The State Bank of Vietnam has announced a draft amendment to Decree 24 on managing gold trading activities, aiming to abolish the monopoly on gold bar production and gold material imports. Instead, the governing body will control the market through annual quota allocation and import licenses for gold bars and raw gold issued to qualified credit institutions and enterprises.

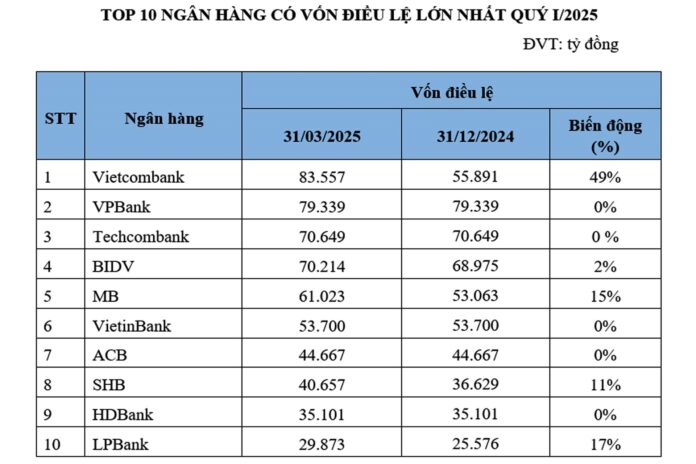

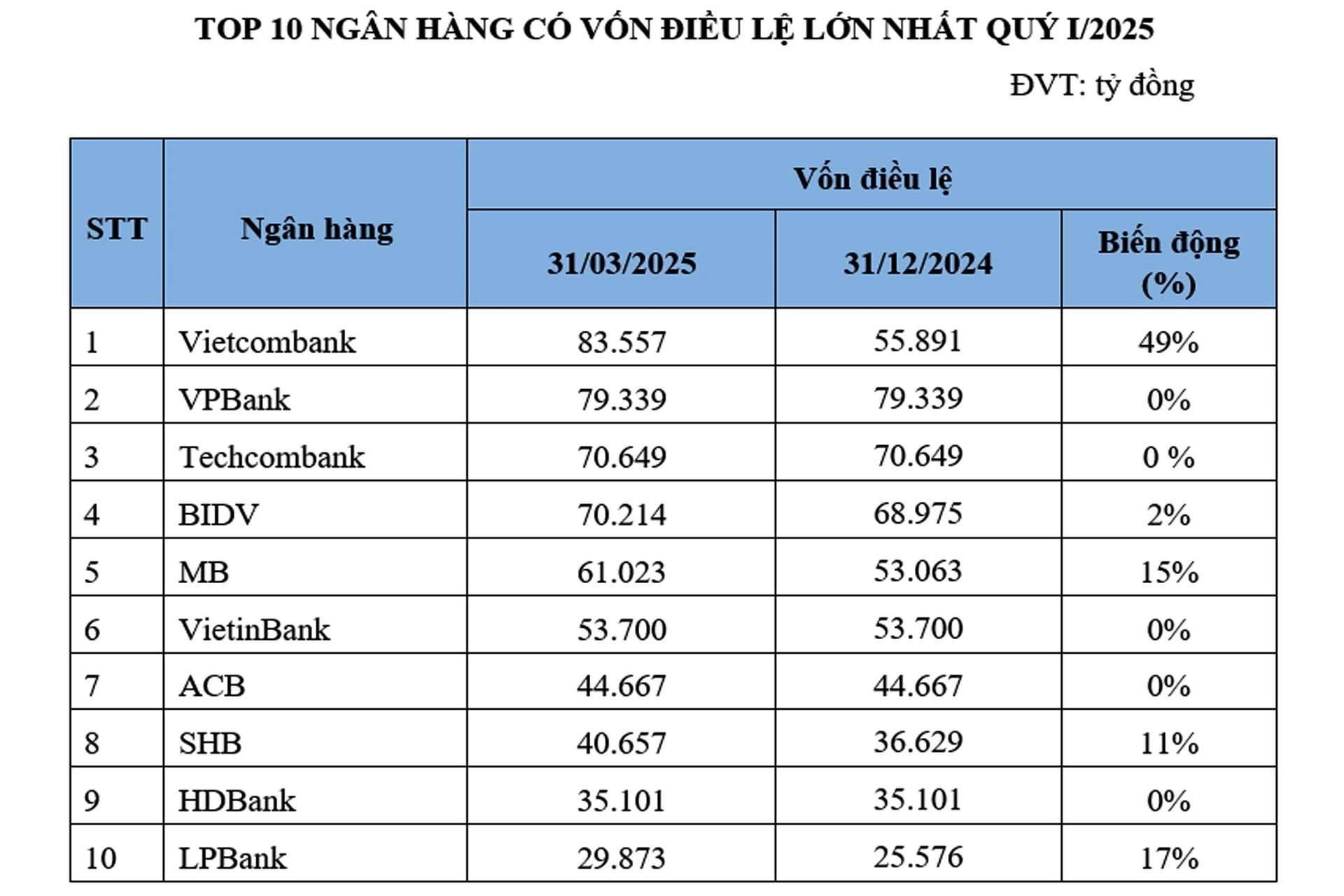

According to the proposed amendments to Decree 24, enterprises seeking a gold bar production license must have a minimum charter capital of VND 1,000 billion, while banks must have a minimum charter capital of VND 50,000 billion. Additionally, these entities must be on the list of entities licensed by the State Bank of Vietnam to trade in precious metals, and they must not have any violations or have rectified any past violations. They should also have internal regulations governing gold bar production.

Currently, 38 enterprises and banks are licensed to trade in gold bars. However, considering the current charter capital scale, only a few enterprises have a charter capital of VND 1,000 billion or more, such as PNJ, DOJI, and SJC.

Regarding banks, Vietcombank, VPBank, Techcombank, BIDV, MB, VietinBank, and Agribank fall into the group with a charter capital of over VND 50,000 billion.

Source: Financial and Monetary Market

The draft also outlines the responsibilities of credit institutions and enterprises engaged in gold bar production, including:

They are only permitted to produce gold bars that meet the specified standards.

They must announce the applicable standards, weight, and fineness of their products as per legal requirements and be accountable for ensuring that the weight and fineness of their produced goods align with the declared standards.

They bear full responsibility for the gold bars they manufacture and provide product warranties to customers as mandated by law.

They are tasked with constructing an information system that ensures the comprehensive and accurate storage of data pertaining to gold bar production. This system should facilitate data provision to authorized entities as stipulated by relevant laws.

They must adhere to the provisions outlined in this Decree and other pertinent legal documents.

The draft also delineates the responsibilities of credit institutions and enterprises granted gold export and import licenses. Specifically:

