As of the end of May, domestic individual investors had a total of over 10 million accounts, equivalent to 10% of the population, achieving the target ahead of the 2025 deadline.

Speaking at the program “Vietnam and the Indices: Financial Prosperity,” Tran Hoang Son, Market Strategy Director of VPBank Securities Joint Stock Company (VPBankS), shared that while the figure of 10 million is commendable, for a young and emerging market like Vietnam, this number is already in the past.

In the next five years, the expert expects this number to continue to grow strongly, accounting for 15-20% of the population.

” About ten years ago, the number of bank accounts held by residents was also low. As the economy grows and consumption, payment, and investment needs increase, similar to bank accounts, the number of securities accounts will advance rapidly and go even further,” Mr. Son pointed out.

Statistics from 2016 to the present show that during normal market periods with moderate economic growth and no significant shocks, the number of new account openings is very low, averaging only 10-20,000 accounts. However, due to the COVID pandemic, which forced investors to stay at home, the number of accounts surged in 2020 through 2022.

In recent years, when the market hit bottom and rebounded, the number of securities accounts also increased rapidly, such as in 2023 and the period from January to August 2024. When market opportunities arise, there are more new account openings. In 2025 alone, after April, the number of new accounts has been rising rapidly. According to the VPBankS expert, many investors are spotting opportunities after the market dips in April 2025.

This year, Vietnam successfully implemented KRX, and there are expectations for an upgrade by the end of the year. If the upgrade is achieved, billions of dollars could flow into the market, causing the index to surge. Therefore, the milestone of 10 million accounts may continue to rise in the coming months if trade negotiations improve and the economy maintains its growth trajectory.

The June-July correction phase is a reasonable time to buy

In terms of strategy, Mr. Son suggests that if investors hold stocks in an uptrend, have positive news, and exhibit upward chart patterns, they should consider holding onto them for the entire year and refrain from frequent trading. This approach helps investors mitigate the impact of market noise. In the past period, some investors noted that forgetting about their stocks in April could have resulted in significant account growth. The April crash forced many investors to sell even their strong holdings. Now, many quality stocks have rebounded and reached new highs.

For short-term investors with a time horizon of two weeks to one month, the 1,350-point region holds many uncertainties and fluctuations. Therefore, if your short-term portfolio is profitable, Mr. Son recommends taking profits in the 1,340-1,350-point range. If the market corrects to the 1,280-1,300-point zone, investors can consider buying back to hold for the year-end rallies.

