VN-Index Surges Past 1,370 Points as Market “Booms”

The Vietnamese stock market witnessed a remarkable week of trading from June 23-27, following a positive previous week that saw the market break through short-term price peaks. The VN-Index continued its upward trajectory, surpassing the 1,370-point mark. Blue-chip stocks took turns in propelling the index higher, with trading liquidity remaining low, indicating investors’ cautious sentiment at this new index level. By the week’s end, the VN-Index had climbed 22.09 points (+1.64%) from the previous week, closing at 1,371.44 points.

Across different sectors, most industries recorded strong gains, except for the oil and gas sector, which took a downturn after the US President announced a ceasefire agreement between Israel and Iran. Gold and crude oil prices plummeted as geopolitical risk concerns eased.

In the stock market, oil and gas stocks faced significant selling pressure following the sharp decline in global oil prices. Investors anticipated that the de-escalation of Israel-Iran tensions would lead to a stabilization of energy supplies.

A Quietly Performing Stock Reaches New Heights, Trading Near VND 170,000 per Share

Despite the market’s unpredictable fluctuations, several stocks have made remarkable breakthroughs. On June 26, TOS, the stock of Tan Cang Sea Services JSC, accelerated by 8% to VND 164,000 per share.

This price marked TOS’s 14th time reaching a new historical peak since the beginning of the year. Its market capitalization also set a record, surpassing VND 5,080 billion. Since the beginning of the year, TOS has skyrocketed by 123%, more than doubling its value in less than half a year.

For more information, please visit: [link]

Foreign Investors Sell Hundreds of Billions of Dong in the Week of June 23-27: What’s the Focus?

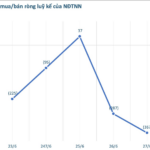

Amid the flourishing stock market, foreign investment transactions were relatively volatile. While foreign investors net bought at the beginning of the week, they later turned to net selling. By the end of the week, they had net sold VND 367 billion across all markets.

Analyzing the week’s performance on each exchange, foreign investors net sold VND 39 billion on HoSE, VND 269 billion on HNX, and VND 59 billion on UPCoM.

Focusing on individual stocks, PVS was the top net sold with a value of nearly VND 249 billion. FPT and STB followed with net selling values of VND 219 billion and VND 212 billion, respectively. VCB was also net sold at nearly VND 179 billion. The list of stocks net sold by foreign investors this week included ACB, VPB, SHB, VCI, HCM, GMD, and others, all recording net selling values of over VND 100 billion.

For more details, please refer to: [link]

Vietcap’s CEO Spends Billions to Purchase VCI Shares

Mr. To Hai, a member of the Board of Directors and CEO of Vietcap (coded VCI), recently announced the completion of his purchase of 250,000 VCI shares on June 20. Following this transaction, Mr. Hai now holds 129.1 million VCI shares, representing a 17.87% stake.

These shares were purchased by Mr. Hai from Vietcap during the company’s issuance of 4.5 million ESOP shares at a price of VND 12,000 per share. The ESOP shares from this issuance will be subject to a one-year lock-up period. It is estimated that Vietcap’s CEO spent approximately VND 3 billion to acquire these shares.

On the stock exchange, VCI shares are currently trading around VND 36,000 per share, a slight increase from the beginning of the year. Vietcap’s market capitalization stands at approximately VND 25,500 billion (~USD 1 billion).

Visit: [link] for further insights.

Two Stocks Attract Heavy Buying from Securities Companies’ Proprietary Trading on the Last Trading Day of the Week

On June 27, the proprietary trading arms of securities companies net bought VND 313 billion on the HoSE.

Specifically, securities companies focused their buying on TCB and MWG, with respective net buying values of VND 310 billion and VND 268 billion. DGC was also net bought at VND 95 billion. Other stocks that witnessed net buying included PNJ, MSN, FUEVFVND, VPB, E1VFVN30, DCM, and PLX.

On the other hand, VHM was the most net sold stock by securities companies, with a value of VND 38 billion. VIC and FPT followed with net selling values of VND 30 billion and VND 28 billion, respectively. Other stocks that were net sold included VNM, HPG, STB, VIX, GEX, VRE, and SSI.

Refer to: [link] for additional information.

Masan Group’s Stock (MSN) Hits Highest Peak Since the Beginning of 2025

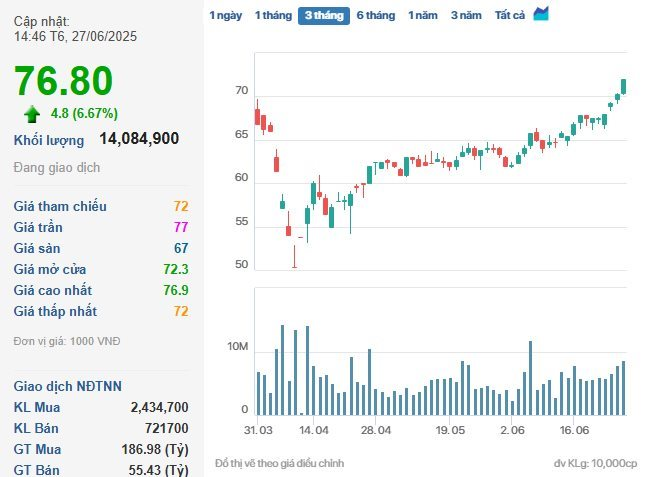

Specifically, by the closing bell on June 27, MSN shares of Masan Group increased by 6.67% to VND 76,800 per share, with matched volume surging to nearly 14.1 million units, nearly double the previous session.

MSN shares surge in volume and price, reaching the upper limit on June 27. (Source: Cafef)

This marked the fifth consecutive gaining session for MSN and its highest price since the beginning of 2025.

As a result, Masan’s market capitalization surged to over VND 116,192 billion.

MSN’s impressive rally occurred amid a stock market that is undergoing sector rotation, reflecting investors’ high expectations for Masan’s intrinsic potential and favorable business environment. The Group has maintained stable operations with consistent growth across its business segments.

Explore more at: [link]

“Vietnam Stock Market Review: VN-Index Surges Past 1,370 Points, Uncovering a Stealthy Stock Star of 2023”

The stock market is on fire with the VN-Index surging past 1,370 points. Amid this frenzy, a stealthy stock has quietly soared to new heights, touching nearly VND 170,000 per share, hitting a new peak 14 times since the turn of the year. Foreign investors offloaded hundreds of billions of dong in the week of June 23-27, but what caught the eye? Meanwhile, Vietcap’s CEO splashed billions on VCI shares.

The Flow of Funds: What Does the Hesitant Money Trail Tell Us?

The VN-Index witnessed its second consecutive week of robust gains, surging past the 1370-point mark. The bulk of these gains were concentrated in the first two trading sessions, with the latter three sessions experiencing minimal fluctuations. Notably, excluding the high-volume trading session on June 24th, the average weekly trading volume was relatively low.

Foreigners Net-Sell Hundreds of Billions in Week of June 23-27: What’s the Focus?

Over the course of five sessions, foreign investors have sold a net total of 367 billion dong on the Vietnamese stock market.

The First Wood Enterprise Reports Record Low Six-Month Profit, Slim Margins Persist

In the first half of 2025, GTA Wood Processing Joint Stock Company (HOSE: GTA) recorded VND 120 billion in revenue, but high expenses ate into profits, resulting in a meager pre-tax profit of just VND 3.2 billion – the lowest half-yearly figure in its history. GTA’s stock has plummeted, losing 45% of its value in the last two years, and its liquidity has all but frozen.