Viettel Consulting and Services JSC (code: VTK) recently announced that July 4 will be the record date for the 2024 cash dividend payment, with a ratio of 15% (1 share will receive VND 1,500). The expected payment date is July 15.

With nearly 9.4 million shares outstanding, VTK is estimated to spend approximately VND 14.1 billion on dividend payments to shareholders. The company’s parent company, Viettel Military Industry and Telecom Group (Viettel), currently holds 63.84% of the capital and will receive nearly VND 9 billion for this payment.

The company maintained a consistent dividend payout ratio of 15% in cash from 2018 to 2021, which decreased to 10% in 2022, along with an 8.8% stock dividend. In 2023 and 2024, VTK returned to its familiar cash dividend policy, both at a rate of 15%.

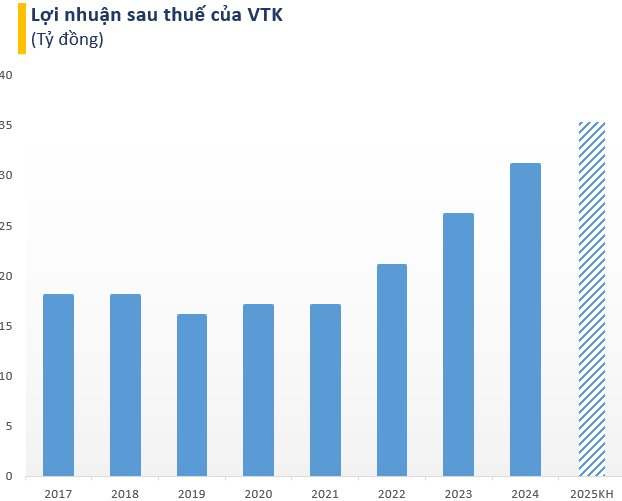

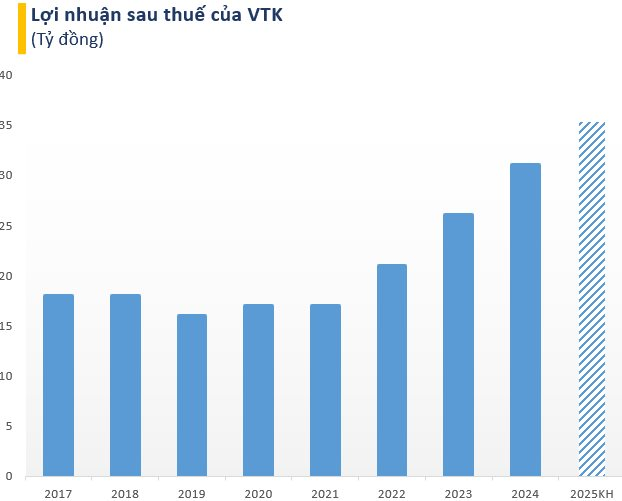

VTK’s vibrant business performance enables it to maintain its dividend policy for shareholders. In 2024, the company achieved a record profit of nearly VND 31 billion, up nearly 18% over the same period last year. Notably, this is the third consecutive year of profit growth.

In 2025, the company continues to aim for the highest profit in its operating history, exceeding VND 35 billion, up 15% compared to the 2024 performance. The AGM also approved the plan to maintain a 15% cash dividend payout.

VTK stated that Vietnam is actively developing its telecommunications infrastructure and implementing supportive policies, including critical projects such as the development of the 5G network, the construction of smart cities/industrial parks, and high-tech data center infrastructure. These initiatives create new markets and growth opportunities, especially in infrastructure and 5G technology equipment.

This presents VTK with work opportunities in areas such as survey and design, infrastructure solutions, and telecommunication and information technology equipment testing, standardization, and compliance.

The management shared that the company would continue investing in infrastructure to strengthen its 4G network and develop a new 5G network for domestic and overseas markets. Additionally, they will implement a project to fortify the network infrastructure to withstand high-level natural disasters like super typhoons in Vietnam. This is an opportunity for VTK to assert its capabilities and take a significant step forward in its business operations.

“MIC Announces 10% Dividend Payout for 2024”

Military Insurance Company (MIC) is proud to announce its planned dividend distribution for the year 2024. The company intends to share its success with its valued shareholders through a dividend payout comprising a healthy mix of cash and stock. This planned dividend distribution strategy includes a 5% cash dividend and a 5% stock dividend, with the payout expected to take place in the third quarter of 2025. This approach showcases MIC’s commitment to rewarding investors while also strengthening its capital structure for continued growth and stability.

“Ricons Postpones IPO Again, Eyes Expansion in Infrastructure Construction”

The leadership team at the Construction Investment Joint Stock Company, Ricons, expresses optimism about growth prospects and opportunities arising from significant infrastructure projects. However, they remain cautious about the real estate industry’s liquidity situation. The contractor has also deferred its IPO plans until market conditions improve.