Fertilizer and Chemical Stocks: Middle East Tensions Ease

The last trading sessions of June 2025 witnessed a noticeable cooling of tensions in the Middle East. News of a ceasefire between Iran and Israel helped soothe the market, causing crude oil and urea prices to reverse their upward trend.

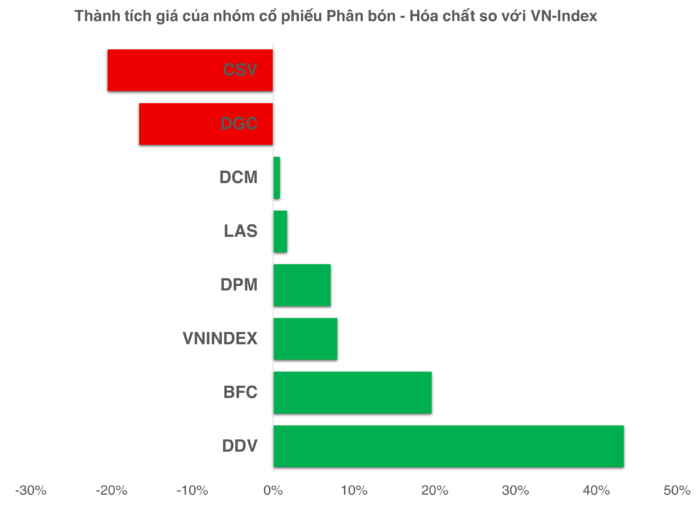

Despite the lack of strong support from geopolitical factors, fertilizer and chemical stocks displayed considerable price resilience. As of the close of trading on June 25, many stocks in this sector continued to record positive growth. The most notable performer was DAP – Vinachem (DDV), with a year-to-date increase of 43.4%, followed by Binh Dien Fertilizer Joint Stock Company (BFC) with a 19.6% gain.

Some other stocks posted more modest gains, including PetroVietnam Fertilizer and Chemical Corporation (DPM) with a 7% increase, Lam Thao Fertilisers and Chemicals Joint Stock Company (LAS) with a 1.7% rise, and Ca Mau Fertilizer Joint Stock Company (DCM) up by 0.8%. These stocks are currently underperforming the VN-Index, which has risen 7.9% since the beginning of the year.

As of the close of trading on June 25, 2025

|

On the other hand, stocks of Duc Giang Chemical Joint Stock Company (DGC) and Southern Basic Chemicals Joint Stock Company (CSV) have witnessed significant declines since the beginning of the year, falling by 16.6% and 20.5%, respectively.

