Vietnam’s stock market experienced a volatile expiry of derivatives contracts. The VN-Index dipped into the red before rebounding towards the end of the trading session on June 19th. At the close, the VN-Index gained 5.21 points to reach 1,352.04 points, the highest level since the beginning of this year. However, liquidity fell short compared to the previous session, with the matching value on HoSE reaching only VND16,220 billion.

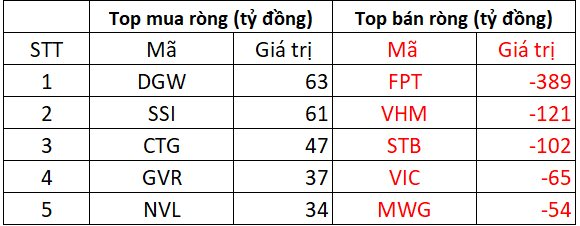

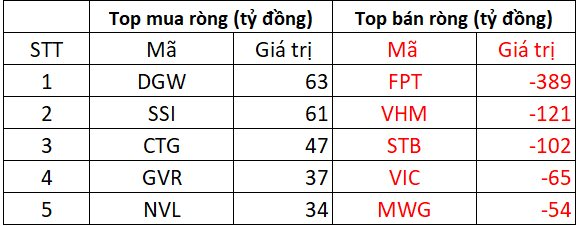

In terms of foreign investors’ activities, they net sold strongly up to VND 901 billion in this session. Specifically:

Foreign investors net sold over VND 893 billion on HoSE

In the selling side, FPT shares were net sold the most with a value of VND 389 billion. Following were VHM and STB, which were also net sold strongly with a value of over VND 100 billion each. Additionally, VIC and MWG were net sold VND 65 billion and VND 54 billion, respectively.

On the opposite side, DGW and SSI were the most net bought stocks in the market, with a value of more than VND 60 billion each. CTG, GVR, and NVL also witnessed net buying in the range of VND 34 to VND 47 billion per stock.

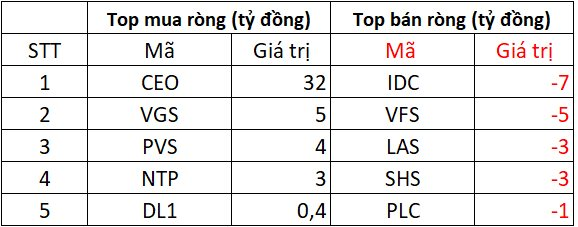

On the HNX, foreign investors net bought over VND 22 billion

In terms of net buying on the HNX, CEO shares led with a net buying value of about VND 32 billion, followed by VGS, PVS, and NTP, which were also net bought by foreign investors in this session with a value of about VND 3-5 billion each.

Conversely, IDC shares were “dumped” by about VND 7 billion. Other stocks such as VFS, LAS, SHS, and PLC were also net sold by a few billion VND each.

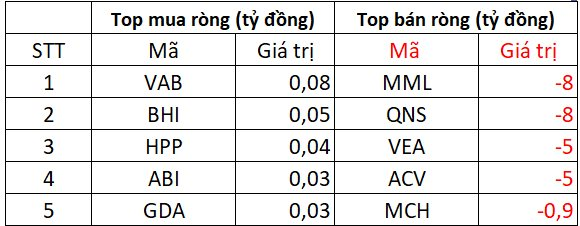

On the UPCoM, foreign investors net sold approximately VND 30 billion

In terms of net buying, VAB, BHI, HPP, ABI, and GDA witnessed net buying, but the values were insignificant, only a few dozen million VND each.

Conversely, MML and QNS were net sold by VND 8 billion each, while VEA and ACV were net sold by VND 5 billion each.

Stock Market Update for Week of June 16-20, 2025: Navigating Volatility Around the 1,350-point Threshold

The VN-Index witnessed a slight decline, failing to sustain the 1,350-point mark in the week’s final session. The index’s candlestick chart displayed a series of long shadows, indicating investor hesitation around previous peak levels. With foreign investors’ net selling trend likely to persist, the short-term upward trajectory may encounter challenges, as evident from the below-average trading volume maintained over the past 20 days.

The Stock That Brokerages Suddenly Sold en Masse: A 700 Billion Surprise

The domestic securities companies turned net sellers on the Ho Chi Minh Stock Exchange (HoSE), offloading a total of VND466 billion ($20.1 million) worth of shares.

Market Pulse June 20: Foreign Investors’ Surprise Sell-Off of VIC, VN-Index Stuck in the Red

At the market close, the VN-Index witnessed a decline of 2.69 points (-0.2%), settling at 1,349.35, while the HNX-Index dipped 0.49 points (-0.22%) to 227.07. The market breadth tilted towards decliners, with 377 tickers in the red versus 337 in the green. However, the large-cap universe painted a slightly different picture, as 16 stocks in the VN30 basket advanced, outpacing 12 decliners, while 2 remained unchanged.

Market Beat on June 20: Banks Strive to Keep VN-Index Above 1,350 Mark

The intense tug-of-war continues, with major indices taking a breather mid-session below reference levels. The VN-Index strives to hold onto the 1,350-point mark, while the HNX-Index pauses at 227.15 points. A growing number of decliners were observed, with 335 falling issues versus 306 advancing ones in the morning session.

“Technical Analysis for June 20: A Prevailing Pessimism”

The VN-Index and HNX-Index both opened lower, with increased trading volume in the morning session, indicating a prevailing sense of pessimism among investors.