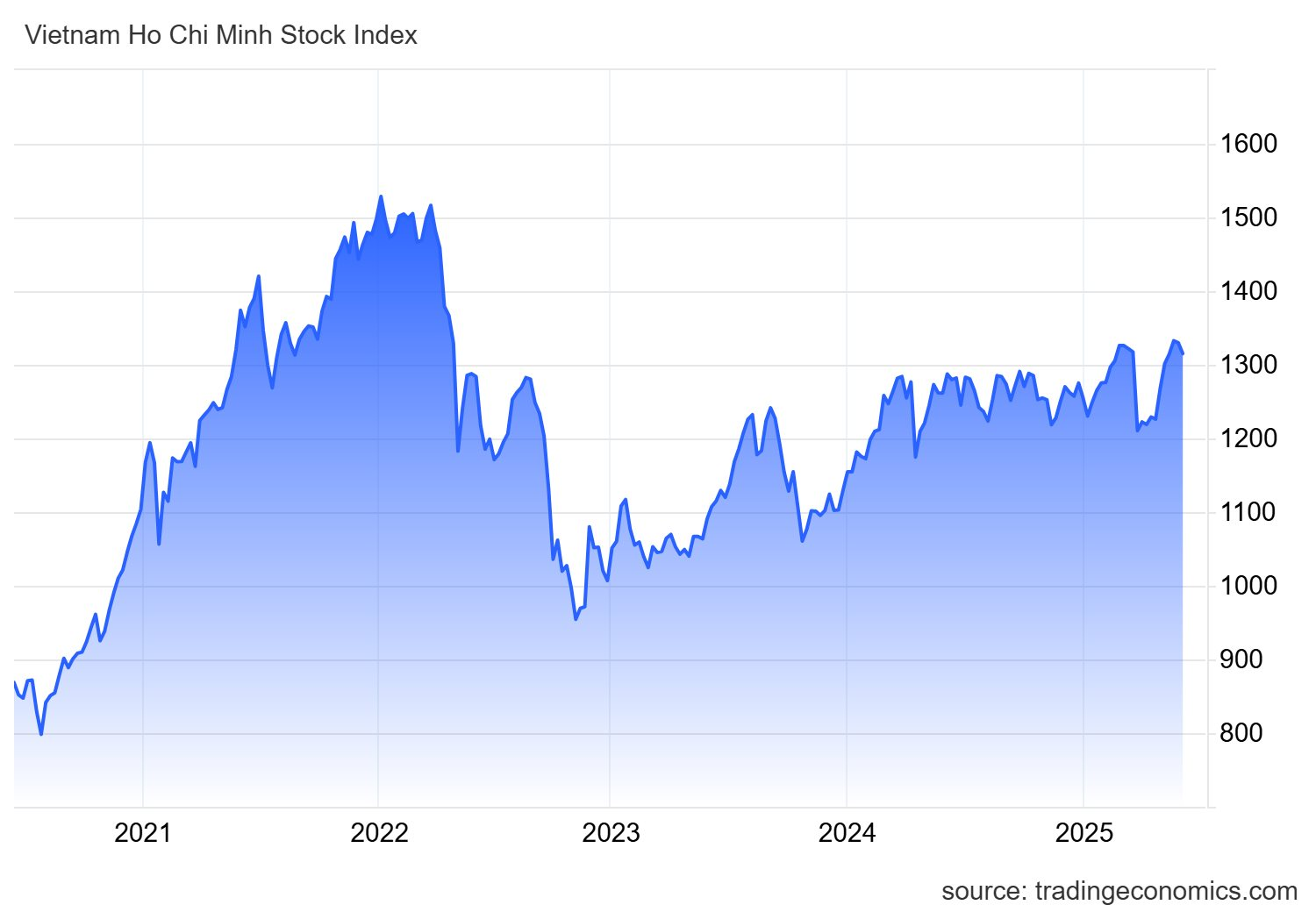

Looking at the monthly chart of the VN-Index, the market is in a very tight sideways state, awaiting breakout moves upward. This pattern has repeated for the third time, similar to the phases of 2004-2005 and 2014-2015.

Currently, the market is going through a pivotal phase. The candlestick charts show tight fluctuations around the 1,200-1,300-point range. On the positive side, during the recovery wave in May, the VN-Index surpassed the fluctuation zone at the upper bound and is now in the 1,300-1,350-point range. The resistance level of the past two years has been broken. The expected corrections in June and July will be opportune moments to enter the market, as there are not many concerning factors.

Considering the weekly chart, the VN-Index faces resistance at 1,350-1,380 points and is showing a downward trend. Therefore, if profits have been made, investors may consider taking profits and then waiting for a market correction to switch to potential stocks for the next wave, with more reasonable buying points.

The VPBankS expert is optimistic about the groups of stocks that will lead the next phase. “If a correction occurs at the end of June or beginning of July amid noisy information, I still expect a recovery and economic growth story, focusing on financial-banking, undervalued real estate, and consumer retail stocks,” said Mr. Son.

Stock Market Outlook for June 13: Will Bank Stocks Continue to Lead the Charge?

The trading session on June 12 ended on a positive note, with the banking sector stocks leading the market higher. This performance has sparked hopes for a continuation of this bullish trend in the next session.

Middle East Tensions: Impact on the Vietnamese Stock Market

The stock market in Vietnam witnessed a decline today (June 13th), mirroring trends across the region amidst Israel’s attack on Iran. The VN-Index fell by over 7 points, despite a valiant effort by oil and gas stocks, along with select banking sector equities, to steer the market in a positive direction.

The Powerhouse Industries: Banking and Oil to the Rescue, Yet Stocks Suffer

The Middle East tensions erupted suddenly before the domestic market opened, causing a significant impact. While the VN-Index was propped up by some large-cap stocks, a deep sell-off occurred across hundreds of stocks. The index closed slightly lower, down 0.57%, but 107 stocks fell by more than 2%, not to mention nearly 70 others that declined between 1% and 2%, or on the HNX.