The VN-Index ended the June 26 session at 1,365.6 points, a slight drop of 1.08 points (equivalent to 0.08%).

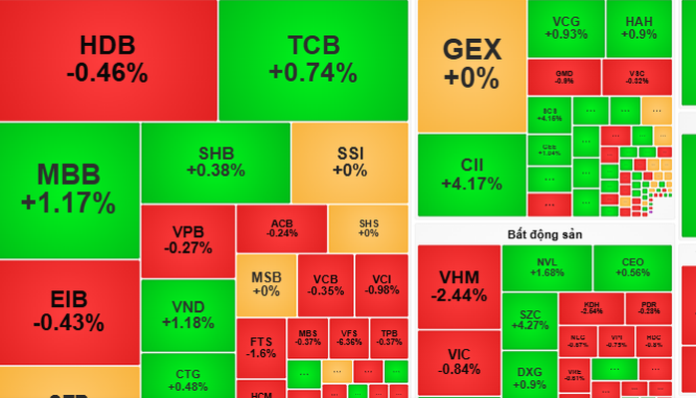

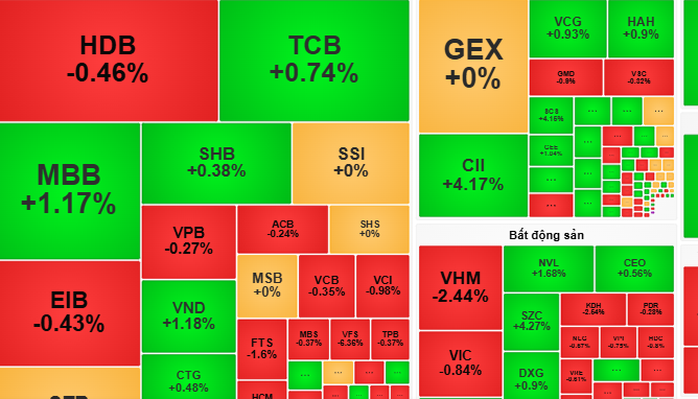

The VN-Index started the trading day on June 26 with a slight gain, but increasing selling pressure and adjustments in large-cap stocks caused the momentum to stall. The index mostly fluctuated around the reference level and even dipped below it during the latter half of the morning session.

The afternoon session saw continued fluctuations, with blue-chips being the main drag on the index. However, gains in sectors such as seafood (VHC, ANV), industrial parks (KBC, SZC), and retail (DGW, MSN, FRT) helped maintain market balance. Notably, in the last 30 minutes of trading, buying demand surged, along with a recovery in some bank stocks, which traded near the reference price or posted slight gains.

At the close, the VN-Index stood at 1,365.6 points, down slightly by 1.08 points (equivalent to a 0.08% decline).

According to Rong Viet Securities (VDSC), although the market adjusted, it found support at the 1,360-point level and showed signs of recovery towards the session’s end. Decreased trading volume indicated that selling pressure was not intense, while funds remained on the sidelines awaiting clearer signals. As stock supply is gradually decreasing, the VN-Index is poised to rise on June 27, targeting the resistance level of 1,372 points.

Meanwhile, VCBS recommended that investors remain cautious but consider investing in stocks in the retail, real estate, industrial park, and seafood sectors, which are attracting funds and have positive business prospects. Monitoring stock supply and demand dynamics will aid investors in making informed decisions in the context of a volatile market.

“Vietcap: Market Average Liquidity to Surpass $1 Billion From 2026 Onwards, Say Brokerages, Foreseeing a New Growth Cycle”

The anticipated implementation of the KRX trading system is expected to reduce settlement cycles, thereby enhancing market liquidity and boosting trading activity.

Top Stocks to Watch Ahead of the Bell on June 27th

The stock market is a dynamic and ever-changing landscape, and keeping up with the biggest gainers and losers is crucial for investors. Vietstock’s statistical insights offer a glimpse into the latest trends, providing valuable information on the stocks that have witnessed significant movement in recent sessions. This data is a powerful tool for investors looking to make informed decisions and stay ahead in the game.