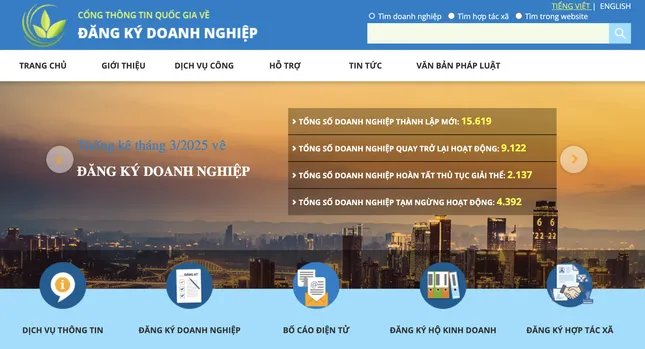

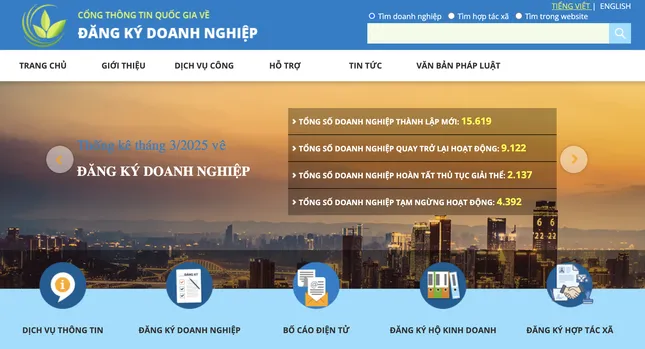

The Ministry of Finance has issued a document to the Departments of Finance of provinces and cities regarding the upgrade of the National Information System for business, cooperative, and household registration.

To comply with the new legal regulations that come into force on July 1st, the Ministry of Finance will upgrade the system from 8:00 AM on June 28th to 8:00 AM on July 1st. This upgrade ensures the system’s synchronization with the new provisions in the Amended Law on Enterprises, the Decree replacing Decree 01/2021/ND-CP on business registration, and the circular issuing business and household registration forms.

The National Information System for business, cooperative, and household registration will be upgraded from 8:00 AM on June 28th to 8:00 AM on July 1st.

The Ministry of Finance requests that the Departments instruct the business registration agencies and related units to proactively arrange their work to avoid any inconvenience in administrative procedure resolution for citizens and enterprises.

Following the merger of provinces and cities, enterprises are not obliged to change their information on business registration certificates and can do so at their discretion. The Ministry of Finance has issued Official Letter 4370/BTC-DNTN to guide business registration in cases of administrative boundary changes.

Specifically, enterprises, business households, cooperatives, union cooperatives, and teams can continue using their issued certificates of enterprise registration, business household registration, cooperative registration, team registration, and certificates of registration for branches/representative offices/business locations.

Business registration agencies are not permitted to require enterprises, business households, cooperatives, union cooperatives, and teams to register changes to their addresses due to administrative boundary adjustments.

“Tax Bureau Halts On-Site Tax Inspections: A Swift Move to Ease Compliance Burdens”

Let me know if you would like me to continue crafting compelling and optimized content for your project!

The Tax Department ensures a seamless transition during the restructuring of the tax administration apparatus. This proactive measure maintains the integrity of the inspection process during this pivotal phase.

A Fresh Proposal: The Fate of 350 District-Level Tax Teams from July 1st Onwards

The Ministry of Finance has proposed a restructuring of the tax administration system in light of the administrative unit merger. The plan includes reorganizing 20 regional tax offices into 34 provincial-level tax offices and transforming 350 district-level tax teams into tax organizations at the grassroots level, under the jurisdiction of provincial/municipal tax offices.

“Streamlining Administrative Codes: A Proposal for 34 Merged Provinces and Cities”

Introducing the dynamic trio of Vietnam’s metropolitan areas, each with their unique codes: Hanoi, with its sleek and sophisticated code of 01, sets the standard for the north. Moving down the coast, we have the enchanting Danang with code 48, a gateway to central Vietnam’s charm. And last but not least, the vibrant Ho Chi Minh City, coded as 79, pulses with energy in the south. These codes are more than just numbers; they represent the heartbeat of each city, reflecting their distinct character and allure.

Pouring $7 Billion into Ho Chi Minh City’s International Financial Center

The heart of Ho Chi Minh City’s International Financial Center is situated in the Thu Thiem New Urban Area, spanning 9.2 hectares. This area will be home to the offices of management, supervisory, and judicial bodies in its initial phase, with estimated investment costs totaling VND 172,000 billion (equivalent to USD 7 billion).