Three Economic Growth Scenarios

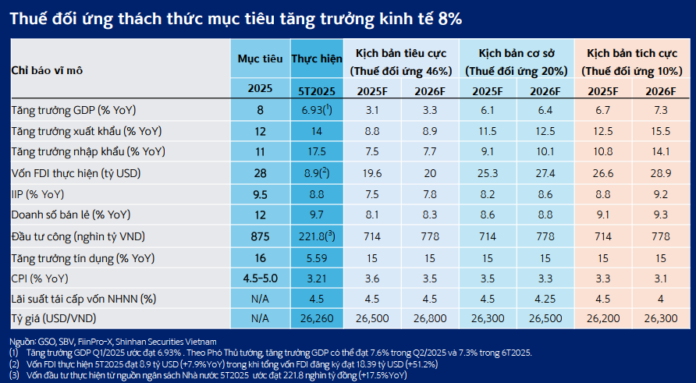

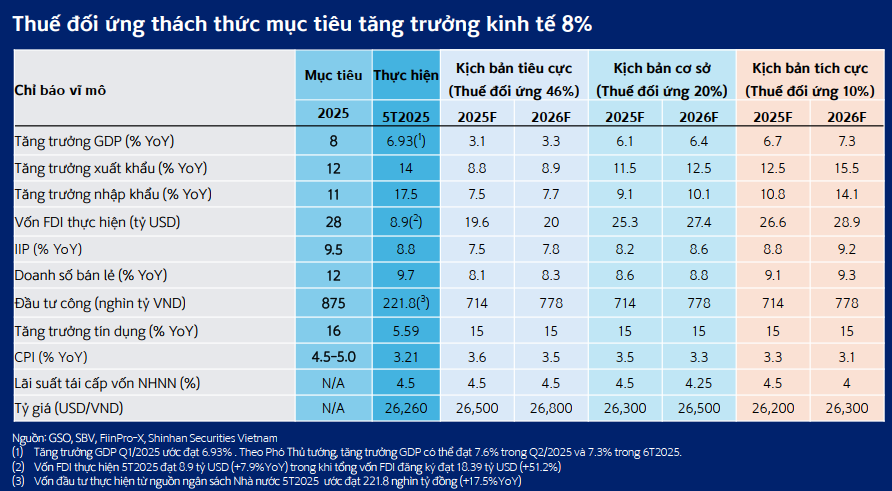

Consolidating the impact of retaliatory tariffs on exports and FDI, Ms. Ly presented three economic growth scenarios for 2025, corresponding to the level of retaliatory tariffs that Vietnam could agree to. However, the negative scenario with an initial retaliatory tariff rate of 46% is unlikely, and it is more likely to achieve a tariff rate of 20-25% in the base scenario and 10-15% in the positive scenario.

In 2025, the government sets a growth target of over 8%, and to achieve this target, the public investment budget has been adjusted to increase by 38% compared to the implementation in 2024. The credit growth target for the whole economy has also been raised to 16% to create room for economic expansion, and the inflation target has been accordingly increased to 4.5-5%.

Regardless of the scenario, Ms. Ly believes that the government will be determined to promote the disbursement of public investment capital to support economic growth. Tariff levels only directly affect exports and FDI, thereby affecting production and consumption.

It is expected that in the next few days, Vietnam will reach an agreement with the US after three rounds of negotiations before the 90-day deadline ends.