Enterprises and credit institutions are only permitted to import gold bars and raw gold from manufacturers certified by the London Bullion Market Association (LBMA)

They must announce the applicable standards, weight, and fineness of imported gold bars and raw gold. They are legally accountable for ensuring that the weight and fineness of the imported products align with the declared standards.

They are responsible for constructing and reporting to the State Bank of Vietnam their internal regulations regarding gold export and import, as well as safety measures pertaining to these activities.

They must establish internal regulations for the sale of raw gold, ensuring transparency and disclosing relevant information, including the rights and obligations of customers.

Moreover, enterprises and credit institutions can only utilize imported gold bars and raw gold for the following purposes: gold bar production, gold jewelry and artwork production, sales to enterprises or credit institutions licensed for gold bar production, and sales to enterprises certified for gold jewelry and artwork production.

The Golden Opportunity: Profiting from the Unprecedented Bullion Boom

This morning (September 23rd), gold ring prices soared to an all-time high of 80.55 million VND per tael. As a result, those who invested in gold rings since the beginning of the year have enjoyed impressive returns, with profits exceeding 25% – a level not seen in recent years.

Setting the Gold Market Free

The State Bank has continued its sale of SJC gold bars through four state-owned banks and the Saigon Jewelry Company (SJC) for the past month. Despite this, citizens are still finding it challenging to purchase either gold bars or gold rings during this period. With the SJC company refusing to buy gold with only one SJC stamp and the mandatory declaration of buyer and seller information for gold transactions, there are concerns that the gold market is being tightly controlled.

Gold Domestic and Global Price Discrepancy Adjustment: Competitive Bidding or Gold Imports?

The relentless surge in global gold prices has caused a hike in domestic SJC gold prices. According to experts, in addition to the State Bank of Vietnam (SBV) preparing to auction SJC gold, the bank must also authorize new gold imports to adjust the difference between domestic and international gold prices.

How to manage gold when prices are “jumping”?

There are conflicting opinions regarding the amendment of Decree 24 on the management of the gold market amidst the continuous rise in the price of SJC gold and gold rings.