluctuations. It’s crucial to remember that not long ago, before the night of April 2nd, most market participants couldn’t fathom a scenario where the VN-Index would plummet 17% in just four trading days.

– 08:38 12/06/2025

“Stock Recommendations for June: Tapping into Potential with a 33-35% Upside”

The sectors recommended in the May strategic report, including Real Estate, Exports, Oil & Gas, and Retail, are maintaining their positive momentum in the recovery process. Investors are advised to continue holding these stocks and to seize opportunities to increase their holdings when adjustments and positive signals arise.

Market Pulse June 11: VN-Index Caught in Tug-of-War, VGI and CTR Surge Ahead

The market closed with the VN-Index down 1.03 points (-0.08%), settling at 1,315.2; while the HNX-Index dipped 0.17 points (-0.08%), ending at 226.23. It was a mildly positive day for the broader market, with buying interest outpacing selling pressure as 345 tickers advanced against 309 declining names. However, the large-cap universe painted a different picture, with the VN30 basket witnessing a sea of red – 16 tickers declined, 11 advanced, and 3 remained unchanged.

Caution Prevails: A Vietstock Daily Overview for June 12th, 2025

The VN-Index witnessed a slight decline, with trading volume continuing to dip, indicating a clear dominance of cautious sentiment in the market. Without a significant improvement in buying pressure in the upcoming sessions, the index is likely to retest the crucial support level around the 1,300-point mark. At present, the Stochastic Oscillator remains downward-bound after exiting the overbought zone, while MACD consistently widens the gap with the signal line, post its sell signal. These indicators suggest that the risks of a short-term correction persist.

“VPBank Launches Record-Low Interest Rate Promotion at 6.6%”

In the midst of a robust stock market recovery, VPBank Securities slashes margin interest rates to an all-time low of just 6.6%/year. This unprecedented move is accompanied by a host of other attractive offers, including lifetime waiver of trading fees, loyalty points redeemable for gifts upon account opening, and exciting gaming rewards.