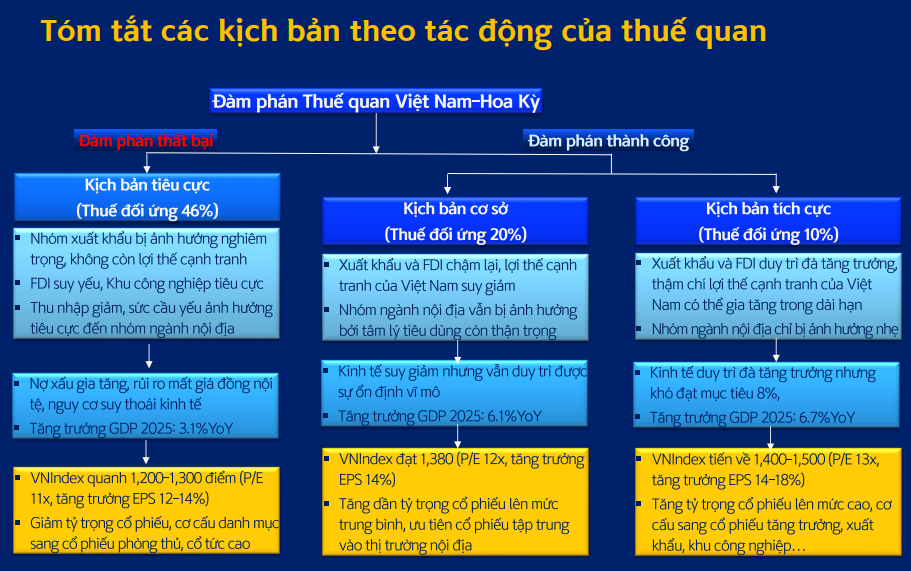

If the negotiations fail, the tariff rate will remain at 46%. Exports and FDI are severely affected when there is no competitive advantage, weak consumption affects domestic industries, bad debts increase, the currency depreciates, the economy faces the risk of recession, and investors need to act immediately to increase the proportion of safe-haven assets while reducing the proportion of stocks, restructuring portfolios towards defense, and high dividends. In this scenario, the VN-Index could fall back to the 1,200-point region.

If the negotiations are successful, the tariff rate could be agreed at 20-25% (base scenario) and 10-15% (positive scenario). Exports, FDI, and domestic consumption will be slightly affected but will maintain their growth momentum. However, economic growth is expected to reach only 6-7% on average, and the 8% growth target will be challenging to achieve as global economic instability remains unpredictable.

The market may have reflected the base scenario as the VN-Index is approaching the reasonable price region of 2025 around 1,380 points and can conquer higher milestones of 1,400-1,500 points in the positive scenario.

“Investors can gradually reduce the proportion of safe-haven assets and increase the proportion of stocks in these two scenarios. Industries focusing on the domestic market are recommended in the base scenario as the 20-25% tariff rate will still pose challenges for exports. However, it is suggested to restructure portfolios towards growth stocks, technology, exports, and industrial zones in the positive scenario because we believe that a tariff rate of 10-15%, which could be lower than or equal to Vietnam’s direct competitors in exports and FDI attraction, can help us gain a competitive advantage in the long term”, added Ms. Ly.

The trade war may have just begun, and flexibility in adaptation is necessary in the current period to maintain business operations and defend against the risk of asset depreciation.

Source: SSV

|

The “Fab Four” to Propel Vietnam’s Take-off

Despite facing global instability, the government remains determined to act with the “Fab Four” pillars, which are considered policies that will help Vietnam take off, including (1) breakthroughs in technology; (2) proactive international integration; (3) promoting private economic development; and finally, (4) a transparent institution to materialize these pillars.

In the short term, there will be technological breakthroughs in the financial sector with the sandbox model for fintech in credit rating, Open APIs, peer-to-peer lending, and the pilot of a digital asset exchange and an international financial center in Ho Chi Minh City.

Additionally, a wave of strong private corporations with the ambition to compete globally, boost industrial growth, exports, and technological advancement, forms the backbone for the country’s development. This opens up countless investment and business opportunities in Vietnam’s new era.

– 08:20 26/06/2025

Accelerating the Implementation of the HCMC – Can Tho Railway Investment Project

“The My Thuan Project Management Unit has released its inaugural report on the highly anticipated Ho Chi Minh City-Can Tho railway development plan. This comprehensive report unveils exciting insights into the strategic vision for this transformative transportation project, which promises to revolutionize travel between these two vibrant cities. With meticulous planning and innovative engineering at its core, this initiative is poised to become a landmark achievement, connecting communities and driving economic growth. Stay tuned as we delve into the fascinating details of this ambitious undertaking.”

The Power of Persuasive Language: Crafting Compelling Titles

“Reimagining Resource Allocation: Vital Resolutions for Progress in Thanh Hoa”

On June 24, 2025, the Thanh Hoa Provincial People’s Council of the XVIIIth tenure convened its 30th meeting to deliberate and pass several crucial and urgent resolutions. These resolutions are intended to provide the legal framework for the organization and operation of the new two-tier local government model, which has been implemented following the reorganization of administrative units at various levels.

“Customs Dialogue Conference 2025: Tan Cang Saigon Supports Businesses.”

On June 20, 2025, the Regional Customs Bureau No. 5 of Bac Ninh province hosted the 1st Customs-Business Dialogue of 2025, in collaboration with the Saigon New Port Corporation.

“Tax Reform Proposal: Vice Prime Minister Ho Duc Phoc Suggests Tax Registration for Small Businesses and Traders with Revenue Below VND 1 Billion”

The Ministry of Finance should conduct a thorough study to advise the relevant authorities on tax regulation policies. This includes proposing a tax threshold based on taxable revenue, which would benefit impoverished households and small businesses, ultimately ensuring a robust and equitable civil society.