Illustrative image

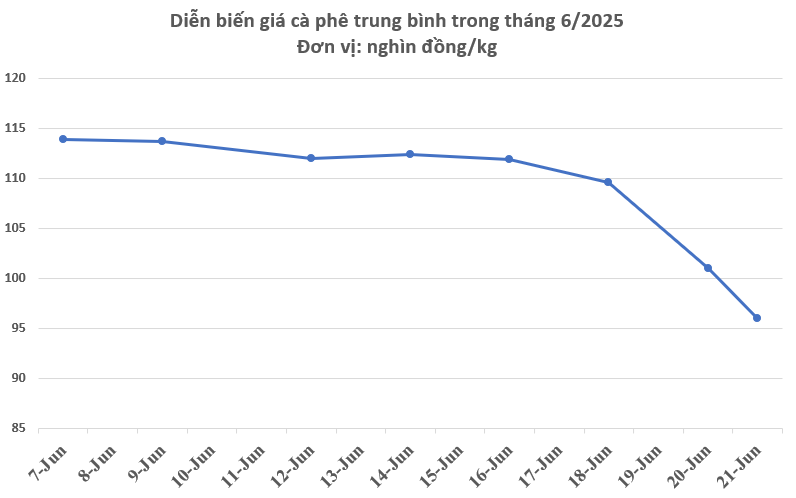

According to data from giacaphe.com, as of June 21, 2025, coffee prices in the key growing regions of the Central Highlands (Dak Lak, Lam Dong, Gia Lai, Dak Nong, and Kon Tum) averaged 96,000 VND/kg, a significant drop of 5,000 VND from the previous day and a decrease of up to 16,000 VND from the previous week.

Compared to the peak of 135,000 VND in March, the decrease is nearly 30%.

In the global market, September-delivery arabica coffee settled at 315.05 cents, while robusta coffee closed at $3,737 per ton, a steep decline of $550 per ton from the previous week’s close, marking the most substantial drop in the eight consecutive weeks of losses.

The ongoing coffee harvest in Brazil is exerting downward pressure on market prices. Safras & Mercado reported last week that Brazil’s 2025/26 coffee harvest had reached 35% completion. Recent rainfall in Brazil has eased drought concerns and is contributing to the downward pressure on coffee prices. Meteorologist Somar Meteorologia recently indicated that the coffee-growing region of Minas Gerais received 10.6 mm of rainfall in the week ending June 14, equivalent to 131% of the historical average for this time of year.

In addition to the situation in Brazil, aggressive selling by speculators following the period of high prices is exerting significant pressure on robusta and arabica coffee prices on the London and New York exchanges. The strengthening US dollar has made dollar-denominated commodities like coffee more expensive, reducing demand. Global geopolitical tensions have also led to a withdrawal of funds from the commodities market.

According to experts, escalating conflicts are driving up crude oil prices, making commodities like robusta, arabica, and cocoa less attractive. Since the beginning of the year, trading returns on the cocoa exchange have decreased by 27%, robusta by 19.5%, and arabica by 1.5%.

Certified robusta coffee stocks held by the London exchange were reported to have decreased by 3,333 bags as of June 18, 2025, falling to 859,500 bags stored in consumer countries in the northern hemisphere. Meanwhile, arabica stocks stood at 861,143 bags.

“Trading activities are currently sluggish as many anticipate further price drops. Due to escalating global tensions, everyone is trading cautiously,” said a trader based in the coffee-growing region. Another trader from the same area commented that the current weather conditions are favorable for the crop, with sufficient rainfall.

Why is China Cracking Down on ‘Pig Fattening’ and Aiming for ‘Slim’ Pigs?

Amid the volatile pork market and excess supply, the Chinese government is clamping down on speculative ‘re-fattening’ of pigs to reduce feed waste, stabilize prices, and protect small-scale farmers.

“The Rising Cost of Real Estate: Unraveling the Mystery”

The Government requires an urgent review to identify the factors contributing to the rise in real estate prices, including land prices, material costs, and interest rates. It is imperative to devise strategies to mitigate these price-driving factors, enhance accessibility, and boost supply to address this pressing issue.