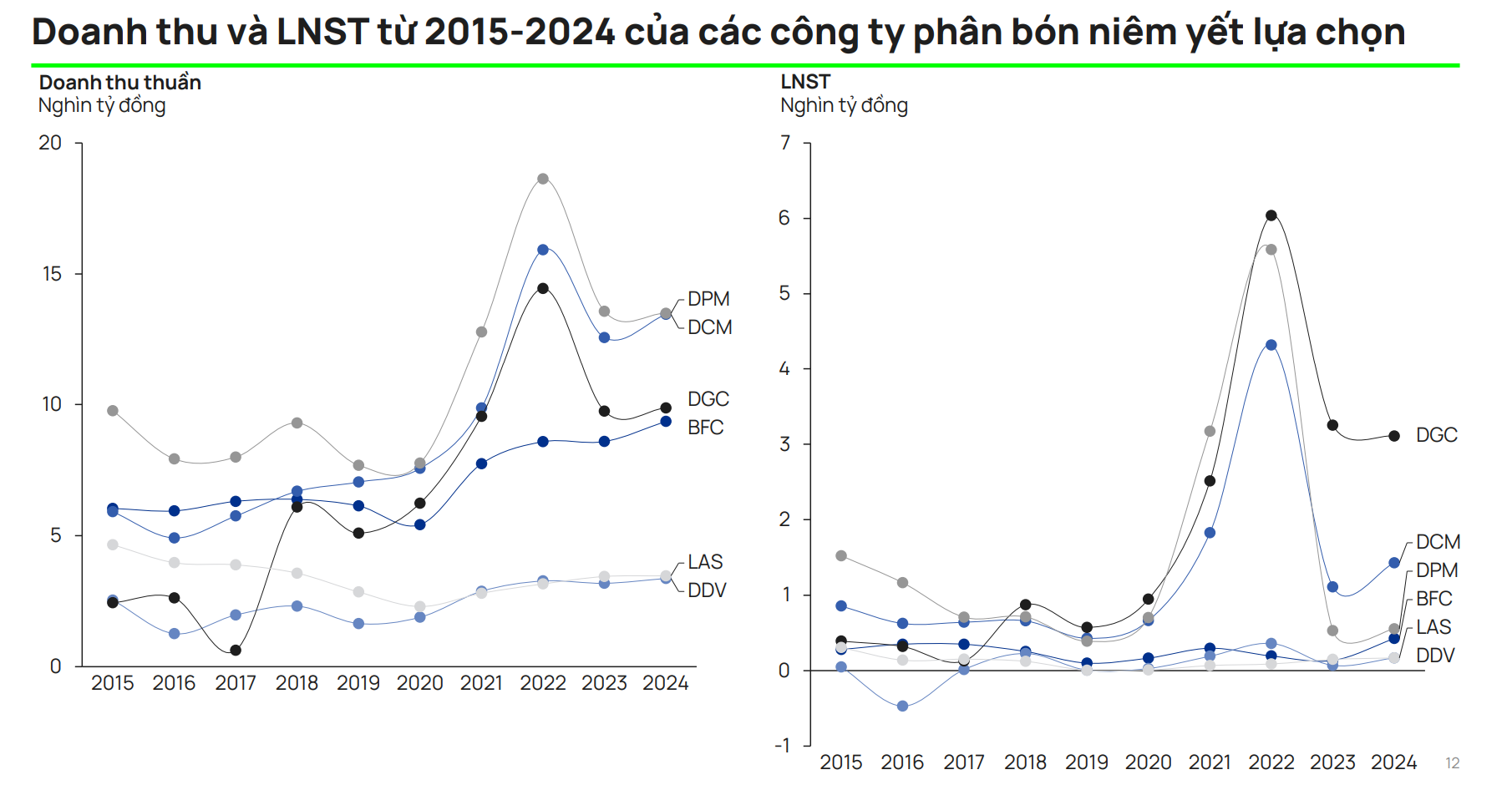

However, it is important to recognize that both DGC and CSV had experienced two consecutive years of price increases prior to this decline and had reached record highs in 2024. In contrast, DCM and LAS have maintained a three-year streak of price increases.

Aside from DGC and CSV, most of the remaining stocks categorized as fertilizer and chemical stocks have been on a long-term upward trend, despite various macroeconomic fluctuations domestically and internationally. This resilience is something that the leading stocks in the oil and gas sector, such as PetroVietnam Drilling and Well Services Corporation (PVD), PetroVietnam Transportation Corporation (PVT), and PetroVietnam Technical Services Corporation (PVS), have not been able to sustain as of the close of trading on June 25.

