Oil Prices Slip

Oil prices retreated after surging over 4% earlier amid concerns that escalating tensions in the Middle East could disrupt supply. Brent crude settled 0.6% lower at $69.36 a barrel, while WTI fell 0.2% to $67.97 a barrel.

The escalating tensions have analysts worried about the potential closure of the Strait of Hormuz, a vital transit route for nearly 20% of global oil supplies. JPMorgan warned that if this scenario unfolds, oil prices could spike to $120–$130 per barrel, although the likelihood is still deemed low.

Meanwhile, the Board of Governors of the IAEA declared for the first time in nearly two decades that Iran has violated its nuclear non-proliferation obligations, raising the possibility of the case being referred to the UN Security Council.

Gold Reaches One-Week High

Spot gold rose 0.9% to $3,383.22 an ounce – its highest since June 5 at 18:08 GMT. Gold futures in the US climbed 1.8% to $3,402.4. The surge was fueled by escalating Middle East tensions and weaker-than-expected US economic data, boosting expectations for a Fed rate cut in September, and possibly a second one in October.

Analyst Peter Grant predicts that if gold surpasses the $3,400 per ounce mark, it is highly likely to reach new highs, with the next resistance levels at $3,417 and $3,431.

Silver prices edged up 0.1% to $36.25 an ounce, nearing its highest since 2012. According to Grant, silver could hit $40 if it surpasses the $38 level, thanks to prolonged supply deficits and positive technical factors.

Platinum climbed 2.8% to $1,291.09 – its highest in over four years, while palladium fell 2% to $1,058.08.

Copper Prices Edge Higher

LME three-month copper rose 0.6% to $9,703 a ton as the US dollar weakened to its lowest in over three years, making the metal more appealing to buyers using other currencies.

However, the demand outlook remains gloomy as manufacturing PMIs in the US, Europe, and China are all contracting, reflecting the negative impact of prolonged trade tensions. Nonetheless, some demand has picked up ahead of US tariff imposition, causing a surge in US copper imports and tightening supply in other markets.

President Trump stated he is open to extending the trade negotiation deadline beyond July 8, but will also be sending out specific terms of new deals to various countries.

COMEX copper in the US increased 0.3% to $4.83 per pound, higher than LME copper by $946 per ton due to the US import probe back in February.

On the supply side, Ivanhoe Mines has resumed underground operations at the Kakula mine (DRC) after an earthquake, but has lowered its production forecast for the year. According to analyst Shah, the copper market could face a supply deficit by year-end.

Among other metals, aluminum rose 0.3% to $2,522 a ton, lead gained 0.4% to $1,995.5, tin ticked up 0.1% to $32,690, while zinc fell 0.4% to $2,643.5 and nickel dropped 0.2% to $15,140.

Iron Ore Prices Slip

Iron ore futures slipped slightly as investors await further developments in US-China trade talks, despite positive signals from President Trump. The September contract on the Dalian Commodity Exchange fell 0.21% to 704 yuan ($98.05) a ton, while the July contract on the Singapore Exchange dropped 0.53% to $94.6 a ton.

A steel mill manager stated that while a deal would reduce export uncertainty, it could also mean less economic stimulus from China.

According to Ge Xin, an analyst at Lange Steel, steel output has declined for two consecutive weeks, indicating weakening demand for raw materials such as iron ore. Coke and coking coal on the Dalian exchange fell 2.79% and 1.77%, respectively.

On the Shanghai Futures Exchange, construction steel dropped 0.7%, hot-rolled coil fell 0.87%, wire rod fell 0.75%, while stainless steel rose 0.48%.

Asian Rice Prices Decline

Rice prices in key Asian markets continued to fall this week due to weak demand and ample supply, with Indian export prices dipping to a two-year low.

In India, 5% broken parboiled rice was offered at $378–$384 per ton, down from $380–$386 per ton last week. The country’s 5% broken white rice was quoted at $372–$377 per ton this week.

As of June 1, the Indian government’s rice reserves (including paddy) reached a record 59.5 million tons, far exceeding the target of 13.5 million tons for July 1.

In Thailand, the 5% broken rice price fell to $398 per ton, compared to $410 per ton last week. Traders attributed the decline to fluctuations in the baht exchange rate and weak demand.

In Vietnam, 5% broken rice was offered at $388 per ton on Thursday, down from $396 per ton last week, according to the Vietnam Food Association (VFA).

“Demand is weak while domestic and international supply is abundant,” said a Ho Chi Minh City-based trader, noting that Vietnam is currently in the middle of its main harvest.

In May, Vietnam exported 784,000 tons of rice, down 9.6% from the same period last year, according to the General Statistics Office.

In Bangladesh, the domestic rice procurement program that started on April 24 is progressing slowly despite the government raising the buying price by 9%. The target is to procure 1.75 million tons of rice and paddy, but the plan is facing obstacles due to higher prices in the free market and inefficient procurement processes. The government is paying 49 taka per kg for parboiled rice and 36 taka per kg for paddy.

Soybeans Hit One-Week Low

US soybean futures dropped to a one-week low amid concerns of weak demand for soybean oil and biofuels, coupled with softer domestic cash prices. The July contract on the Chicago Board of Trade fell 9 cents to $10.41-1/2 per bushel, after touching a low of $10.38-1/2 – the lowest since June 4.

