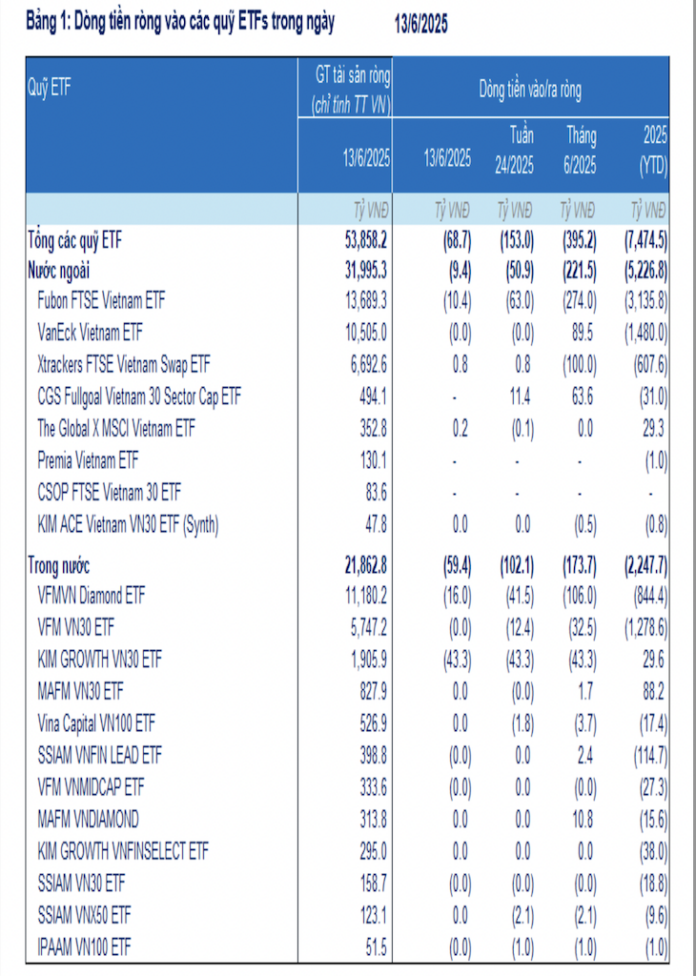

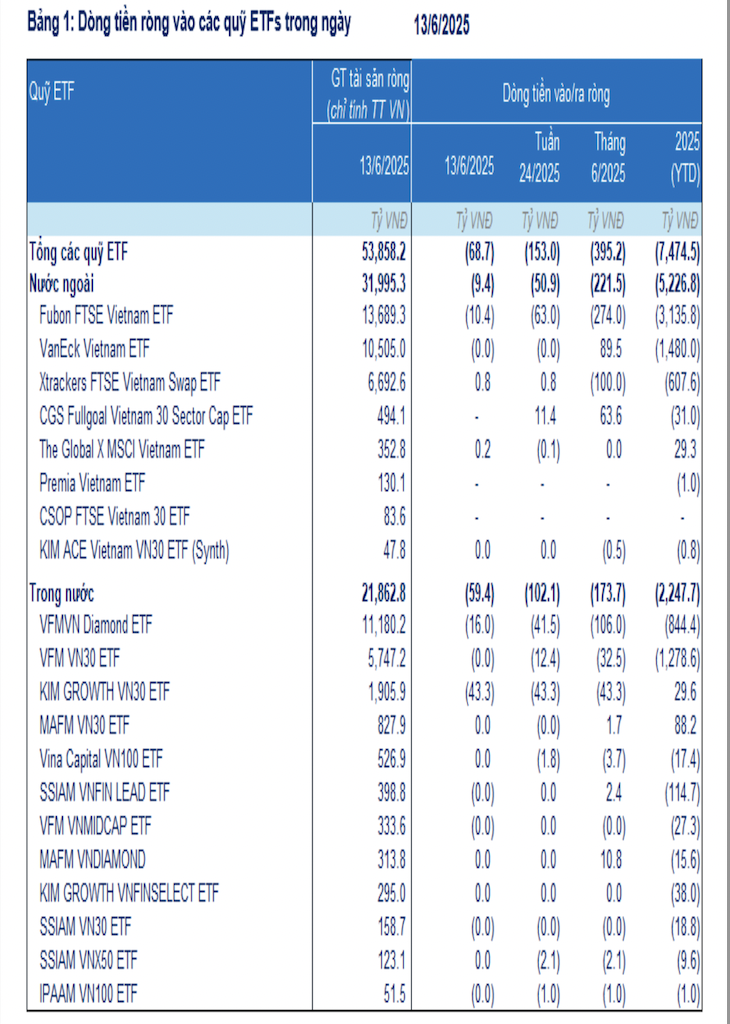

For the week of June 9-13, 2025, ETFs investing in the Vietnamese stock market experienced net outflows of over VND 142 billion. However, the value of net outflows decreased for the third consecutive week.

Specifically, outflows occurred in 11 out of 20 funds, mainly in the foreign fund Fubon FTSE Vietnam ETF. Foreign ETFs recorded outflows of more than VND 40 billion, concentrated in the Fubon FTSE Vietnam ETF (-VND 52.6 billion). In contrast, the CGS Fullgoal Vietnam 30 ETF attracted net inflows of over VND 11 billion.

Domestic ETFs continued to face net outflows of more than VND 102 billion, mainly from the Kim Growth VN30 ETF (-VND 43.3 billion). Similarly, two funds managed by Dragon Capital, the VFM VNDiamond ETF and the VFM VN30 ETF, also experienced net outflows of over VND 41 billion and VND 12 billion, respectively.

Regarding Thai investment through depository receipts (DRs): Thai investors sold a net of 500,000 DRs in the VFM VNDiamond ETF (code: FUEVFVND01), equivalent to nearly VND 16 billion.

In June 2025, ETFs recorded net outflows of over VND 395 billion, bringing the total net outflows since the beginning of 2025 to more than VND 7,400 billion (lower than in 2024 – VND 21,800 billion).

As of June 13, 2025, the total net asset value of ETFs (only considering allocations to the Vietnamese market) stood at VND 53,800 billion, a 6% decrease compared to the end of 2024. The top stocks sold by funds from June 9-13, 2025, were VIC, HPG, TCB, ACB, VHM, and VCB (see Table 2).

On June 16, 2025: The Fubon FTSE Vietnam ETF witnessed no significant money flow changes. Meanwhile, the VFM VNDiamond ETF and the VEM VN30 ETF experienced net outflows of over VND 26 billion and VND 2 billion, respectively.

The Vietnam Stock Market Surges Ahead in Asia Despite Middle East Tensions

The Vietnamese stock market has just witnessed its strongest rally in over two months, dating back to April 11th.

“AgriS Proposes 100% Foreign Ownership to Shareholders, Accelerating International Partnerships”

The Ho Chi Minh City Stock Exchange-listed company, Thanh Thanh Cong – Bien Hoa Joint Stock Company (AgriS), is seeking shareholder approval for its strategic initiatives. With the Vietnamese stock market on the cusp of a potential upgrade, AgriS (HOSE: SBT) is poised to expand its international cooperation and seize new opportunities.

“VPBank Launches Record-Low Interest Rate Promotion at 6.6%”

In the midst of a robust stock market recovery, VPBank Securities slashes margin interest rates to an all-time low of just 6.6%/year. This unprecedented move is accompanied by a host of other attractive offers, including lifetime waiver of trading fees, loyalty points redeemable for gifts upon account opening, and exciting gaming rewards.