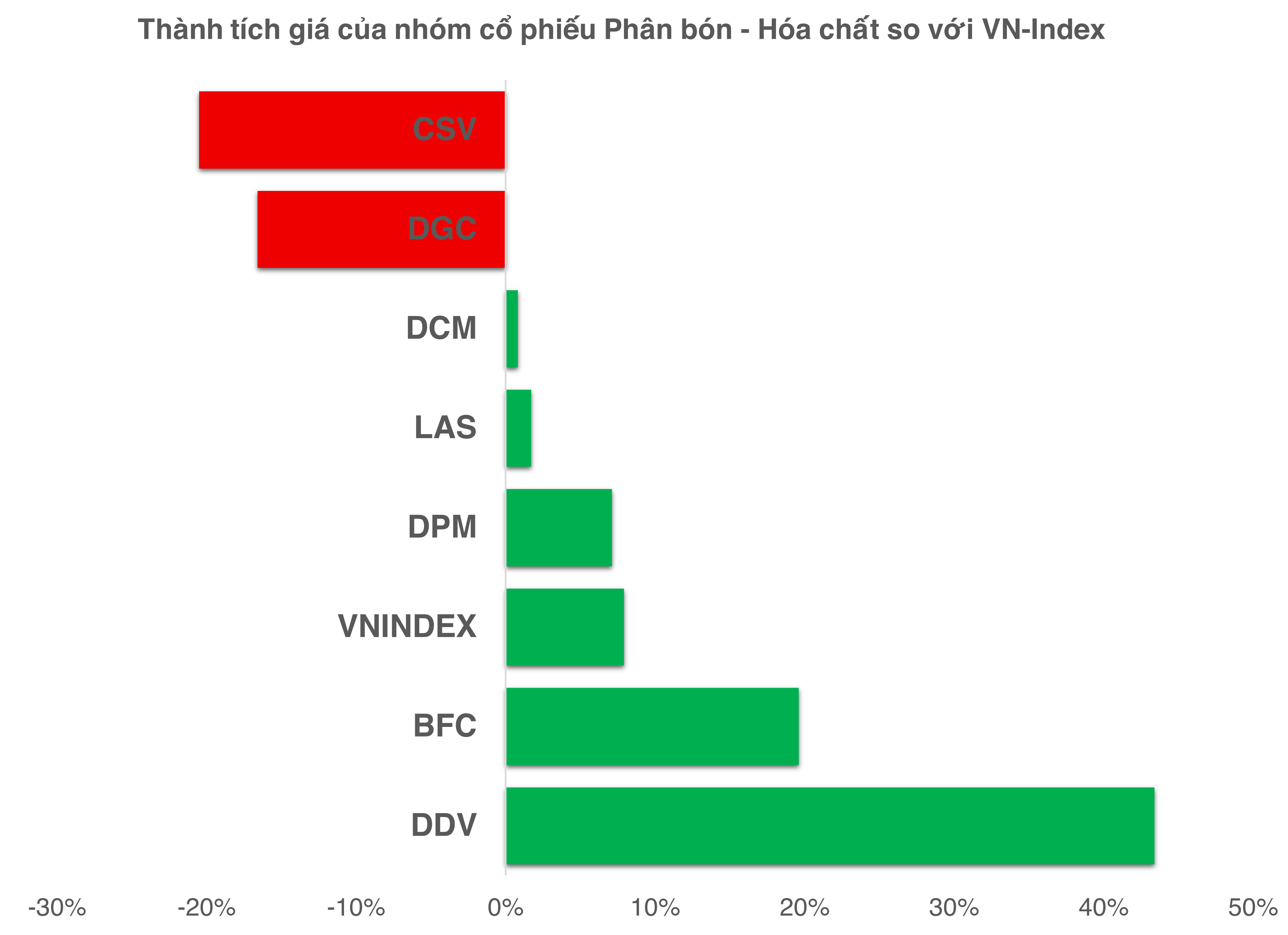

While oil prices are no longer a prominent driving force, the market is currently reflecting expectations about a more fundamental factor – value-added tax (VAT) policies. Starting July 1, 2025, the fertilizer industry will officially be subject to a 5% VAT on output, instead of being exempt from VAT as before. This change is anticipated to bring about a turning point in the cost structure and profitability of fertilizer businesses, especially for companies with a high proportion of taxable raw materials and those that have not been able to deduct input tax previously.

Business Prospects for Companies

Although the new tax policy will only come into effect from July, securities companies have already made positive profit forecasts for fertilizer and chemical stocks, indicating that the market has taken a proactive approach in pricing these stocks according to their growth prospects.