Wheat prices fell 8 cents to $5.26-1/4 a bushel as global exports slowed. Conversely, corn prices rose 2 cents to $4.39 a bushel, supported by a weaker dollar.

The soybean market is under pressure as US soybean crushers are lowering their bids for immediate delivery. Soybean oil prices also fell 1% amid concerns that the EPA will propose new biofuel blending mandates that are lower than industry expectations.

Wheat is impacted by weak global demand, while the USDA lowered its forecast for US wheat stocks but kept its production estimate unchanged. Corn found some support from currency factors.

Japanese Rubber Falls on Stronger Yen

Rubber futures on the Osaka Exchange (OSE) fell 0.67% to 297 yen per kg as the yen strengthened and trade tensions loomed, halting a two-session winning streak.

Analyst Farah Miller of Helixtap in Singapore stated that this reflects a stronger yen and could signal weakening international demand amid falling car sales and an uncertain trade environment.

On the Shanghai Futures Exchange, September 2025 rubber rose slightly by 0.11% to 13,850 yuan per ton, while butadiene rubber climbed 1.12% to 11,285 yuan per ton.

In Thailand, the price of smoked sheet rubber grade 3 rose 1.56% to 77.05 baht per kg, while block rubber increased 2.49% to 62.19 baht per kg.

A government survey showed that business sentiment in Japan weakened in the second quarter – the first decline in five quarters – due to concerns about the impact of US trade policies on exports. Auto and parts makers forecast nearly a 20% drop in profit for the fiscal year 2025.

Oil prices climbed to a two-month high amid Middle East tensions, providing support to natural rubber, which competes with synthetic rubber made from oil.

Raw Sugar Hits Four-Year Low; Coffee, Cocoa Steady

Raw sugar prices on ICE extended their decline to a four-year low as improved supply prospects in Asia and rising output from Brazil weighed on the market. Meanwhile, coffee and cocoa prices held steady.

Sugar

raw fell 0.9% to 16.27 cents per lb, dipping as low as 16.18 cents – the weakest since April 2021. The market sentiment is bearish due to favorable rains in India, Thailand, and China. In Brazil, dry weather in May supported the harvest.

S&P Global predicted that sugar output in the second half of May in Brazil’s main center-south region would increase by 4.7% to 2.84 million tons, while Datagro estimated a 5.8% rise to 2.86 million tons.

Oil prices steadied after surging on Middle East tensions, which could support sugar prices if Brazilian mills shift towards ethanol production.

White sugar fell 1.4% to $466.30 per ton.

Coffee

robusta rose 0.5% to $4,314 per ton after hitting a 9.5-month low last week. Domestic prices in Vietnam fell due to weak trading, while Indonesia faced pressure from robust exports. Arabica fell 0.9% to $3,453 per lb as the harvest in Brazil progressed smoothly. Some Brazilian farmers are experimenting with conilon coffee varieties to adapt to climate change.

Cocoa

London rose 0.3% to £6,367 per ton, while New York cocoa climbed 1.9% to $9,239 per ton.

ADMISI stated that the dry conditions earlier in the year affected the mid-crop, although recent rains could benefit the next crop. However, cocoa arrivals at Ivory Coast ports remain slow, causing concerns.

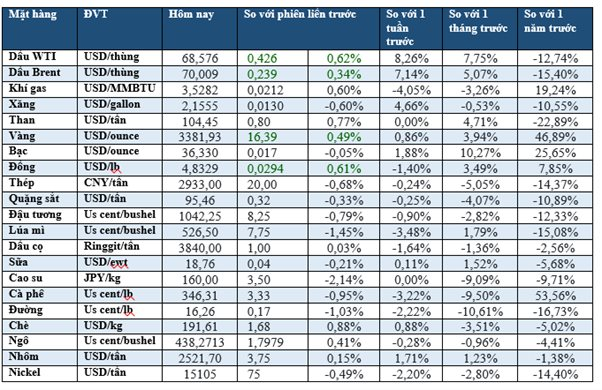

Prices of Key Commodities This Morning

The Price of Gold Surges Following Israel’s Attack on Iran

“Moreover, the latest statistics indicating weaker-than-expected inflation in the US have bolstered the case for a rate cut, providing a boost to gold prices.”

Gold Surges as US CPI Falls Short of Expectations

The demand for gold as a safe-haven asset remains strong, according to analysts. This is due to the unpredictable nature of US trade policies and the escalating geopolitical tensions in the Middle East. Gold has traditionally been seen as a hedge against economic and political uncertainty, and it appears that investors are still seeking this precious metal as a means of protecting their wealth. With the potential for further volatility in the global markets, it seems that gold’s allure as a safe investment is here to stay.

Gold Prices Rise Despite Positive Trade Talks

The ongoing trade tensions between the world’s two largest economies have investors on edge. Analysts believe that until a definitive agreement is reached to reduce tariffs, the demand for gold as a safe-haven asset will remain high.

The Energy Market on June 7: Oil Prices Continue to Surge, Gold Plunges Over 1%

The energy complex continued its upward trajectory on June 6th, with oil prices extending gains. Silver shone brightly, surging to a 13-year high, while platinum reached a 3-year peak. However, gold suffered a sharp decline, dropping over 1%. Raw sugar prices remained subdued, languishing at a 4-year low.