Recently, Hang Xanh Automobile Service Joint Stock Company (Haxaco, Stock Code: HAX, HoSE) released its consolidated financial report for Q3/2025, revealing a significant decline in business performance.

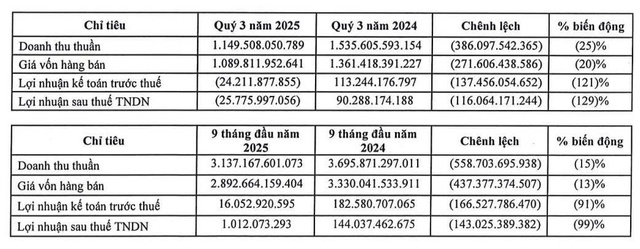

Specifically, Haxaco generated over VND 1,149.5 billion in net revenue during Q3/2025, a 25% decrease compared to the same period last year. After deducting the cost of goods sold, gross profit reached nearly VND 59.7 billion, down by approximately 66%.

During the quarter, financial expenses surged by 84% year-on-year to nearly VND 9.2 billion. Similarly, selling expenses rose from VND 55.5 billion to VND 58.8 billion, and administrative expenses exceeded VND 36.4 billion, marking a 34% increase.

As a result, after accounting for taxes and fees, Haxaco reported a net loss of nearly VND 25.8 billion, in contrast to a net profit of VND 90.3 billion in the same period last year.

Source: Haxaco

According to Haxaco’s explanation, the automotive market experienced significant fluctuations in Q3/2025, with numerous aggressive discount programs not only in the luxury segment but also extending to the mass market.

Additionally, competitors continuously launched new models with deep incentive policies to enhance competitiveness and attract customers. Meanwhile, operating costs increased compared to the same period due to the company’s expansion efforts. These factors collectively exerted considerable pressure, narrowing profit margins and reducing the company’s earnings.

For the first nine months of 2025, Haxaco achieved nearly VND 3,137.2 billion in net revenue, a 15% decrease compared to the same period in 2024. Post-corporate income tax profit amounted to just over VND 1 billion, plummeting by 99% year-on-year.

As of September 30, 2025, Haxaco’s total assets slightly decreased by 2% from the beginning of the year to over VND 2,360 billion. Cash and cash equivalents dropped by 55% to VND 117.7 billion, while inventory rose by 23% to VND 812.2 billion.

Furthermore, the company recorded investment real estate valued at over VND 542 billion, representing the transfer of land use rights on Vo Van Kiet Street, Ward 3, Ho Chi Minh City.

On the liabilities side, total payables stood at over VND 1,001.6 billion, up 9% from the beginning of the year. Short-term loans and finance lease liabilities accounted for nearly 72% of total liabilities, amounting to VND 718.5 billion.

Q3 Profits Flatline: Agimexpharm Achieves Nearly 68% of Annual Target

Agimexpharm Pharmaceutical JSC (UPCoM: AGP) has released its Q3/2025 financial report, showcasing a modest growth compared to the same period last year.

North Ha Hydro Power Rebounds Strongly in Q3

North Ha Hydropower JSC (HNX: BHA) reported a decline in post-tax profit for Q3/2025 compared to the same period last year, primarily due to lower water levels in the reservoir, which impacted revenue. However, this quarter marks a significant recovery for the hydropower company when compared to the previous two quarters.

Bình Minh Plastics (BMP) Reports Record Profits Under Thai Ownership, with Nearly 70% of Total Assets in Cash

In the first nine months of 2025, Binh Minh Plastic reported a net revenue of VND 4,224 billion, marking a 19% increase compared to the same period in 2024. The company’s after-tax profit reached VND 967 billion, reflecting a notable 27% growth year-on-year.