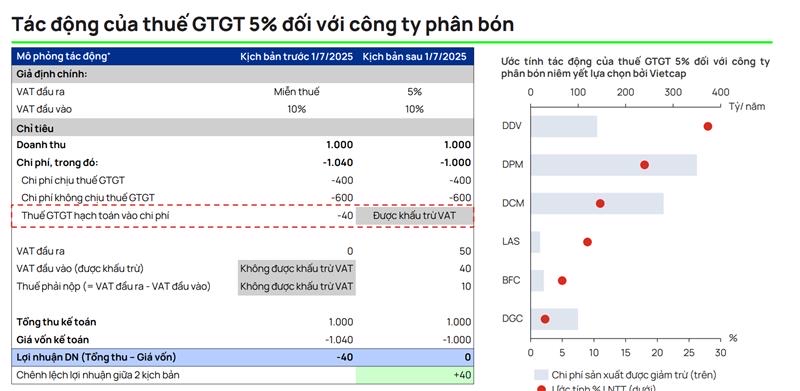

According to estimates by ACBS Securities Joint Stock Company, PetroVietnam Fertilizer and Chemical Corporation (DPM) may be able to deduct approximately VND 170 billion in 2025. This figure is expected to increase to around VND 350 billion in 2026, when the full impact of the policy is reflected in the company’s full-scale production.

Regarding Ca Mau Fertilizer Joint Stock Company (DCM), Agribank Securities Company (Agriseco) assesses that the company will be able to reduce its cost of goods sold by approximately 3.8-3.9% thanks to the VAT deduction mechanism, equivalent to more than VND 400 billion per year. This significant reduction will improve the company’s gross profit margin and boost net profit growth in the coming years.

Source: Vietcap

|

In their latest report, Vietcap Securities Joint Stock Company expanded their analysis of the impact of tax policies on multiple companies in the industry. In addition to DPM and DCM, who are expected to benefit the most, DAP – Vinachem (DDV) is also forecast to experience significant profit improvements due to input tax deductions. Other companies, such as Lam Thao Fertilisers and Chemicals Joint Stock Company (LAS) and Binh Dien Fertilizer Joint Stock Company (BFC), are also expected to benefit but to a lesser extent. According to projections by Vietcap, LAS and DCM’s profits in 2025 could grow by around 20%, while Duc Giang Chemical Joint Stock Company (DGC) is expected to achieve a profit growth rate of about 10%. For DPM, profit growth may reach up to 60%, reflecting the impact of tax factors, cooler gas prices, and improved urea selling prices.

Source: Vietcap

|

Notably, Vietcap predicts that DPM’s profit will continue to grow by over 50% in 2026 and by an additional 30% in 2027. The main driver for this growth is expected to be stable urea selling prices at high levels due to carbon costs incurred by exporting countries, while DPM enjoys the advantage of low-cost gas thanks to long-term contracts with Vietnam National Gas Corporation (PV GAS).

At the 2025 Annual General Meeting of Shareholders, DPM’s leadership emphasized the positive outlook supported by stable and low-cost gas supply. The company expects to be prioritized for the use of domestic low-cost gas and continues to negotiate the purchase of LNG at competitive prices to stabilize production costs and ensure profit margins.

Quan Mai

– 10:42 26/06/2025

The Ultimate Oil Deal: A Mystery Nation’s Deep Discounts and China’s Growing Reserves

“China is the dominant purchaser of crude oil from this nation, securing a significant supply of this valuable resource. As the leading global importer of crude, China’s actions have a profound impact on the oil industry and the broader energy market. This nation’s oil reserves are a key factor in China’s strategic energy acquisitions, shaping the dynamics of international trade and geopolitics.”

The Ultimate Guide to Investing: Oil Surges to 2-Month High, Gold Shines, Sugar Plunges to Near 4-Year Low

As of the market close on June 11, 2025, oil prices surged over 4% to a two-month high amid escalating Middle East tensions. Gold prices maintained their upward trajectory, buoyed by lower-than-expected US inflation data and expectations of an early Fed rate cut. Copper prices, however, took a hit due to concerns over Chinese demand and protracted trade tensions. Raw sugar plunged to a near four-year low, while coffee prices also witnessed a decline.